The Daily Fix: When will record high valuations matter for global equity indices?

As we’d also expect, given there was some hope that the tariff rollbacks would play out immediately post the signing of Phase One, we’ve seen a slight move higher in USDCNH, which seems important, given the influence this cross has had on Asia FX and EM in general. The CHF has outperformed in G10 FX, largely as a result of buying from traders post the US Treasury added Switzerland to its ‘manipulator’ list.

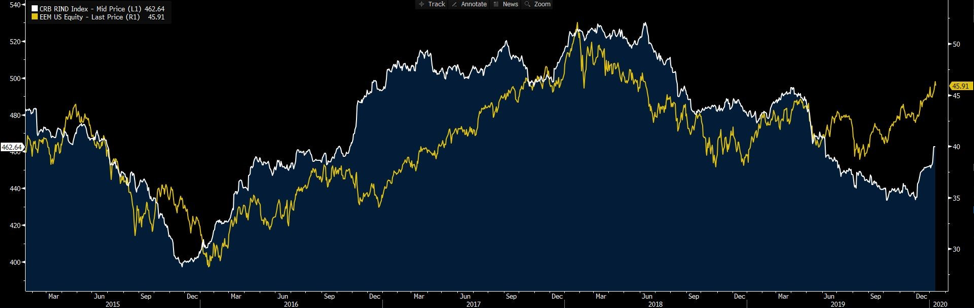

There has been modest buying in US fixed income, notably with real (or inflation-adjusted) moving a couple of basis points lower and it really throws out the notion of getting carried away with the reflation trade, which has gripped markets since late 2019. In fact, if we look at the CRB industrial raw materials index (white), which consists of inputs such as copper and steel scrap, tallow and zinc (among many others), and is considered a good leading indicator of change in the business cycle, the index has moved up, but still has a lot of work to do to convince. I have overlapped this against the EEM ETF (Emerging Market ETF), which has got a lot of attention in markets of late.

(Source: Bloomberg)

Staying on reflation in economics, I will be keeping an eye on China aggregate financing as well today (no set time), as China's credit impulse has had a reasonable influence on PMI’s and after yesterday’s solid import data, we get the sense that policy moves from different Chinese authorities are having a positive impact. Credit data is key here.

Equity valuations have seldom been higher

Equity markets may be incredibly expensive on any traditional valuation metric (price/earnings, price/sales, price/book ratio). In fact, if we look at the ASX 200 12-month P/E ratio, which resides at just over 18x, it’s really never been higher. Can one justify putting new money to work in an index where valuations are just so stretched, and you have to pay such a lofty price for those cash flows? Certainly, it’s very hard. But when we see implied volatility in all asset classes at multi-year lows, central banks ready to support when required, with the big three (Fed, ECB, BoJ) already expanding their balance sheets at a monthly clip of $100b, while real rates are negative, amid stability in the global economic data flow, the fundamentals tend to be seen in a different light. That is, until, these dynamics are called into question.

At this stage we obviously don’t know what that shock will be, but it will likely come from a more worrying trend in global economics, or from a US political situation, and not from a central bank policy error, such as we saw in late 2018. It will have us questioning the reflation trade, perhaps revising calls around the probability of a US or even global recession, and then valuation will absolutely matter, as when that elastic band is stretched as far as it currently is, then the drawdown in markets can be just that bit more violent and pronounced.

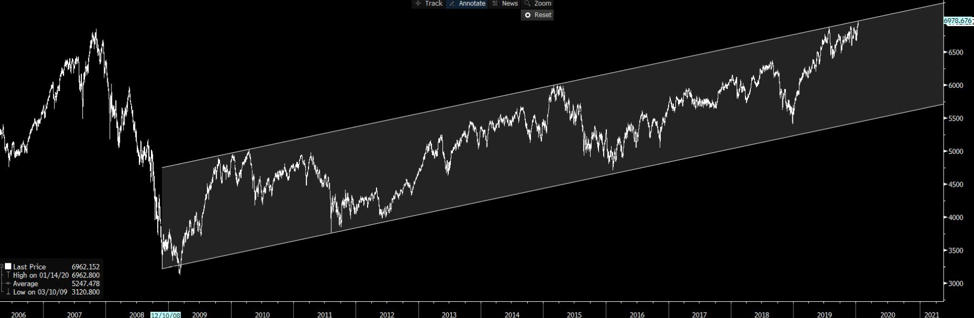

The ASX 200 into key resistance around 7000

It’s hard to go past this chart of the ASX 200, where we see price pushing into the top of the channel formed since the GFC lows. It seems a natural place for traders to fade the move, adopting counter-trend short positions, although, the backdrop for shorts is tough as everyone just buys pullbacks and sell-offs are short-lived affairs, especially when the S&P500, one of the core influences on the variability of the ASX 200 hasn’t had a 1% pullback in 67 trading sessions.

US politics in focus today

On the subject of US politics, at 1 PM AEDT we see the last TV debate before the IOWA Democrat caucus on 3 February. The debate will include five Democrat front-runners, although many will likely centre on a head-to-head tussle between Warren and Sanders. The event is unlikely to be a volatility driver for markets, however, if we consider that perhaps the biggest single risk for markets in 2020 is a market that gives Sanders a chance in November, then it pays to see how the candidates perform.

As mentioned earlier in the week, Bernie Sanders is the favourite to take out Iowa, helped by the fact he has real form there, narrowly losing to Clinton in 2016. He is well known to voters, as he is in New Hampshire, and this is significant as we can go back to 1976 (11 elections) and in all but two cases, whoever takes Iowa has been successful in achieving the Democratic nomination.

One to watch, as the market is of the belief we see a Biden v Trump showdown in November, and it is not out of the realms of possibility that is could be Sanders, and not Biden, facing off against Trump and that will not please markets, even if Trump would be the clear favourite in this battle. The TV debate will get a lot of focus on Democrat voters.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.