分析

May 2024 BoE Preview: The Old Lady Isn’t Far From The First Cut

While cuts are on the horizon, Bank Rate should remain unchanged at 5.25% at the culmination of the May MPC meeting, remaining at a post-crisis high, where rates have resided since August last year. Such a hold, however, is once more unlikely to be a unanimous decision, with uber-dovish external member Dhingra again set to vote for a 25bp reduction, seeing the Committee again split 8-1 in favour of holding rates steady.

Some may argue that Deputy Governor Ramsden’s recent remarks, that risks to the inflation outlook are “now tilted to the downside” compared to the February forecasts, would warrant an additional vote for a cut, though it would be highly unusual, and incredibly unlikely, for one of the MPC’s ‘core’ members not to vote in line with the remaining four internal members on the Committee.

Unsurprisingly, the GBP OIS curve prices no chance of any shift in policy at the May meeting, though does appear too dovishly priced further out. The curve implies just a 38% chance of a 25bp cut at by the June meeting, and around an 88% chance of a cut by August, with a 25bp reduction not fully priced until the September decision, with just 45bp of easing priced for the year in its entirety.

This appears an overly cautious path compared to recent BoE rhetoric. While the March statement stressed, and the May statement is likely to repeat, the assertion that policy will need to “be restrictive for an extended period of time” in order to sustainably return inflation to the 2% target, the MPC have been clear that said ‘restriction’ can be maintained even if Bank Rate were to be reduced.

Minutes from the March meeting were explicit in flagging that “the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced”, while recent speakers have also echoed such a view. Furthermore, Governor Bailey, who noted recently that rate cuts are “in play”, has also remarked that it is not necessary for headline inflation to fall to 2%, before the BoE begin to act, even if the inflation target is likely to be achieved – albeit briefly – during Q2.

Taking this all into account, it seems likely that the MPC will deliver the first Bank Rate cut in June, so long as the economy evolves in line with expectations (on which more is below). Cuts, however, are likely to proceed at a relatively cautious pace, probably quarterly, from June, resulting in a total of 75bp of easing this year. Initially, though, it seems likely that, particularly if the BoE do begin to ease in June, the MPC will do so via a split decision, with three external members – Haskel, Greene, and Mann – as well as, potentially, Chief Economist Pill, remaining concerned about upside inflation risks.

These diverging views among MPC members reflect an economic outlook which, while likely rosier than that outlined in the February forecast round, is still surrounded by plentiful risks, on both sides.

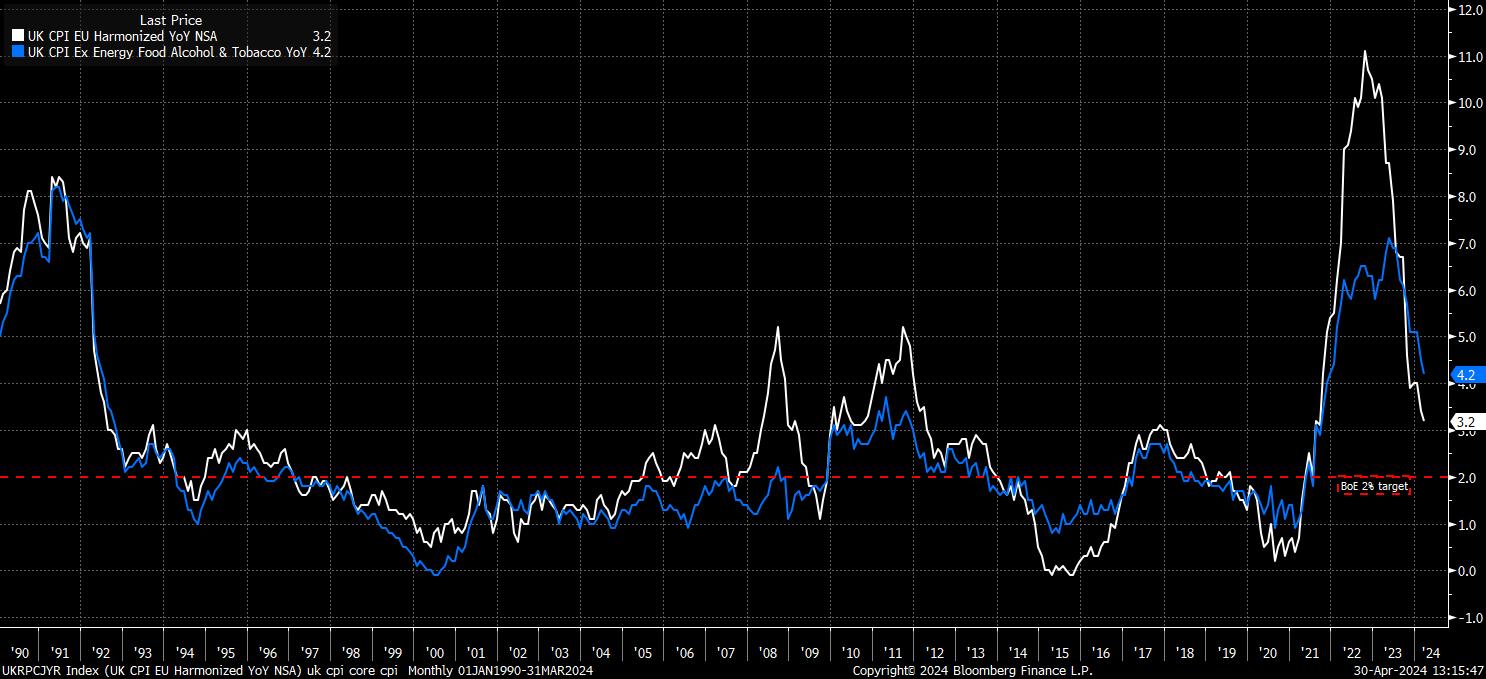

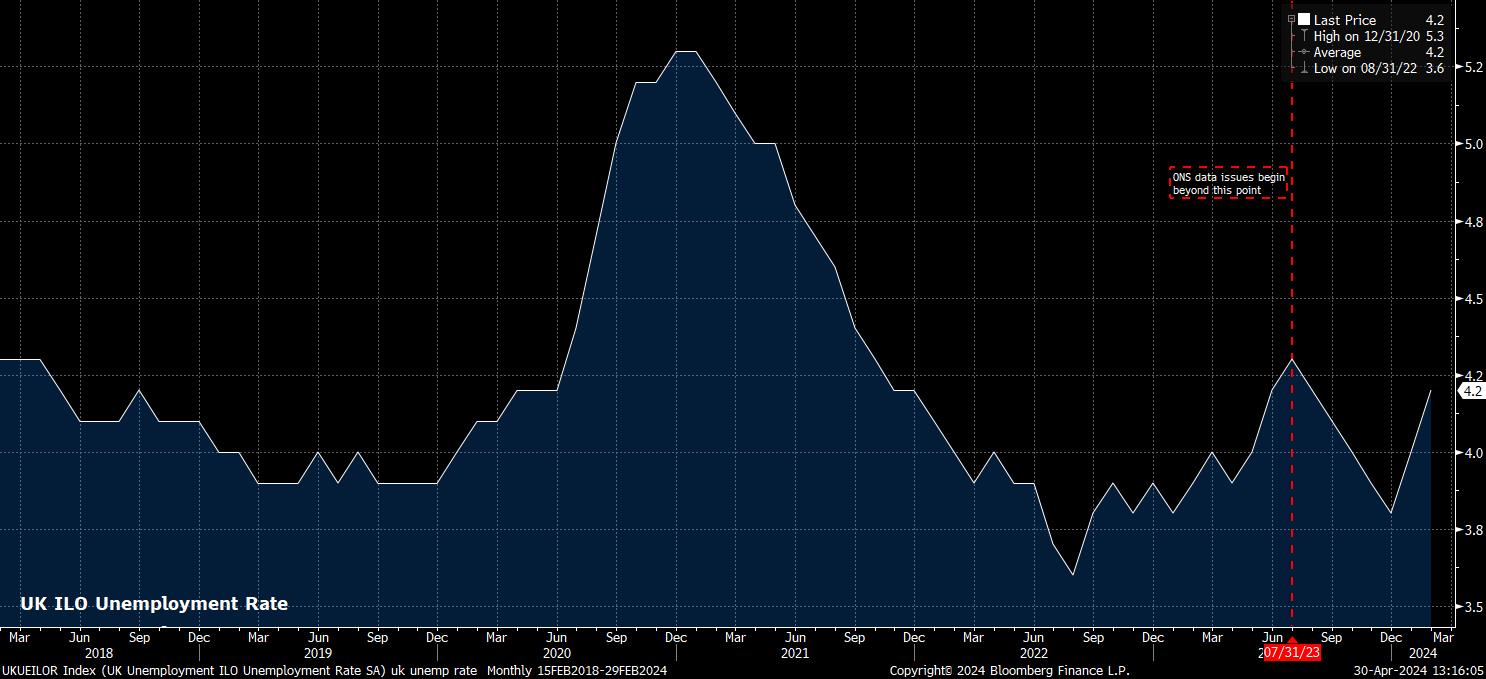

The MPC’s hawks can point to average earnings continuing to rise at a rate incompatible with the inflation target, having risen 6% YoY in the three months to February, in addition to the stubborn nature of services prices, with services CPI having remained north of 6% on an annual basis, since September 2022. Meanwhile, the doves, can point to the recent rise in unemployment, to a 6-month high 4.2% in the most recent report, and the likelihood of headline CPI hitting 2% during Q2, as the impact of falling consumer energy prices continues to impact the data.

In any case, as is typical, the BoE will release their updated economic forecasts at the May meeting, as part of the latest Monetary Policy Report.

On growth, the outlook appears brighter than that outlined in February, with risks now likely tilted to the upside of the MPC’s 0.3% 2024 GDP growth projection. The UK continues to recover well from the shallow recession experienced in late-2023, with GDP likely to have expanded by around 0.4% QoQ in Q1, needing the economy to simply stagnate in March to achieve such a pace of growth.

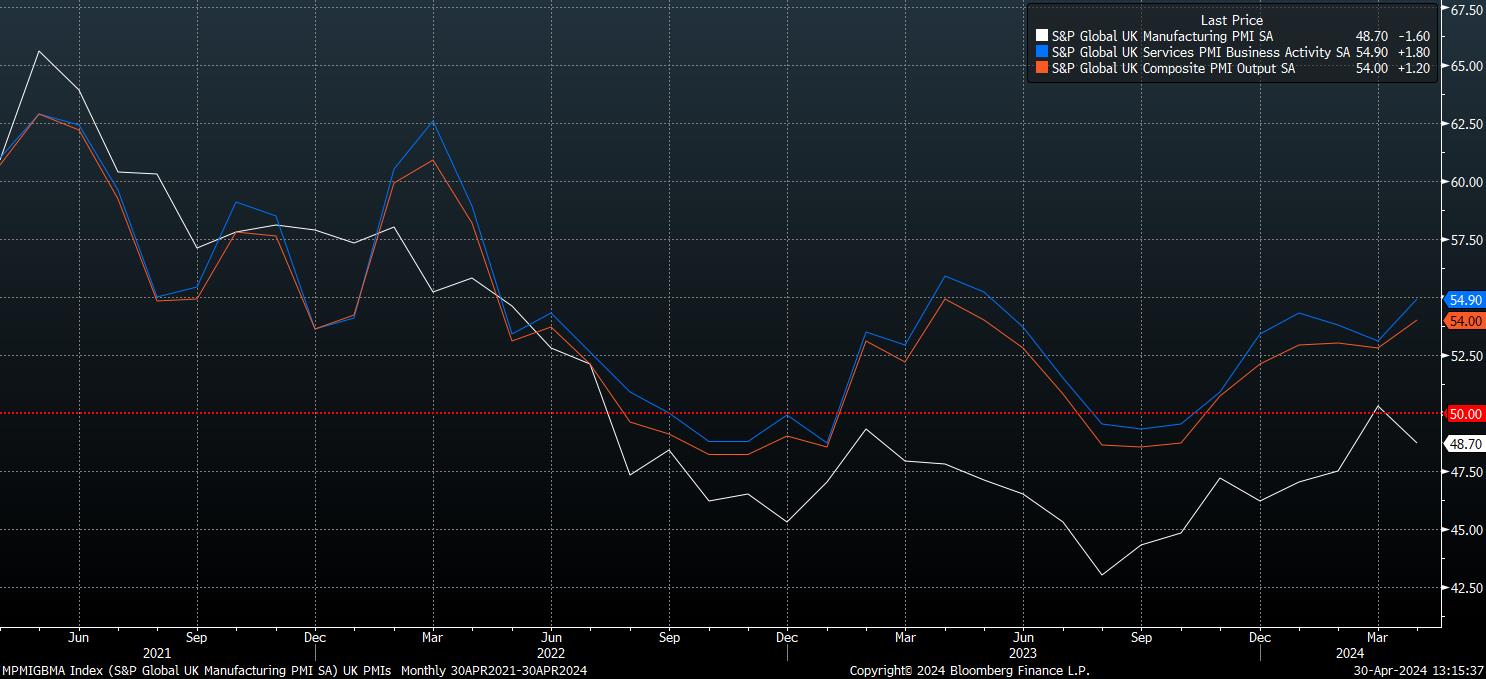

Concurrently, leading indicators point to this resilience having continued into the second quarter, with April’s ‘flash’ composite PMI ticking higher to 54.0, its highest level since last May.

A significant proportion of this growth, however, is being supported by resilient consumer spending, and relatively upbeat consumer confidence. Hence, to a significant extent, a continuation of this solid momentum likely requires a marginally looser policy stance, given the degree to which hopes of rate cuts have underpinned this resurgence in consumer optimism.

Naturally, said cuts hinge on the inflation outlook, though for the BoE to deliver the three 25bp cuts from June in my base case, inflation likely needs to simply fall in line with expectations, and need not exceed the pace at which policymakers see price pressures receding towards the 2% target. Speaking of which, while headline CPI is likely to fall to, and possibly dip beneath, 2% in Q2, inflation is likely to end the year just above the 2% target, while potentially also remaining above target in 2025, when the forecast is conditioned on the market rate path.

When conditioned on a constant-rate basis, headline inflation will likely significantly undershoot target. However, given that MPC members likely favour a rate path more dovish than that currently implied by the OIS curve, the usual implicit signalling mechanism of comparing the 2 forecasts will prove less effective than is typically the case, leaving any massaging of rate expectations to Governor Bailey at the post-decision press conference.

Lastly, on unemployment, the BoE’s forecasts from the February MPR are likely to remain relatively unchanged, with joblessness seen rising to around 5% by the end of the forecast horizon.

While concerns over the reliability of labour market data persist, with the ONS not due to produce the renewed Labour Force Survey until September, clear signs of loosening are beginning to emerge. As noted earlier, unemployment rose to a 6-month high 4.2% in February, while the rate of wage settlements is likely to slow post-April, once the minimum wage hike, and increase in the salary of other lower-paid workers, feeds through the data, and when negotiations are taking place in an environment with inflation back at, or just above, target.

That said, while such a high degree of uncertainty over the data accuracy persists, the BoE will likely prove reluctant to significantly alter current expectations.

In terms of market implications from the May MPC decision, risks appear tilted in a dovish direction compared to how markets are currently priced, as alluded to above.

This suggests potential downside for the GBP, despite cable having recently recovered from its lowest since last November. Cable has something of a double-whammy to contend with, given that downside risks stem not only from the BoE’s policy path likely being more dovish than that of market pricing, but also from risks to the FOMC outlook tilting in an increasingly hawkish direction, as ‘no rush to cut’ remains the policy mantra in DC. Cable revisiting the 1.23 lows seems plausible in the medium-term.

_2024-04-30_13-18-09.jpg)

Related articles

Pepperstone不代表這裡提供的材料是準確、及時或完整的,因此不應依賴於此。這些資訊,無論來自第三方與否,不應被視為建議;或者買賣的提議;或者購買或出售任何證券、金融產品或工具的招攬;或參與任何特定的交易策略。它不考慮讀者的財務狀況或投資目標。我們建議閱讀此內容的讀者尋求自己的建議。未經Pepperstone的批准,不允許複製或重新分發此信息。