- لغة عربية

- English

- 简体中文

- 繁体中文

- ไทย

- Español

- Tiếng Việt

- Português

What is the definition of hedging

Taking a hedge can mean different strategies in trading. One is based around money management; the others are used by trading correlated products. The main objective of a hedge is to limit the potential downside of a trade or portfolio.

Hedging can be simplistic or an advanced strategy that requires an algorithm to execute the separate legs.

Figure 1 Hedging. Not to be mistaken for a hedge

A simple Hedging Strategy – the direct hedge

Let us look at an example:

You have taken a long (Buy) position in EURUSD as your medium-term analysis highlights that the bias is bullish or positive for the major currency pair. You are 5 units long.

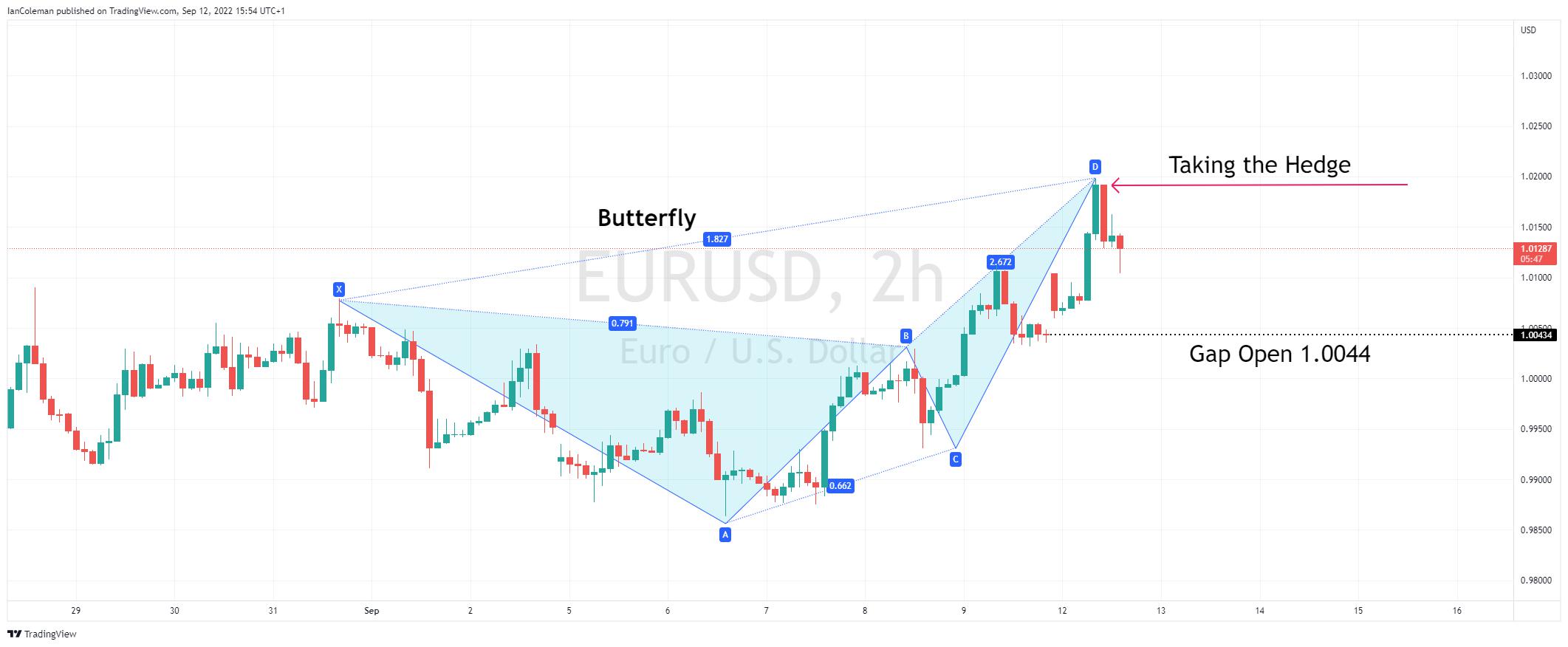

A ‘gap open’ happened this morning and you are conscious that gaps or windows normally get closed. You can also see a short-term reversal pattern called a Butterfly. You don’t want to close your position but are wary of a correction to the downside.

You sell 3 units at 1.0175 with a target level of 1.0045, the gap closed. You have hedged 3 units and now have an overall net long position of 2 units.

You look to take the hedge off at 1.0045. This will result in a profitable hedge trade (3 units x 130 pips). It will also result in the full 5-unit long position coming back into play.

What happens if your hedge is incorrect?

Your hedge trade does not move to your desired level. What next?

- You can place a stop loss on your hedge position resulting in a loss being taken

- You can keep both long and short positions open knowing that you are net long 2 units. You aim for the original target (limit) closing both positions at the same time.

Figure 2 Hedging. EURUSD scenario

Hedging using options

The holder of a currency option has the right, but not the obligation, to exchange a currency pair at a certain price at the expiry date.

It can sound complicated, but it is worth the time and effort to investigate further. The important part of the last sentence is the right but not the obligation. You don’t have to take the ‘option’!

Let us look at another example using the EURUSD scenario above:

You have taken a long position in 5 units. Instead of taking the direct hedge you take a PUT OPTION at 1.0045.

If the downside move extends lower, you will lose on your spot FX EURUSD long position but can execute your option to sell EURUSD at 1.0045.

Complicated Hedging Techniques

Some hedging techniques are highly complex. They may even extend to the point of arbitrage*. They may involve multiple correlated currency pairs or correlated products like the Canadian Dollar (CAD) and Oil.

Can I hedge at Pepperstone

Yes, Pepperstone offers the ability to hedge.

*Arbitrage is the technique of taking multiple trades at the same time to lock in a profit.

Related articles

لا تُمثل Pepperstone أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. البيانات، سواء كانت من جهة ثالثة أو غيرها، لا يجب اعتبارها توصية؛ أو عرض لشراء أو بيع؛ أو دعوة لعرض لشراء أو بيع أي أمان، منتج مالي أو صك؛ أو المشاركة في أي استراتيجية تداول معينة. لا تأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار الخاصة بهم. ننصح أي قارئ لهذا المحتوى بطلب نصيحته الخاصة. بدون موافقة Pepperstone، لا يُسمح بإعادة إنتاج أو إعادة توزيع هذه المعلومات.