Preview For The February 2024 US Jobs Report

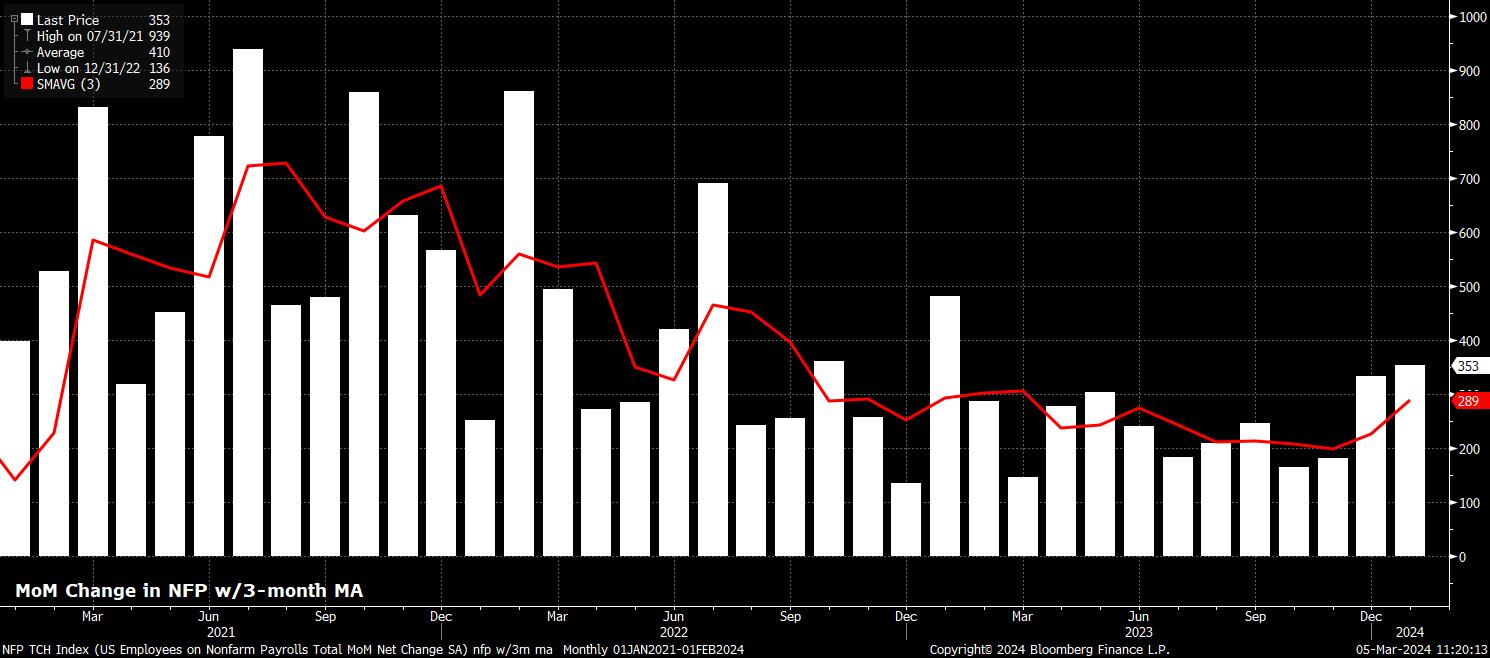

Consensus sees headline nonfarm payrolls as having risen +200k last month, a slowdown from the +353k pace seen at the beginning of the year, and moderately below the +255k average monthly gain seen last year, though still a pace that would remain above the approx. +120k required to keep up with population growth. As always, the range of forecasts for the NFP print is wide, from +125k to +260k, with the usual rule of thumb applying, that a print around +/-30k from consensus can broadly be considered to be ‘in line’.

In any case, were headline NFP to print in line with consensus, pending revisions to the prior 2 months of data, this would drag the 3-month average of job gains to +295k, an 11-month high – a clear sign that there is little cooling of the labour market just yet.

Leading indicators for the nonfarm payrolls print are rather mixed. Both initial and continuing jobless claims rose in the survey week, by +26k and +66k respectively, though both gauges remain at historically low levels. Meanwhile, the latest PMIs also point to potential downside risks to the +200k forecast, with the ISM manufacturing survey indicating employment contracting at a faster pace (the sub-index falling to 45.9 from 47.1 prior, and the equivalent services survey falling to 48.0, also implying contraction MoM.

The ADP employment report, meanwhile, should as always be ignored, with it both having a negative correlation with the official BLS figures, in addition to ADP themselves having recently noted that their report is “not intended to forecast the Bureau of Labor Statistics monthly jobs report”. Time to, if you haven’t already, take that input out of the models used for your NFP sweepstake guesses.

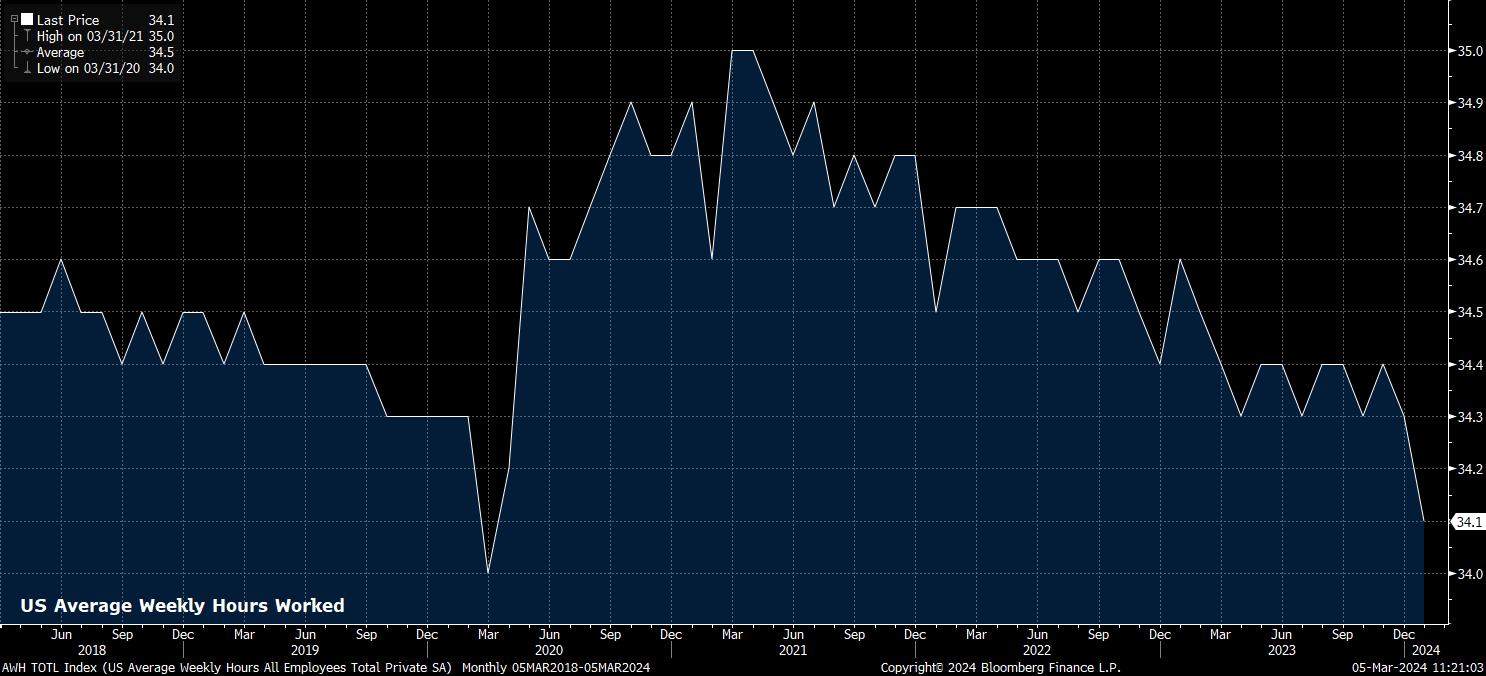

ADP aside, the February NFP jobs report will prompt a couple of questions. Firstly, will be an attempt to gauge the degree to which seasonal adjustment impacted the surprisingly hot January data, and to what extent this contributes to a subsequent slowdown in hiring in the February report. Secondly, there is the question of how much adverse weather skewed the January data, with a return to more regular climate conditions likely to see average work week hours rise to 34.3, from a prior 34.1, with the January print having been the lowest since the pandemic first hit in March 2020.

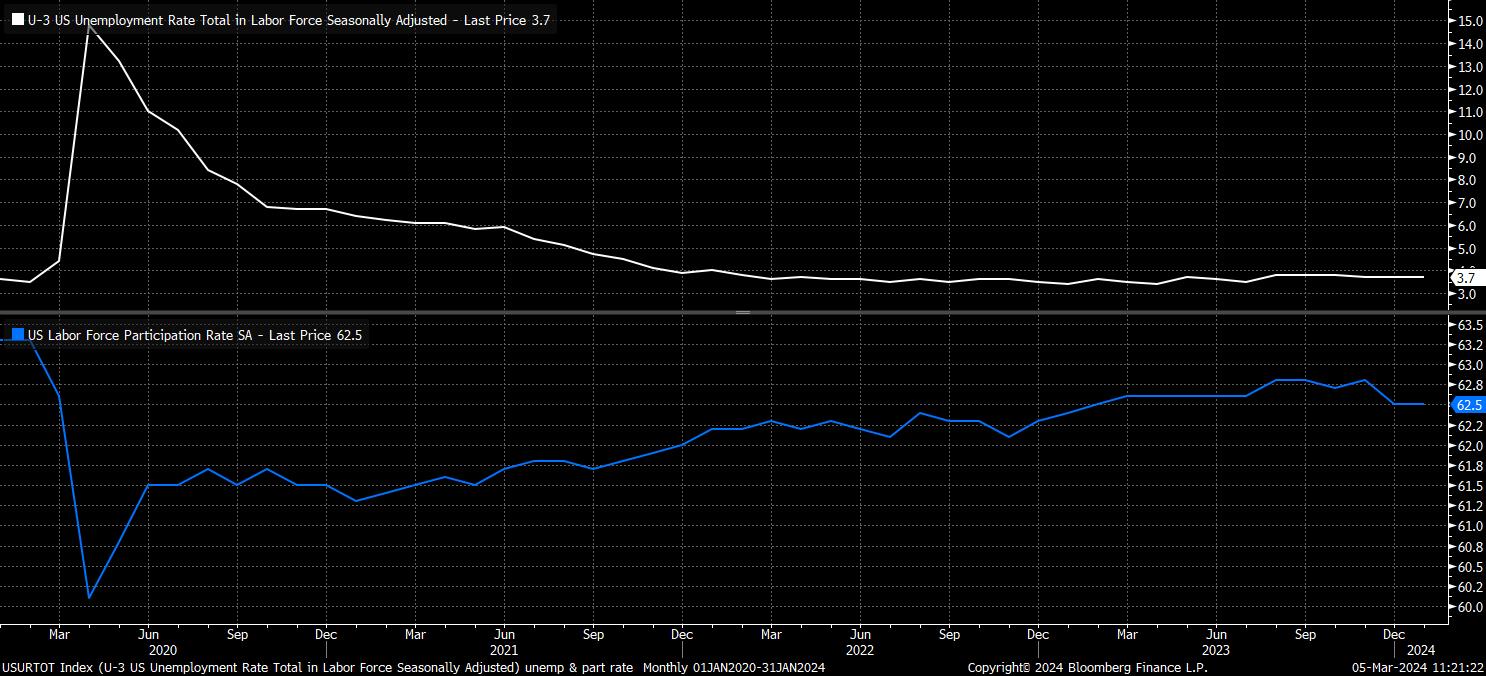

Turning to other areas of the jobs report, unemployment is seen holding steady at 3.7% in February, which would represent the fourth straight month at said level. Clearly, this continues to signify a tight jobs market, though the expected 0.1pp MoM rise in labour force participation to 62.6% would likely be a pleasing sign for policymakers. This is as labour market progress continues to be relatively broadly spread across all swathes of the economy, particularly after the unexpected plunge in participation towards the back end of 2023.

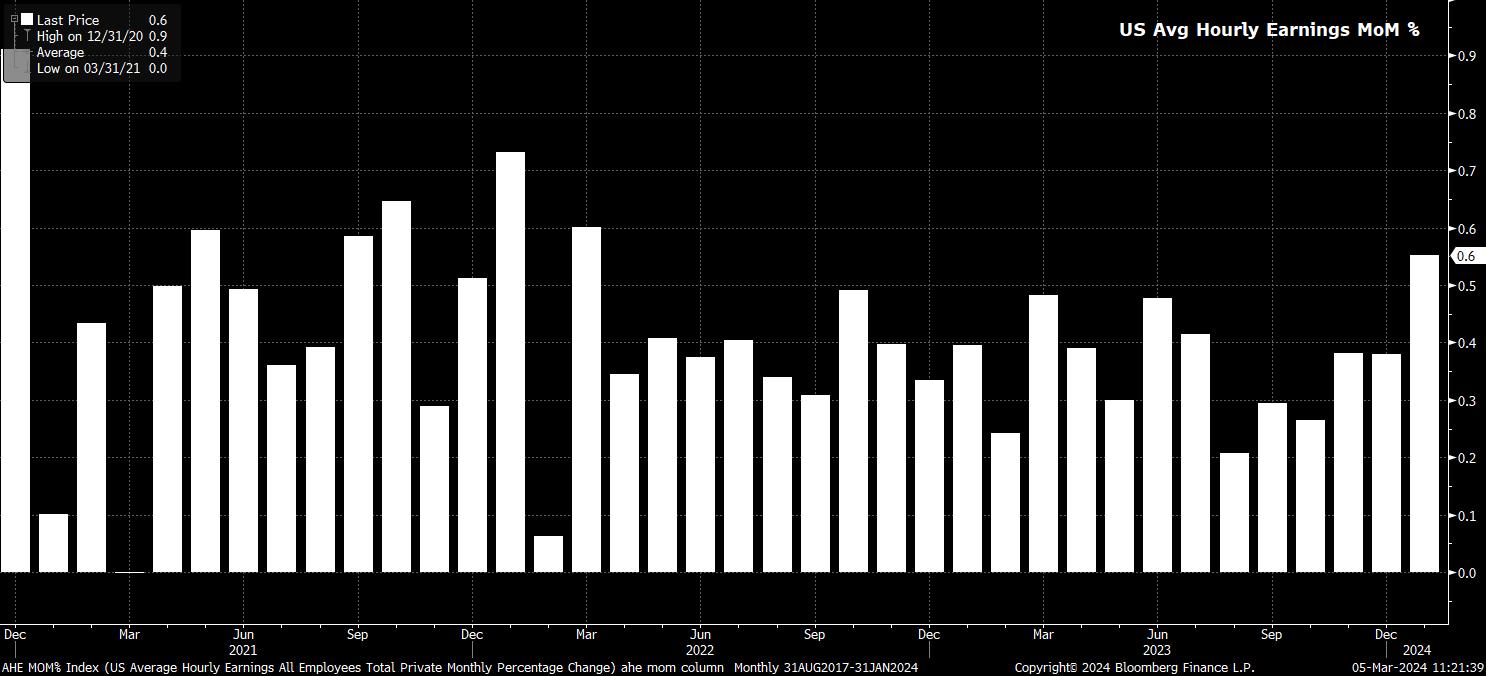

Average earnings growth, meanwhile, is set to cool from the near 2-year high 0.6% rate seen in January, to a much more modest 0.2% last month.

On an annual basis, this should bring earnings growth down to 4.3%, from 4.5% prior, likely pinning real earnings growth somewhere around 1.2-1.3%, depending on the February CPI report, potentially allaying some lingering concerns about sticky services inflation continuing to be underpinned by the red hot labour market.

With all that said and done, one naturally questions what impact the jobs report may have on the policy outlook, market pricing, and sentiment more broadly.

While the usual caveats that policymakers will not over-react to one data point apply, it seems particularly unlikely that the February jobs report will significantly move the needle in terms of the FOMC’s likely policy path – a March, or May, cut is now firmly off the cards as policymakers continue to seek additional data that inflation is indeed returning to the 2% target, while a cut in June remains the base case, and likely will continue to do so even if the jobs report were to surprise to the downside, snapping a run of three straight beats vs. consensus.

Conversely, it is tough to imagine a hotter than expected slate of jobs figures sparking a significant hawkish repricing of policy expectations. Last week, for the first time, USD OIS priced precisely 75bp of easing this year, bang in line with the median expectation from the FOMC’s December ‘dot plot’. While a modest dovish re-adjustment has taken place since, with around 80bp of cuts currently in the curve, it is tough to envisage markets, at this stage, pricing a more hawkish path than policymakers have indicated, at least not until the new dots are revealed at the conclusion of the March FOMC in a couple of weeks’ time.

With that in mind, the balance of risks likely tilts towards a more significant market reaction on a data miss, than on a beat. Though, with that being said, markets would also do well to take heed of the Fed’s ‘modus operandi’ in not overreacting to a single print. Naturally, though, this advice is unlikely to be heeded, with equities & bonds facing downside risks on a hot print, while the dollar would likely find demand; the opposite, obviously, is true on a cooler figure.

In the grand scheme of things, however, one jobs report is highly unlikely to entirely derail the continuing theme of ‘US exceptionalism’, nor will it dispel expectations that the economy will achieve a ‘soft landing’. As such, the path of least resistance will likely continue to lead higher for the greenback.

In a similar vein, one jobs report shan’t change the broader direction of travel for monetary policy, with the next move in the fed funds rate to be a reduction, quantitative tightening set to wrap up mid-year, and the return of inflation towards the 2% target giving policymakers the flexibility to cut when and how they like, and to provide liquidity injections to as great a magnitude as required, where they are needed. Consequently, the medium-term backdrop for risk remains supportive, with a prolonged drawdown in equities unlikely, and dip demand likely to remain significant.

Related articles

Pepperstone不代表這裡提供的材料是準確、及時或完整的,因此不應依賴於此。這些資訊,無論來自第三方與否,不應被視為建議;或者買賣的提議;或者購買或出售任何證券、金融產品或工具的招攬;或參與任何特定的交易策略。它不考慮讀者的財務狀況或投資目標。我們建議閱讀此內容的讀者尋求自己的建議。未經Pepperstone的批准,不允許複製或重新分發此信息。

_2024-03-05_11-22-45.jpg)