Blockbuster NFP Shows Fed Patience Is Warranted

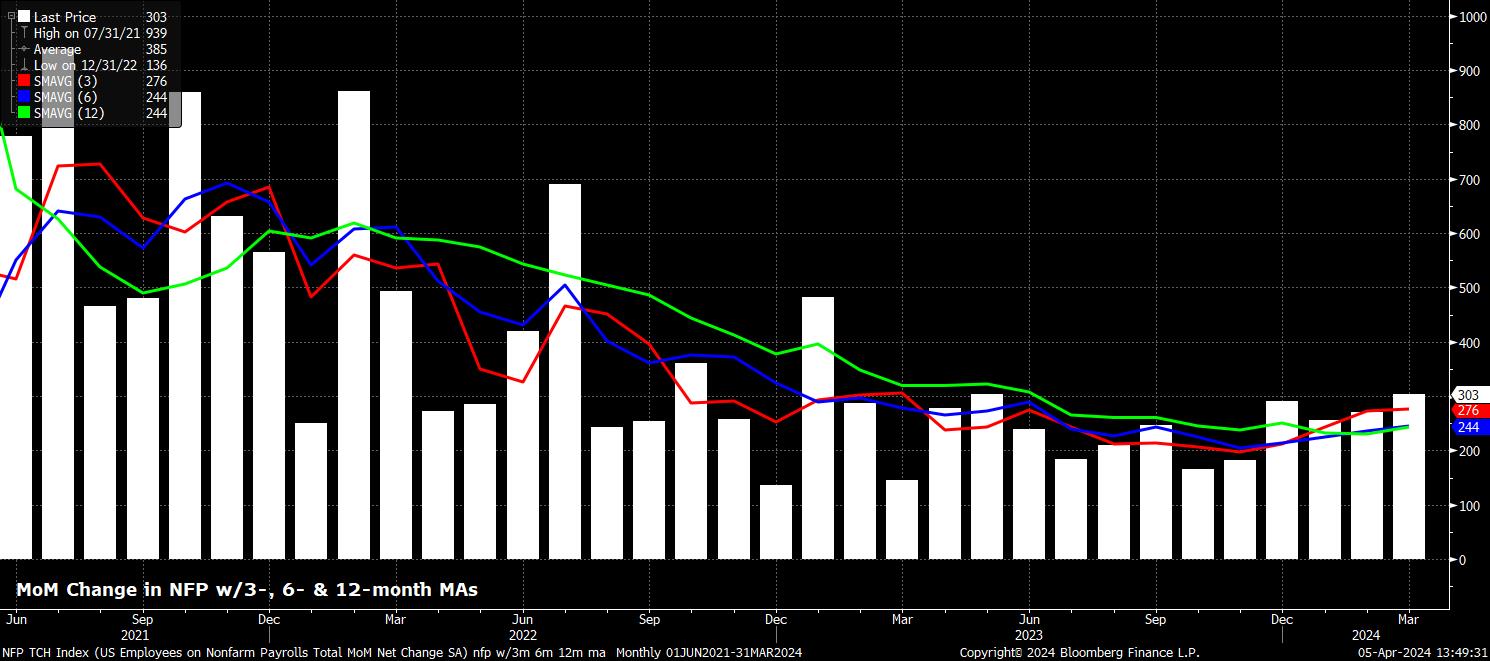

Headline nonfarm payrolls rose by a blockbuster 303k in March, well above consensus expectations of a +214k rise, while also being above the top of the forecast range. In addition, the January and February payrolls prints were revised higher by a net +22k, taking the 3-month average of job gains to +276k, its highest level in a year.

At a sectoral level, the picture is equally as strong as the blowout headline print would imply. Every sector saw a monthly gain in employment, besides manufacturing and information where job gains were flat. Meanwhile, government, plus leisure and hospitality made the biggest positive contributions to the NFP print.

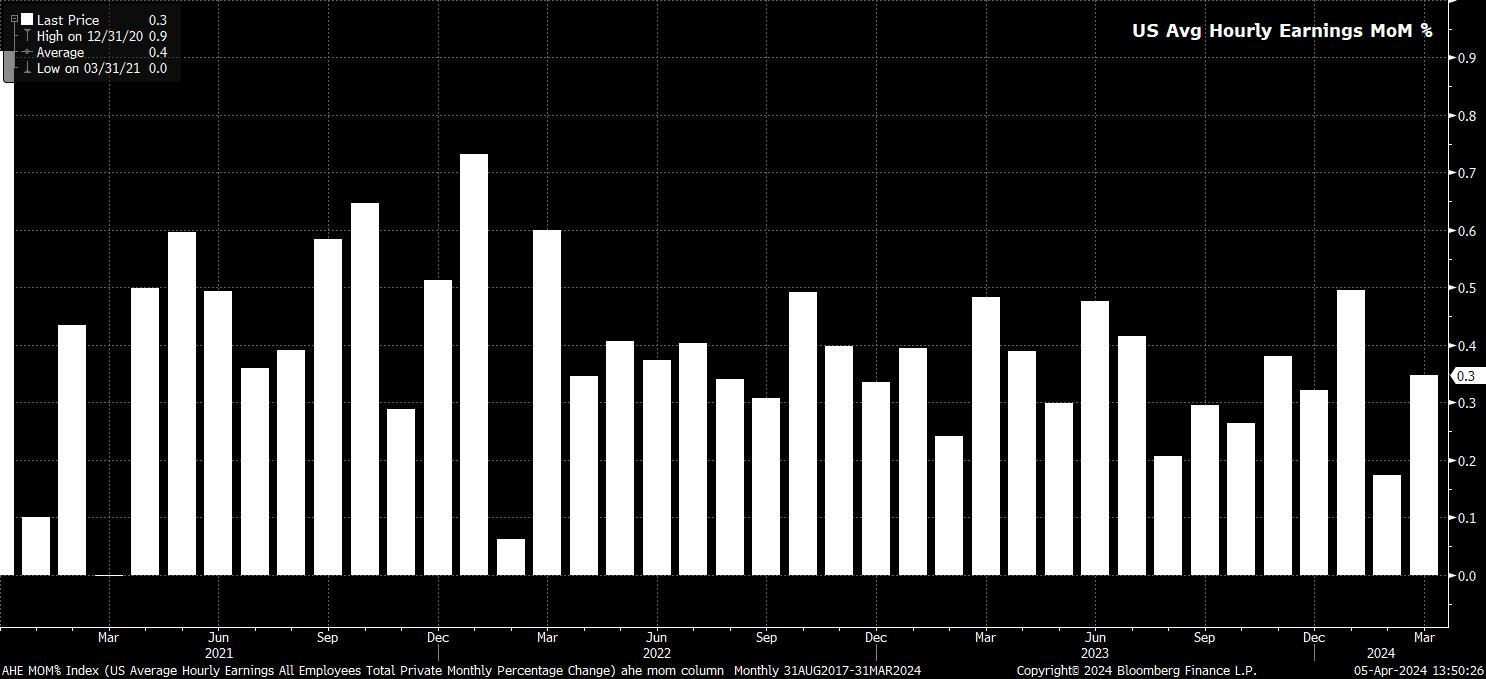

Sticking with the establishment survey, the jobs report showed average hourly earnings rose by 0.3% MoM in March, a modest rise from the sluggish 0.1% pace seen in February, and bang in line with consensus expectations. Nevertheless, the annual pace of earnings growth continued to cool, mainly due to higher comps from last year, with YoY average hourly earnings rising 4.1%, down from the 4.3% seen a month prior. Of note, these earnings figures came despite average work week hours ticking marginally higher, to 34.4 from a prior 34.3.

Turning to the household survey, data showed headline unemployment sat at 3.8% last month, as expected, a modest downtick from the 3.9% seen in February, which was the highest such rate since the beginning of 2022.

Other measures of labour market slack, meanwhile, also pointed to the labour market remaining tight. While underemployment held steady at 7.3%, participation rose 0.2pp on the month, to 62.7%, inching back towards the cycle highs seen towards the middle of 2023.

Despite the strong jobs report, it seems unlikely that this will significantly move the needle in terms of the FOMC policy outlook. As noted by Chair Powell in the March FOMC press conference, a strong job market would not be a reason to “hold off” on delivering rate cuts, particularly with the FOMC seemingly relatively unconcerned at the moment about the potential inflationary implications of the continued solid labour market performance.

Likely as a result of this, rate pricing was relatively unchanged as the payrolls print dropped, with USD OIS continuing to fully price the first 25bp Fed cut for July, while also pricing around 68bp of easing by year-end, a modest hawkish repricing compared to the 71bp priced pre-NFP.

Similarly, the market reaction to the jobs report was relatively muted.

While a knee-jerk hawkish move was seen across the board as the data dropped – equities touching day lows, Treasuries day yield highs led by the front-end, and the dollar fresh day highs – the move was relatively modest in nature, and incredibly short-lived, with all paring back to pre-release levels relatively rapidly.

The jobs report, more broadly, changes little in terms of the balance of risks for markets at present, with the path of least resistance still likely to lead higher for risk, as the ‘Fed put’ remains in place and cuts look likely to begin in the summer, while also leading higher for the dollar, with the jobs figures reinforcing the ‘US exceptionalism’ narrative that continues to drive the G10 FX market.

As noted, the payrolls print likely also changes little in terms of the policy outlook, with inflation still the primary determinant of when, and by how much, the FOMC will cut this year, despite the two sides of the dual mandate coming back into better balance. On this note, next week’s CPI report, due 10th April, will be pivotal, particularly after three straight hotter-than-expected headline figures.

Related articles

Pepperstone不代表這裡提供的材料是準確、及時或完整的,因此不應依賴於此。這些資訊,無論來自第三方與否,不應被視為建議;或者買賣的提議;或者購買或出售任何證券、金融產品或工具的招攬;或參與任何特定的交易策略。它不考慮讀者的財務狀況或投資目標。我們建議閱讀此內容的讀者尋求自己的建議。未經Pepperstone的批准,不允許複製或重新分發此信息。