February 2024 BoE Review: The Old Lady Takes Tentative Dovish Steps

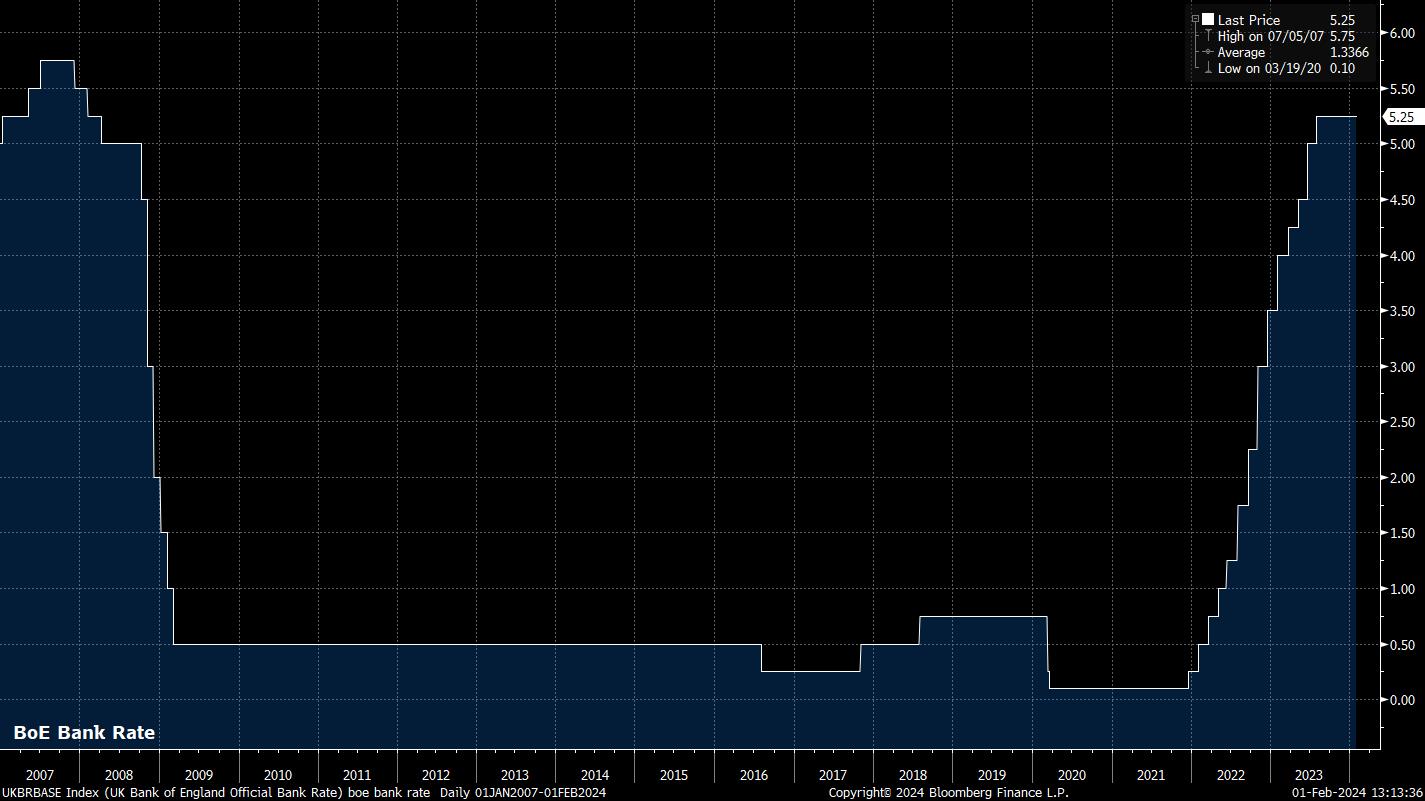

To the surprise of nobody at all, Bank Rate was kept on hold, for the 5th straight meeting, an outcome that OIS had fully discounted prior to the announcement. That said, the vote split among MPC members was more interesting, being the first 3-way split among MPC members since all the way back in 2008.

While the ‘core’ of the Committee – including Governor Bailey, and Chief Economist Pill – voted with 4 others to maintain Bank Rate, external MPC members Haskel and Mann stuck with their hawkish dissent from December, instead voting to increase Bank rate by 25bp. In contrast, external member Dhingra, who hadn’t voted for a hike since November 2022, dissented in a dovish direction, favouring a 25bp cut to 5.00%.

Along with the highly unusual 3-way vote split, which was marginally more dovish than markets had expected, the MPC also offered fresh policy guidance, altering wording that had previously been unchanged since the August 2023 decision.

While the MPC continue to see a need for policy to remain “restrictive for an extended period of time”, the policy statement omitted the previous reference to the Bank’s preparedness to tighten further if signs of persistent inflation were to emerge. This firmly implies, as if it wasn’t already clear, that the MPC’s tightening cycle is at an end, with the next move in Bank Rate to be a cut. To be frank, such a guidance shift was long overdue, and brings the Old Lady’s policy stance much more into line with their G10 peers.

As if to further emphasise this point, the statement noted that the Committee will now “keep under review” how long Bank Rate should remain at its current level. Clearly, the discussion on Threadneedle Street has now formally shifted from how high rates should rise, to the duration for which they should remain at current levels, and when the first Bank Rate cut should be delivered.

Money markets continue to price a relatively aggressive path of policy easing, despite a modest hawkish repricing over the decision, with the first 25bp rate cut still foreseen in June, in addition to pricing around 110bp of cuts over 2024 in its entirety.

It seems relatively clear that the MPC are unhappy with this dovish rate path.

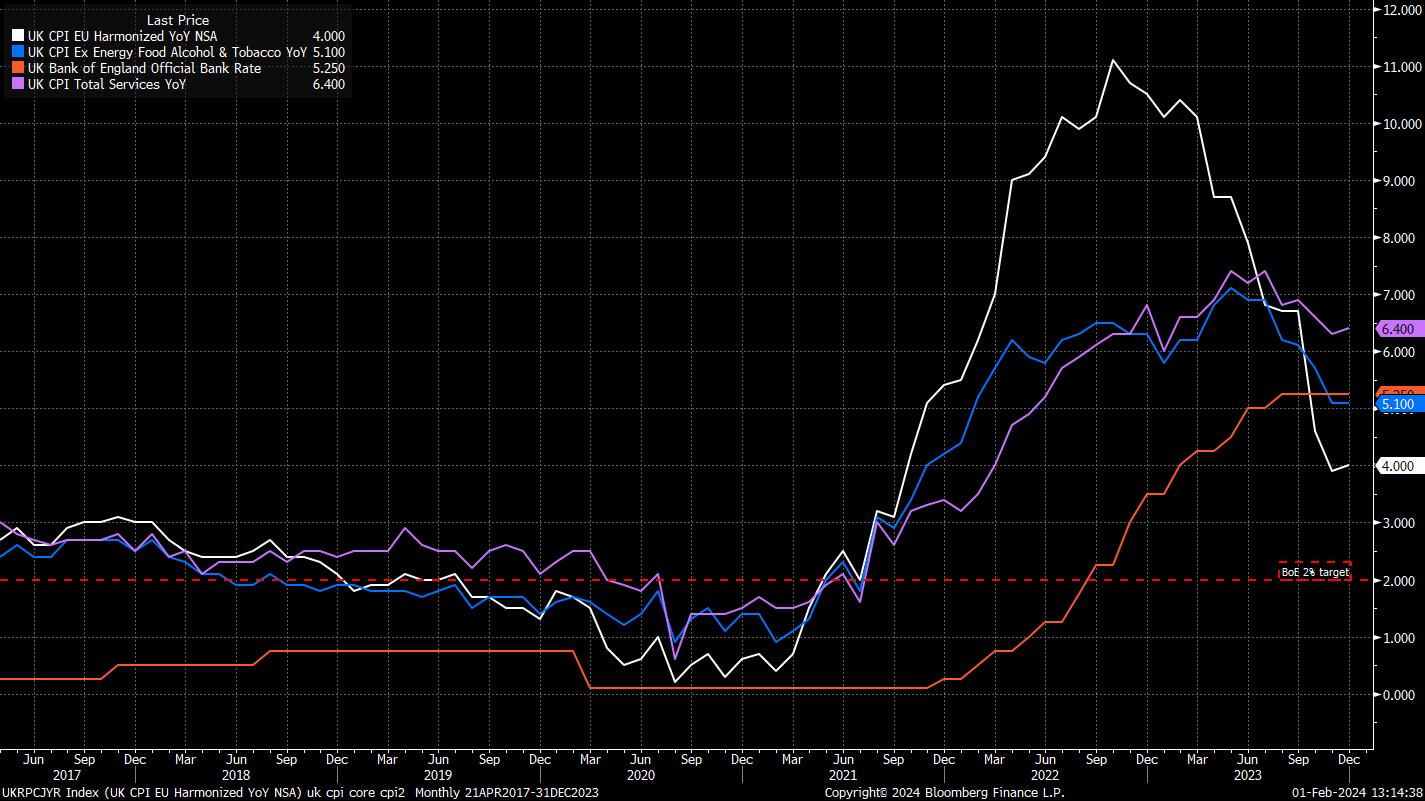

The Bank’s latest economic forecasts, when based on the market rate path, point to this unhappiness, with headline CPI, when conditioned on OIS-implied rate expectations, set to remain north of the 2% target all the way through to Q4 2026. Given the MPC’s prior tendency to signal via inflation forecasts, this is an important and deliberate message, and represents relatively significant pushback on the rate path that markets currently price.

Governor Bailey picked up on this notion at the post-meeting press conference, noting the divergence between the market-based and constant-rate inflation forecasts, and stressing that the MPC’s focus is now to get the balance between the two correct, keeping policy sufficiently restrictive for sufficiently long, “nothing more, and nothing less”.

Bailey continued at the presser to outline the MPC’s current thinking, reiterating the message from the policy statement that policymakers will, at coming meetings, be mulling how much longer Bank Rate should remain at 5.25%, and whether price pressures have eased enough to enable the easing cycle to begin.

On this latter point, there is notable caution on the MPC about the inflation outlook, with Bailey himself noting that even if inflation were to return to target in the spring, that is not a case of “job done”, particularly with services inflation set to remain sticky, and upside risks having emerged amid rising geopolitical tensions.

With this in mind, it was perhaps no surprise that the Governor would not be drawn on the precise timing of any rate cut, noting that he will “not speculate” on the next meeting, or on what may occur at further meetings this year. This should be no surprise; no central bank that has adopted a “data-dependent” stance – be that the BoE, the ECB, the FOMC, or anyone else – can stick a date on when the appropriate data conditions for easing will be reached.

Amid all of this, the market reaction was relatively subdued. The GBP rallied a touch, around 40 pips, over the MPC decision, though this seemed largely an unwind of short bets that were placed in the run-up to the news hitting wires, with cable having slipped for much of the morning. Front-end gilts, meanwhile, found some modest sellers, with 2s rising around 7bp on a yield basis, while remaining well within yesterday’s ranges.

For cable, in particular, the story hasn’t particularly changed, with the broad 1.26 – 1.28 range remaining intact, and risks continuing to point to the downside as the ‘goldilocks’ US macro narrative continues to point towards a ‘soft landing’.

Overall, then, the February MPC meeting represented what many would consider an overdue dovish step from the Committee, with a formal acknowledgement that the next move in rates will be a cut. Nevertheless, in keeping with the theme of other G10 central banks, the ‘Old Lady’ will want to see further data to reassure policymakers that inflation is on its way back to target before firing the starting gun on the eventual easing cycle. Once again, it appears that markets will get the cuts they seek, just not as fast, or to as great a degree, as currently priced.

لا تُمثل Pepperstone أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. البيانات، سواء كانت من جهة ثالثة أو غيرها، لا يجب اعتبارها توصية؛ أو عرض لشراء أو بيع؛ أو دعوة لعرض لشراء أو بيع أي أمان، منتج مالي أو صك؛ أو المشاركة في أي استراتيجية تداول معينة. لا تأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار الخاصة بهم. ننصح أي قارئ لهذا المحتوى بطلب نصيحته الخاصة. بدون موافقة Pepperstone، لا يُسمح بإعادة إنتاج أو إعادة توزيع هذه المعلومات.

_2024-02-01_13-14-55.jpg)