Analysis

May 2025 FOMC Preview: Staying In ‘Wait & See’ Mode

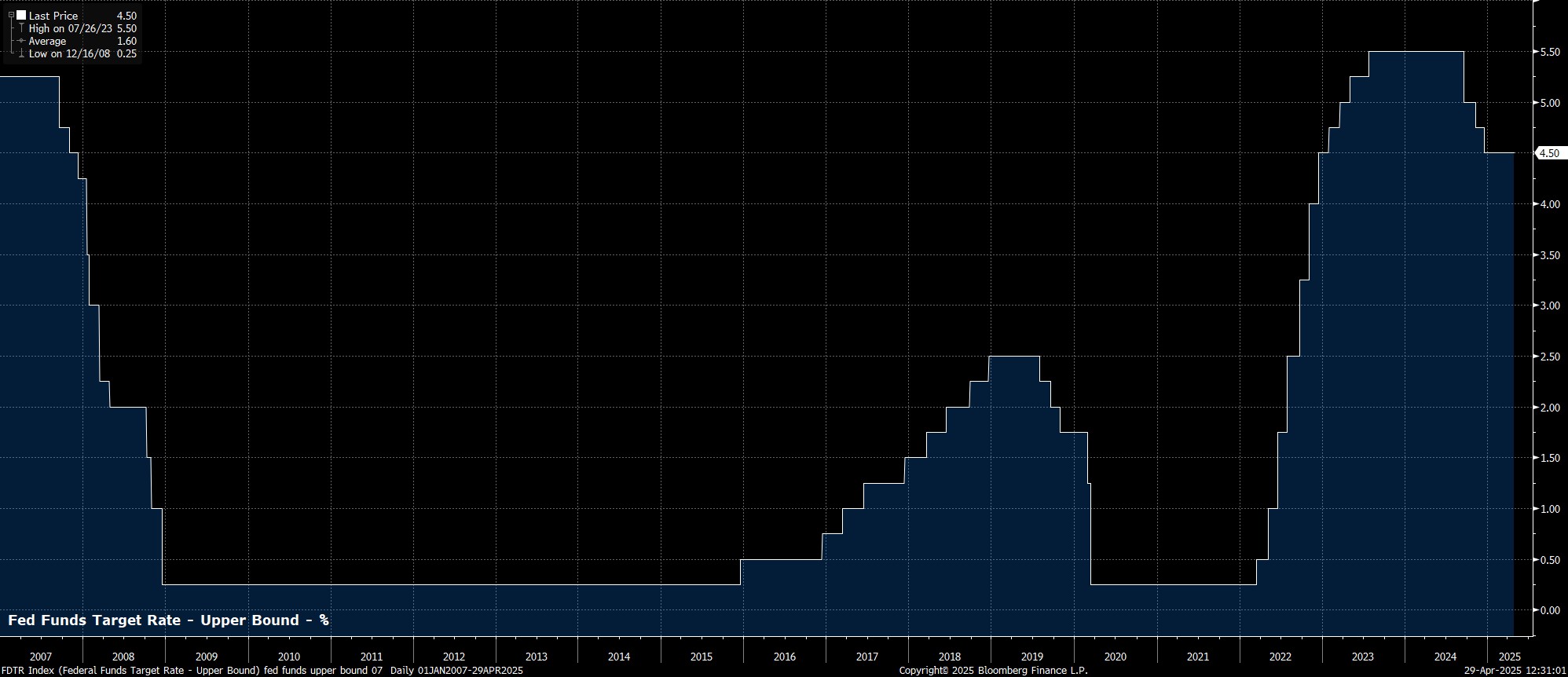

As noted, the FOMC are all but nailed-on to maintain the target range for the fed funds rate at 4.25% - 4.50% at the conclusion of the May meeting, in a decision that should come by virtue of a unanimous vote among policymakers. Standing pat will see the FOMC extend the ‘pause’ in the policy normalisation cycle, which begun in January.

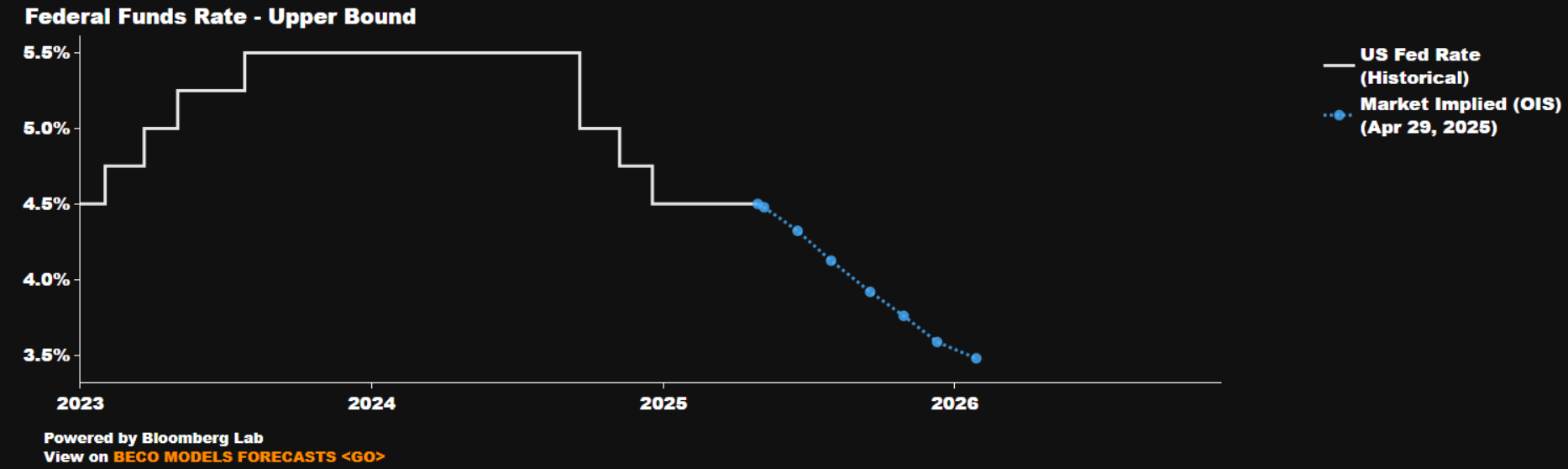

Money markets, per the USD OIS curve, price a modest 10% chance of a 25bp cut at the May meeting, while also seeing a more sizeable 7-in-10 chance of such a reduction being delivered by June, and fully pricing a cut by the July meeting. This pricing, though, remains fluid, especially with Q1 GDP and the April NFP figures having not been published at the time of writing, and with a significant degree of this dovish path stemming from hedges placed amid sizeable downside growth risks stemming from the Trump Administration’s tariff policy.

While policy is likely to be held steady, the FOMC are likely to acknowledge headwinds facing the economy in the updated policy statement. The Committee will probably amend their language on economic growth, noting that the pace of expansion has ‘moderated’ from the ‘solid pace’ seen over the last 18 months or so. Furthermore, the statement is also likely to stress that risks to both sides of the dual mandate are now ‘elevated’, in an acknowledgement of both the downside growth, and upside inflation, risks that tariffs present.

Despite growing, and conflicting, risks to the dual mandate goals of price stability and maximum employment, the Committee are unlikely to alter their policy guidance. Consequently, the statement should repeat that the modus operandi for policymakers remains one of ‘data-dependence’, with the FOMC being prepared to adjust policy ‘as appropriate’, depending on how the economy evolves.

While the risks of ‘stagflation’ in the US economy are clearly growing, this is likely to be a topic for the post-meeting press conference, as opposed to one that the FOMC seek to explicitly address as part of the statement.

As Chair Powell noted in a recent speech, the FOMC’s response to such a scenario where either side of the dual mandate was in tension with the other would be to consider how far each goal is from being achieved, and the time horizons over which those goals would be obtained, before determining the appropriate policy response. That said, ensuring that inflation expectations remain ‘anchored’ will remain a priority.

In any case, a considerable amount has taken place since the last FOMC meeting in mid-March, which has rendered the forecasts issued in the last SEP effectively redundant. Naturally, the bulk of these developments centre on the trade backdrop, with President Trump having announced sizeable ‘reciprocal’ tariffs on imports into the US on 2nd April, only to pause the bulk of these tariffs for 90 days just a week later. Meanwhile, tensions between the US and China have only increased, with each now imposing tariffs of well over 100% on the other, amounting to an effective trade embargo being in place between the world’s two largest economies.

While trade policy has been ever-changing in recent months, and could well change again before the FOMC take their May policy decisions, the economic impacts of the policies are obvious, in the short-term.

Firstly, on inflation, even though the bulk of ‘reciprocal’ levies, which were higher than even the Fed’s upside scenario, have been paused, the average effective tariff rate charged by the US remains at multi-decade highs, well north of 20%. The vast majority, if not all, of this increase in costs is likely to be passed on to consumers in the form of higher prices, in turn likely sending CPI to somewhere around 4% over the next quarter or so, as the full impact of tariffs is felt.

This rise in inflation, though, is likely to prove ‘transitory’ in nature, owing to the one-off nature of tariff-linked price hikes, assuming that policy doesn’t shift again. Over the longer-term, tariffs are more likely to have a disinflationary impact, as higher prices act as a stiff headwind to demand. Policymakers, though, will want to be sure that these price pressures do indeed prove temporary, before pulling the trigger on any policy action.

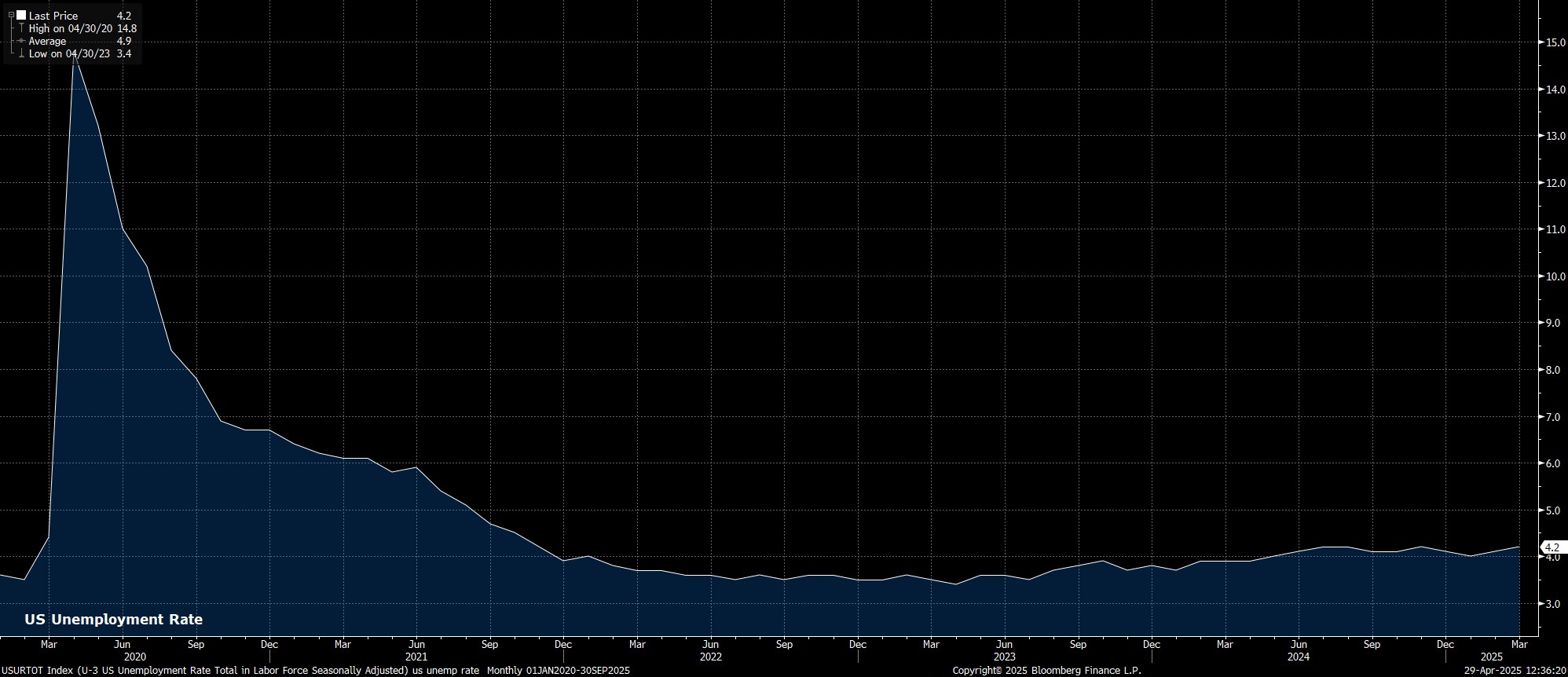

Meanwhile, from a growth perspective, tariffs clearly pose fairly substantial downside risks in the short-term, particularly given that US-China trade has now, effectively, come to a complete halt. In turn, this marked slowdown in economic activity will also present significant risks to the labour market.

Initially, these risks will likely emerge in the most trade-sensitive sectors, such as shipping and logistics, which will bear the brunt of supply chains seizing up. That labour market weakness, though, will slowly but surely permeate to other sectors as spending more broadly slows, likely pushing the unemployment rate towards 5% around the end of the year.

As noted earlier, Chair Powell will likely remain relatively non-committal on the matter of the dual mandate goals coming into conflict, instead seeking to preserve as much policy flexibility as possible, as the Fed seek not to box themselves in, given the present fluid nature of the economic outlook.

On the subject of the presser, it seems almost inevitable that Powell will be peppered with numerous questions regarding the Fed’s independence, even if President Trump has backed off his attacks on the institution, and on Powell himself, in recent days. In keeping with the tone of his previous remarks, Powell seems certain to reiterate that the Fed’s independence is a matter of law, that FOMC members are not removable except “for cause”, and that he will not resign if asked by the President.

Taking a step back, the May meeting should reiterate that the FOMC will be staying firmly on the sidelines for the time being, continuing to take a ‘wait and see’ approach to future policy decisions, thoroughly assessing the impacts of tariffs on the US economy, and achievement of the dual mandate objectives. While the direction of travel for rates remains lower, the elevated risks of ‘stagflation’ will likely lead policymakers to ensure that the ‘hump’ in inflation does indeed prove to be short-lived, and that inflation expectations remain well-anchored. As such, any cuts before the summer is out seem a very long shot indeed.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.