A Traders’ Week Ahead Playbook – Risk flying high into CPI

Opportunities in HK/China

A clear area of focus is HK/China, where we see bullish breakouts in HK50 and the H-shares, and these markets remain front and centre with heavyweights Tencent and Alibaba reporting earnings on Tuesday, and Baidu and JD.Com on Thursday. The options market prices some big moves on the day of reporting, so we could feasibly see the HK50 testing 20k soon enough, although it’s Tencent that really needs to deliver given it is the market darling having rallied 39% rally since early March and all but 1 of the 70 analysts who cover having a ‘buy’ rating on the stock.

Reports that Chinese regulators are considering removing dividend taxes for Chinese retail traders who buy HK equity through ‘Stock Connect’ should aid sentiment further. However, there are also increasing signs of FOMO kicking into Chinese/HK equity indices, and we’ll see if the CN50 & CSI300 can join the party, where a bullish break in the CN50 index above 12,800 would see likely traders chase. Liquidity is always a big consideration for Chinese equity performance, but a big week of data may impact sentiment too, with new & used home prices, industrial production, retail sales and fixed asset investment data due on Friday, alongside property sales.

Elsewhere the Dow closed higher for 8 straight days, while the S&P500 added 1.9% w/w, although Friday’s University of Michigan survey took the wind out of the bull’s sails when it felt like the index could kick towards new highs. In the week ahead we get earnings from US consumer names - Home Depot and Walmart, with Cisco, also getting in on the action, and they need to impress given the lacklustre technical set-up (daily) and price action, highlighting investors see an opportunity cost in holding this name.

Many will start to position for Nvidia’s number next Tuesday (after-market) and after US CPI, this could be the next big event risk for broad markets.

All eyes on the US CPI report

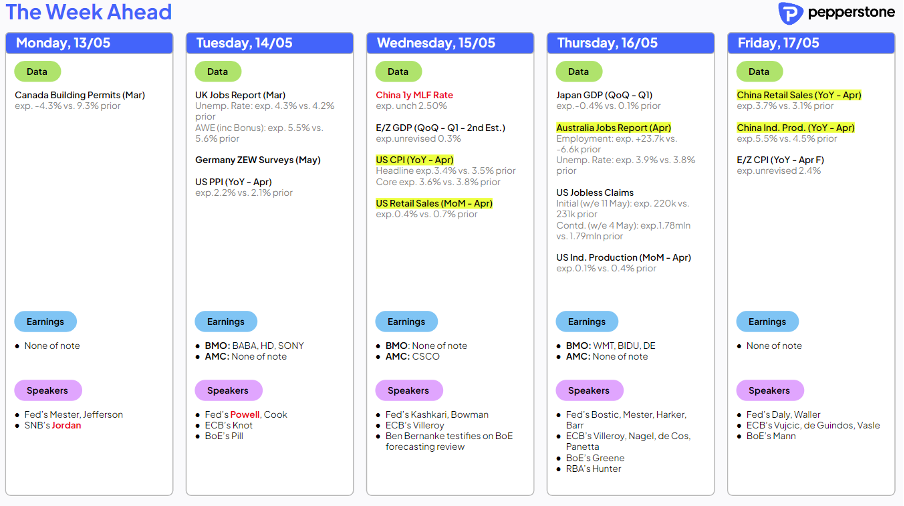

US equity traders, along with bond, gold, and USD traders (well, everyone really), will be looking to start the week by massaging exposures ahead of US PPI, and CPI and retail sales. Fed chair Jay Powell also speaks on Tuesday, but given his speech occurs before the US CPI data any guidance may not have the same impact relative to those scheduled to speak after the inflation and retail sales data.

(Source: Bloomberg)

It’s the CPI report that is the marquee risk event this week, with core CPI expected to moderate to 0.30% m/m (3.6% y/y). While the components of the CPI basket matter (notably rents), we can use the headline core CPI print for a loose playbook and consider an outsized reaction on a print above 0.35% or below 0.25%. The question to ask is whether we get a greater move in the US 2yr Treasury, and subsequently the USD, gold, and equity, on a downside miss or upside beat. I would argue the skew to greater cross-asset movement is on a downside outcome, primarily because the Fed want to see evidence that can allow them to cut rates.

Of course, a core CPI at 0.4% (or above) will likely see US 2-year Treasury yields up 8-10bp and push the USD higher, but with early signs of a cooling labour market, a moderating CPI print fits a scenario that could promote Fed action potentially by July.

Another region which is seeing good flow like the HK50 are EU and UK equity markets. Last week the German DAX was the star performer of the major equity markets, ripping 4.3% for the week, with 6 straight days of gains, and 42% of index constituents closing at a 4-week high. From a macro perspective, the collective sees attractions from somewhat better EU growth data (off low levels), while inflation is in a far better place than the US. Traders like the trend and momentum seen in these markets, and that too many is all that matters.

This week while we get revisions to EU Q1 GDP and CPI, the micro also kicks in with earnings due from Bayer, Allianz, Siemens, and Commerzbank, so it could remain lively in these indices.

Could the BoE cut rates in June?

The UK gets further focus, and after the BoE last week opened the door to a 25bp rate cut in June, with swaps pricing a cut at around 50%, and just over 2 cuts priced this year, the data this week matters. GBP traders will look at data in the form of wages, and labour data, and then, we also hear speeches from BoE officials Huw Pill, Megan Greene, and Catherine Mann, all speaking after the wage/labour data. GBPUSD is a tough call this week as the US data and the influence on the USD trumps all, so the FX cross rates can be an easier play - tactically selling GBPAUD with a stop above 1.9050 feels a good position.

Time for the AUD to shine?

In Australia, tomorrow’s budget should reinforce the focus that Australia’s fiscal position is comparatively better than many other DM economies. Like all budgets, the range of measures announced is not likely to be a volatility event for AUS200 or AUD traders to be overly concerned with but do note this week we see Q1 wages (consensus +0.9% Q/Q & 4.2% Y/Y), with the April employment data on Thursday. Aussie interest rate futures have priced out hikes for 2024, but I do feel this may be a good opportunity to reengage with AUDNZD longs, with stops below 1.0940, with GBPAUD downside a trade I like.

Commodity markets continue to garner good attention - Gold saw big interest all through the week from clients, notably on the breakout above the range highs of $2352, with some talk of buyers working orders on news that Biden will slap new tariffs on Chinese EV’s. A formal announcement should come this week and a clear sign that China is in the crosshairs for both presidential candidates into the November election. The US CPI print, however, should be the bigger influence this week on the gold market. Keep an eye on platinum too, with price closing higher in 7 of the last 8 sessions but coming into $1000 – a level that has been a reliable reversal zone since June 2023.

Related articles

Pepperstone不代表這裡提供的材料是準確、及時或完整的,因此不應依賴於此。這些資訊,無論來自第三方與否,不應被視為建議;或者買賣的提議;或者購買或出售任何證券、金融產品或工具的招攬;或參與任何特定的交易策略。它不考慮讀者的財務狀況或投資目標。我們建議閱讀此內容的讀者尋求自己的建議。未經Pepperstone的批准,不允許複製或重新分發此信息。