- لغة عربية

- English

- 简体中文

- 繁体中文

- ไทย

- Español

- Tiếng Việt

- Português

February 2024 BoE Preview: The Old Lady’s Soon For Turning

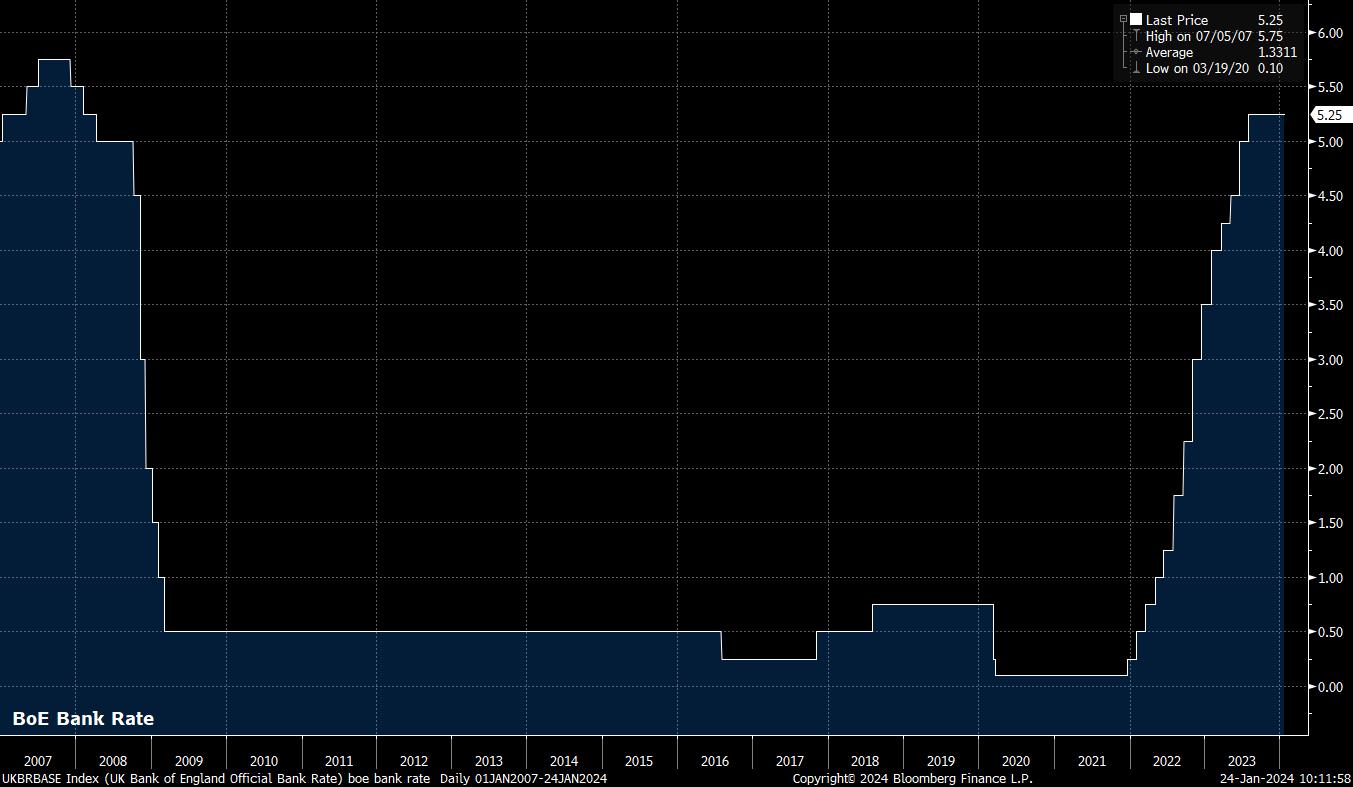

As noted, the first MPC meeting of the year should conclude with the Committee voting to maintain Bank Rate at 5.25%, equal to the highest level since early-2008, and extending a rate hold that began last August, with the tightening cycle now clearly at an end. Unsurprisingly, money markets price no chance of any change to Bank Rate at the February meeting, with a similarly slim chance seen of any move at the following meeting in mid-March.

While Bank Rate is near certain to remain unchanged, the vote split among MPC members is something of a more complex matter. After a 6-3 vote to hold rates at the December meeting, with external MPC members Greene, Haskel and Mann dissenting in favour of a 25bp hike, it once again seems likely that the Committee will be split in terms of the appropriate rate move.

Though there has been relatively little by way of fresh economic data since the final meeting of 2023, recent remarks have pointed to some, including Haskel, beginning to view things through a more cautious lens, though the recent upside surprise in December’s CPI figures – more on which below – may have tempered such caution. In any case, as the lagged impacts of prior tightening continue to be felt, particularly with around 4 million households set to refinance mortgages this year, it seems likely that those hawkish dissenters on the MPC will, gradually, join consensus and stop voting for a hike. Furthermore, external member Dhingra, who last voted in favour of a hike in November 2022, seems likely to be the first to vote for a rate cut, though the February meeting may prove too early for such a dovish dissent.

Speaking of cuts, OIS currently prices just over 100bp of easing from the BoE in 2024, fully pricing the first 25bp cut for June. This is pace is, likely, roughly in line with what the MPC would consider reasonable at this juncture, though clearly out of line with the guidance provided in the most recent policy statement.

At the December meeting, the MPC reiterated the relatively hawkish guidance that has been given for six months now, noting that policy will need to be “sufficiently restrictive for sufficiently long” to return inflation to the 2% target, while also flagging the risk of further policy tightening if evidence of “more persistent inflationary pressures” were to present itself.

This guidance presents something of an issue for the MPC. Given that the next move in Bank Rate is set to be a cut, likely towards the end of the first half of the year, the Committee will need to begin to lay the groundwork for such a move early on, to avoid eroding credibility by delivering a rate reduction, while continuing to guide towards further hikes. Removing reference to ‘further tightening’ at the February meeting seems like the most obvious first step on this road, though the ‘higher for longer’ stance will probably be reiterated, primarily to avoid an unwarranted and undesirable loosening in financial conditions.

That said, the MPC have historically displayed a tendency to prefer to signal the policy path via shifts in their forecasts, as opposed to explicit guidance changes.

The inflation forecast has been the primary signalling mechanism in the past, and will probably be so once again, with the CPI path conditioned on a constant Bank Rate likely to point to an undershoot of the 2% target over the medium-term, while that conditioned on the market-implied rate path points to a more sustained return to that level. The implication of all this being that, by and large, the path markets currently price is the more appropriate one.

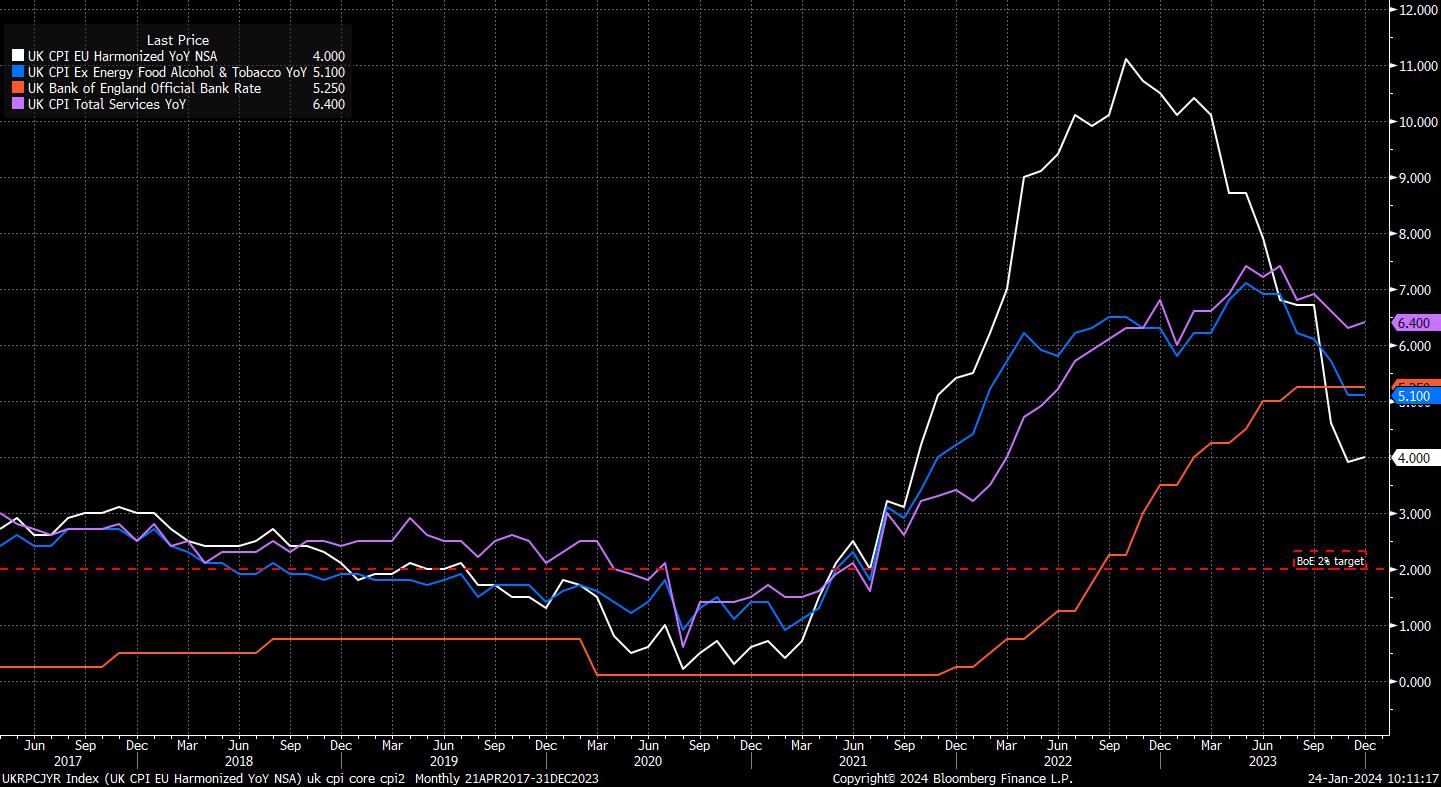

On the subject of inflation, it’s important to note that progress on disinflation has somewhat stalled of late. Headline CPI unexpectedly ticked higher to 4.0% YoY in December, while core CPI remained at 5% YoY for the second straight month; notably, though, this uptick in headline inflation was driven largely by a rise in alcohol and tobacco duties, which policymakers are likely to look through.

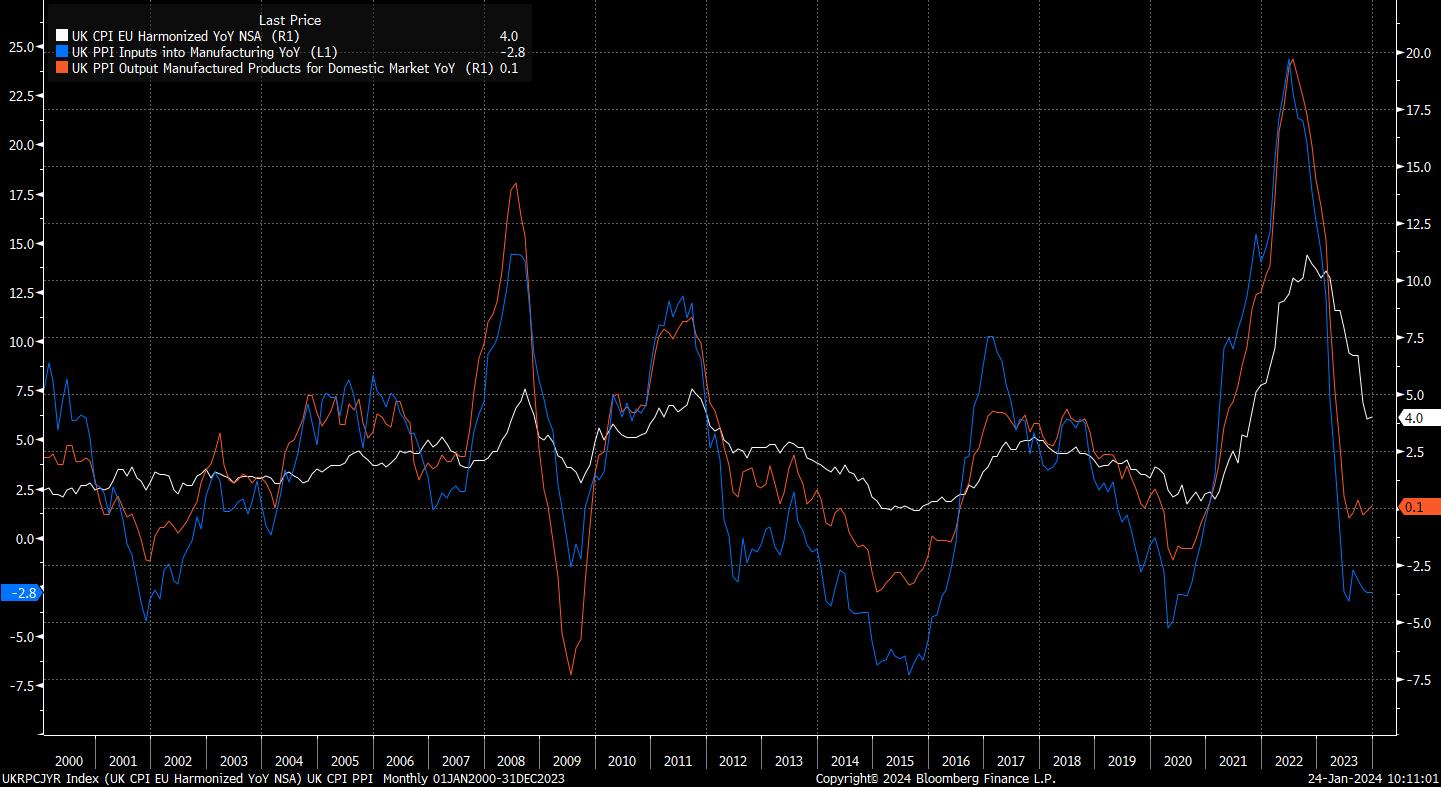

Of more concern will be the sticky and stubborn nature of services inflation, which has now remained north of 6% YoY for 15 consecutive months, and shows little sign of budging. While this has been a worry for some time, elevated services prices are a growing inflationary risk for the economy, particularly as goods inflation seems likely to make something of a resurgence amid ongoing geopolitical tensions in the Middle East, resulting in extended Asia-Europe transit times as shipping companies avoid the Red Sea.

Services inflation continues to be underpinned by a relatively tight labour market, though jobs data must continue to be taken with a ‘pinch of salt’, as the ONS continue to refine a new methodology for data collection, after a dramatic decline in response rates to the prior labour force survey (LFS).

Per the aforementioned ‘experimental’ data, unemployment remained at 4.2% in the three months to November, having been broadly unchanged over the second and third quarters of last year. While the MPC’s present end-24 unemployment forecast of 4.8%, followed by a further rise to 5.0% in 2025, appears a little punchy, any significant downward revisions appear unlikely at this stage, given data quality issues.

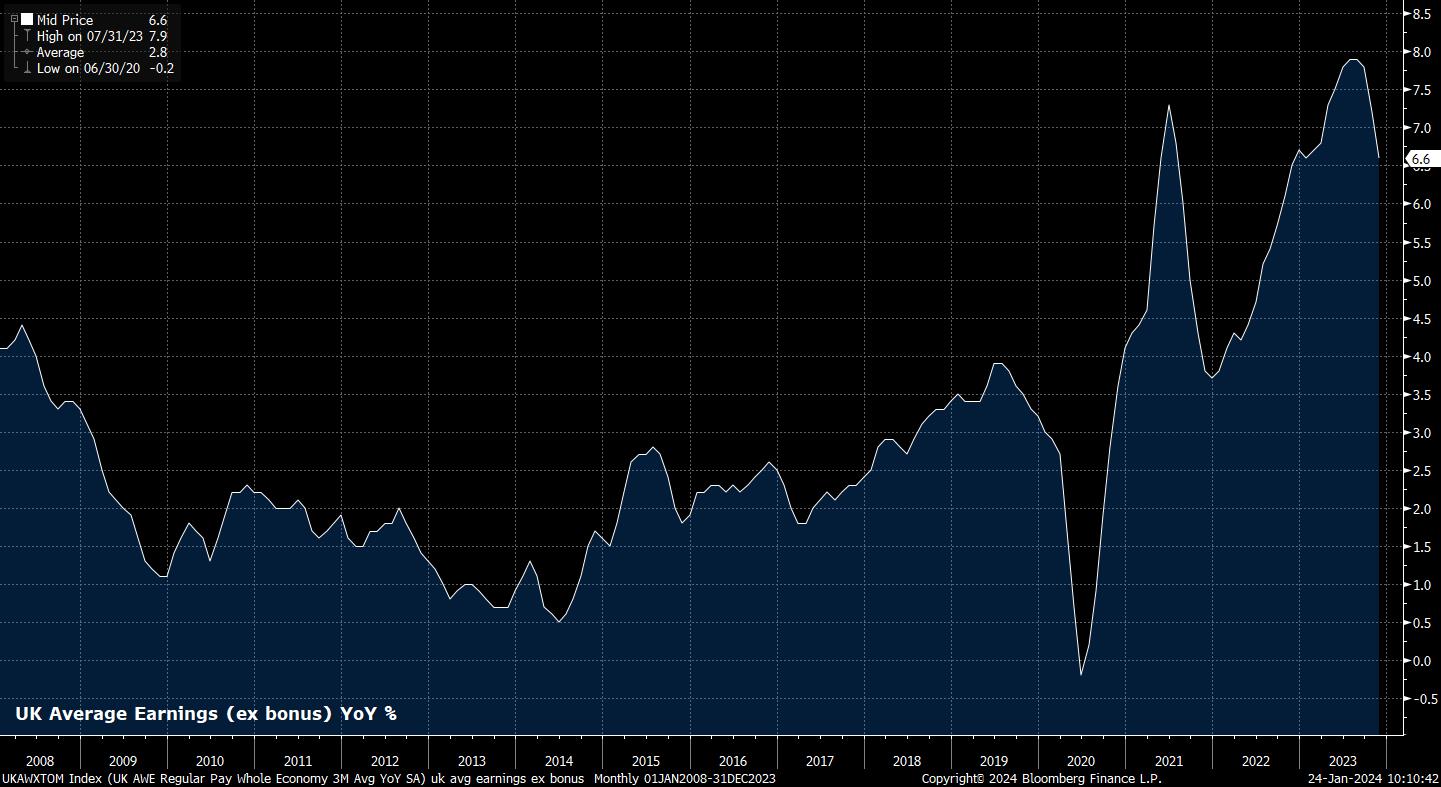

The MPC will, however, likely be pleased with the recent modest softening in earnings pressures, with regular pay growth having fallen to 6.6% YoY in November, down from a peak of almost 9% during the summer. With this pace continuing to represent real earnings growth of just shy of 3%, the MPC will likely want to see a further cooling, in order to exert further downward pressure on services prices.

Meanwhile, on growth, the outlook for the UK economy appears rather mixed. Retail sales unexpectedly fell over 3% MoM during the festive period, likely subtracting around 0.05pp from output in the final quarter of 2023, raising the chances of GDP having notched a second straight quarterly contraction in Q4, following an 0.1% QoQ decline in Q3 – confirming a technical recession if so.

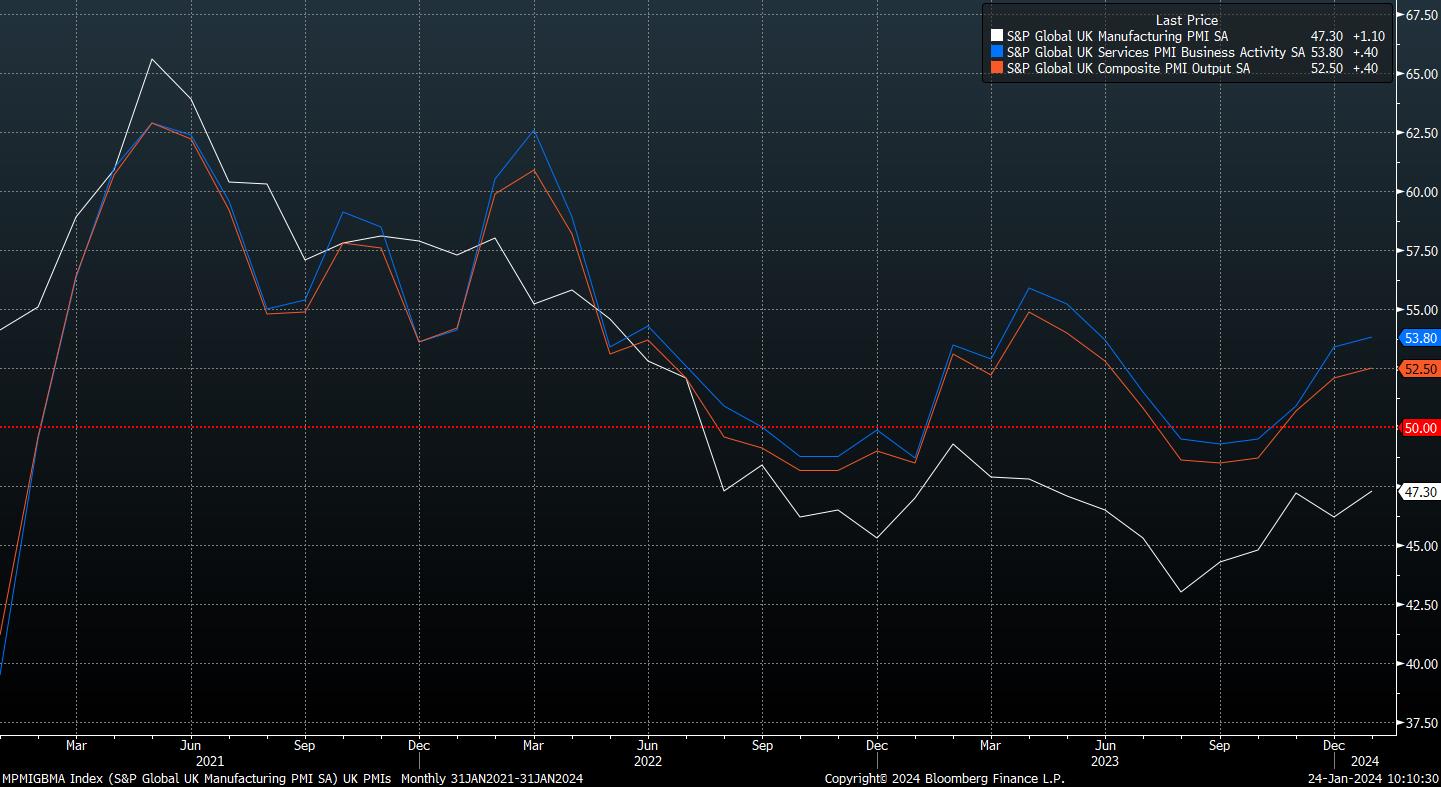

Despite this, more up-to-date indicators appear to be pointing towards something of a rosier outlook. The most recent round of PMI surveys, for example, pointed to a relatively rapid pace of expansion as 2024 got underway, with both the services and composite measures rising to their highest levels since last summer, while the manufacturing index pointed to the slowest pace of contraction in 9 months.

Nevertheless, despite these mixed indicators, there seems little scope for significant revisions to the MPC’s GDP forecasts, with the economy already expected to stagnate on an annual basis this year, followed by a relatively anaemic 0.3% pace of growth in 2025. Any adjustments to these expectations are more likely as a result of shifting market-based rate expectations, rather than being a reflection of recent economic developments.

While the forecasts may lack intrigue, Governor Bailey’s post-decision press conference is likely to be of substantially more interest. Bailey faces something of a communications challenge, needing – as noted above – to lay the groundwork for a pivot towards a more dovish policy stance in the months ahead, while also needing to present forecasts condition on overly-optimistic rate expectations in the MPC’s eyes, as well as navigating an uncertain political environment with further fiscal loosening likely in the March Budget, and an election approaching later this year.

For the pound, the balance of risks appears to point toward a more dovish MPC than has been seen in recent months, particularly if the explicit reference to further hikes is removed from the statement.

_2024-01-24_10-10-03.jpg)

Cable has, however, spent much of the last two months in a relatively tight 1.2600 – 1.2800 range, showing little desire to move outside of those trading bands, though the 50-day moving average has provided support to a very modest rally of late. Rallies, though, look ripe to be sold into at this stage, particularly as the USD continues to strengthen across the G10 board, as the ‘US exceptionalism’ narrative that ruled the roost through most of 2023 continues into the new year.

Related articles

لا تُمثل Pepperstone أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. البيانات، سواء كانت من جهة ثالثة أو غيرها، لا يجب اعتبارها توصية؛ أو عرض لشراء أو بيع؛ أو دعوة لعرض لشراء أو بيع أي أمان، منتج مالي أو صك؛ أو المشاركة في أي استراتيجية تداول معينة. لا تأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار الخاصة بهم. ننصح أي قارئ لهذا المحتوى بطلب نصيحته الخاصة. بدون موافقة Pepperstone، لا يُسمح بإعادة إنتاج أو إعادة توزيع هذه المعلومات.