- لغة عربية

- English

- 简体中文

- 繁体中文

- ไทย

- Español

- Tiếng Việt

- Português

We see US banks under pressure, and worries about deposit outflows are one factor, but sentiment has not been helped by the FDIC’s proposal to charge a fee to larger banks to fund the fallout from the 3 failed regional banks. The US debt ceiling rolls on, although I am seeing some constructive signs in Washington and the market understands there will be a time, once agreement happens when the US Treasury will issue a mountain of T-Bills, which will suck USDs out of the system - a big USD positive. Negotiations ramp up this week, so we’ll be looking for closer ties as we rattle towards the X-date.

China is clearly at the backbone of the growth concerns – credit data, imports, PPI, and PMI data all looking shaky and suggesting the best in the reopening phase is behind us. Has the market become too bearish on China though? This week we shall see, but I suspect the authorities will not want the world to feel that is the case. USDCNH is my guide, with copper also portraying a strong view. If USDCNH is moving higher in this backdrop we know China is exporting its deflation and that could be a huge game-changer for developed market economies. One to watch.

Trading views for the week ahead

DXY

closed above theupper Bollinger Band and 50-day MA. The move looks strong, as traders’ price global growth concerns. More in store?

NAS100

stopped short of a bearish outside day reversal on Friday. For now, biased for higher levels and 13,800 remains the target, but a daily close below 13,139 would suggest turning to a neutral bias. Would like to see Apple, Microsoft and Nvidia fire up again to get the tech-heavy index pushing to new highs.

US500

While the bias in the NAS100 is constructive the US500 continues to consolidate. With the trend firmly sideways, and the RSI (14) mid-range, mean reversion is the preferred strategy on the daily timeframe and on the week see the risk of price trading in a range of 4200 to 4050. If the VIX can push above 22% then could look to target 3980. A rally in the USD could see equity sellers become dominant this week.

GER40

price action remains stuck in a range of 16,000 to 15,700. This worked last week, and it remains my view – A breakdown in Chinese equities could weigh, so keep an eye on the CN50, CHINAH and HK50.

HK50

Yet another equity index tracking a tight range – for now, biased for lower levels and watching the 25 April low of 19,362 where buyers may step in.

XAUUSD

A stronger USD may negatively impact price, but the market still sees reasons to hedge risks around US regional banks and the US debt ceiling.I’m watching the KRE ETF (regional bank ETF) and US Treasury daily cash balance – the latter sits at $143b having fallen $109b last week and is headed to levels where the market may start increasing hedges – a move into $50b may see traders start looking at long JPY, CHF, and gold as debt ceiling hedges.

SpotCrude

having found sellers at the 50% fibo of the April to May sell-off ($73.74) we see the sellers dominating with demand the greater concern. Headlines around potential OPEC action may be a concern for crude shorts, but I favour selling rallies with a bias for lower levels. China data and moves in USDCNH could be well worth looking at for crude traders.

EURUSD

the pair has been impacted by global growth concerns, with China at the epicentre. Recall, China data has been weak of late, and the market expresses a view that the best of the reopening has been priced – Europe is a major trading partner of China and traders are selling EURs as a consequence. The left side of the USD smile theory is working well here. 1-week EURUSD implied volatility sits at 6.60% - near 52-week lows. For context, options traders see EURUSD trading a 82-pip move on the week (higher or lower). Personally, hoping that low vol is priced incorrectly and we see some lift in expected movement, but this sanguine volatility has implications for my risk and position sizing.

GBPUSD

some focus on UK jobs this week but the USD is the dominant driver this week and we question whether it can continue to rally on a broad basis. Big support into 1.2347 – a level for the scalpers and I think it gets there.

Bitcoin

holding a slight negative bias – a daily close below the range lows of 26,500 opens a quick move to 25,180.

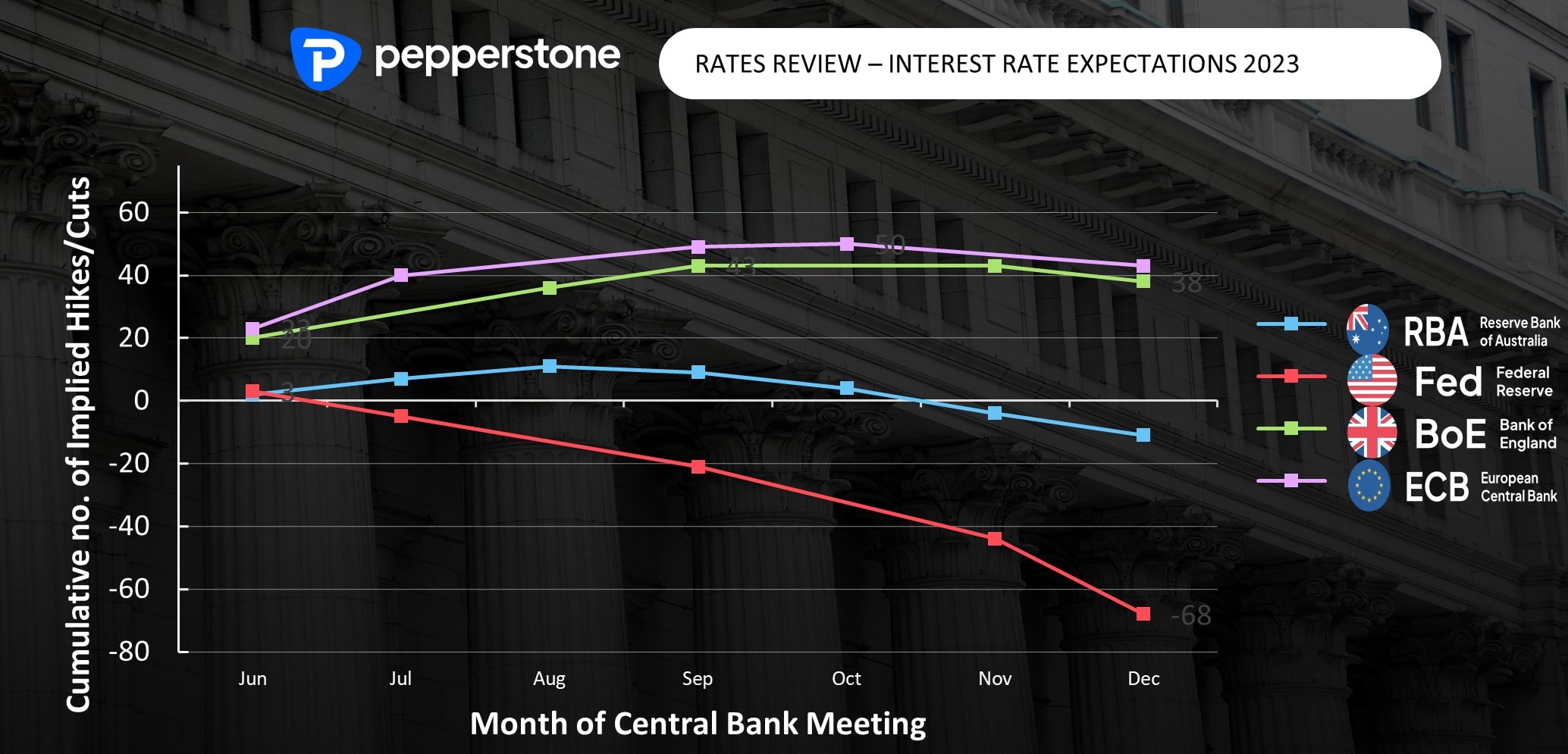

Interest Rates Review

we look at interest rate pricing and the cumulative number of hikes/cuts (in basis points) expected for each future central bank meeting in 2023. For example, we see3bp of hikes priced for the June FOMC meeting, but then this reverses and the market prices 68bp of cuts cumulatively priced by December.

The marquee event risks for the week ahead:

China industrial production

(16 May 12:00 AEST) – the market expects a solid improvement in the industrial production read at 10.8%. We also get retail sales (+22%), and fixed asset investment (5.7%) – a big year-on-year improvement shouldn’t surprise given it is measured against a stagnant economy that was in lockdown. However, with China’s data throwing up a few concerns of late (we’ve seen poor import, PPI, and loan data) China’s growth is very much at the heart of market moves. USDCNH seems key to G10 FX pricing, and a further rise towards 7.0000 should weigh on EURUSD and AUDUSD.

Japan national CPI

(19 May 09:30 AEST) – a data point that flies under the radar, but this print could be very important for Japan govt bond (JGB) and JPY pricing. With expectations of a change in BoJ (Bank of Japan) policy recently pushed back to the July/September BoJ meetings (there is no August BoJ meeting), a hot CPI print could see views of a tweak to policy pushed forward. The market expects headline CPI at 3.5% (from 3.2%) and core at 4.2% (3.8%). The core print is concerning given the extent of the recent rise and if it does indeed come in at 4.2% it would be the highest since Aug 1982. The JPY should be on the radar here and a print into 4.4% could see JPY shorts cover.

US retail sales

the market will be watching ongoing US debt ceiling negotiations and the tape in the regional banks, but US retail sales could potentially impact pricing – the market expects a 0.8% lift in sales in April. With just 3bp of hikes priced for the June FOMC, we’d need to see a punchy number (well above 1%) to move the USD on this release. USDJPY is the cleanest play on this data, with the risk skewed for a move back to key resistance at 137.69.

UK employment report

(16 May 16:00 AEST / 07:00 BST) – the market looks for 5.8% earnings growth (from 5.9%), with the U/E rate unchanged at 3.8%. The market prices 20bp of hikes for the 22 June BOE meeting, and a peak (terminal) bank rate of 4.87%, so the employment report could impact the GBP. GBPUSD trades heavy, with 1.2344 as the big support target. EURGBP saw a bullish outside day on Thursday and I like buy stop orders above 0.8734 for 0.8760/70.

Aus Q1 wage price index

(17 May – 11:30 AEST) – the market is looking for 3.6% YoY wage growth (0.9% QoQ), with the range of estimates set from 3.8% to 3.5%. With just 1bp of hikes (a 4% chance) priced for the June RBA meeting, a blowout wage print could lift very sanguine rates pricing. Probably good for a small lift in the AUD, but the bigger driver remains concerns around global growth, so China’s data dump is likely more important for the AUD this week.

Aus April employment report

(18 May – 11:30 AEST) – the consensus is calling for 25k net jobs created, with the U/E rate unchanged at 3.5% and the participation rate at 66.7%. Unlikely a volatility event for the AUD, or at least one where any initial move is likely quickly faded.

Canada CPI

(16 May 22:30 AEST) – the market expects headline CPI at 4.2% YoY (from 4.3%) and core at 4.3% (from 4.6%). The market sees the Bank of Canada (BoC) on pause through 2023, with cuts priced in January 2024 – the risk is we see a downside surprise opening cuts in Q3 23. Upside risks in USDCAD remain for a re-test of 1.3667.

Fed speakers

it’s a massive week of Fed speakers and it could get noisy, although I suspect they will all say a similar thing; that inflation is still too high, and that interest rates may need to go up further, although they will need to assess the lag effect of policy tightening. Chair Powell speaks with Ben Bernanke (20 May at 01:00 AEST) and that could be worth a listen.

A full line-up can be seen here

ECB speakers we see 12 ECB speeches this coming week – a full line-up and times (in AEST) can be seen

here

Related articles

لا تُمثل Pepperstone أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. البيانات، سواء كانت من جهة ثالثة أو غيرها، لا يجب اعتبارها توصية؛ أو عرض لشراء أو بيع؛ أو دعوة لعرض لشراء أو بيع أي أمان، منتج مالي أو صك؛ أو المشاركة في أي استراتيجية تداول معينة. لا تأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار الخاصة بهم. ننصح أي قارئ لهذا المحتوى بطلب نصيحته الخاصة. بدون موافقة Pepperstone، لا يُسمح بإعادة إنتاج أو إعادة توزيع هذه المعلومات.