WHY PEPPERSTONE

Spread Bet with the #1 Trading Platform Provider*

Enjoy tax-free trading** on FX, Indices, Commodities, Shares and more.

**In the UK spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

WHY PEPPERSTONE?

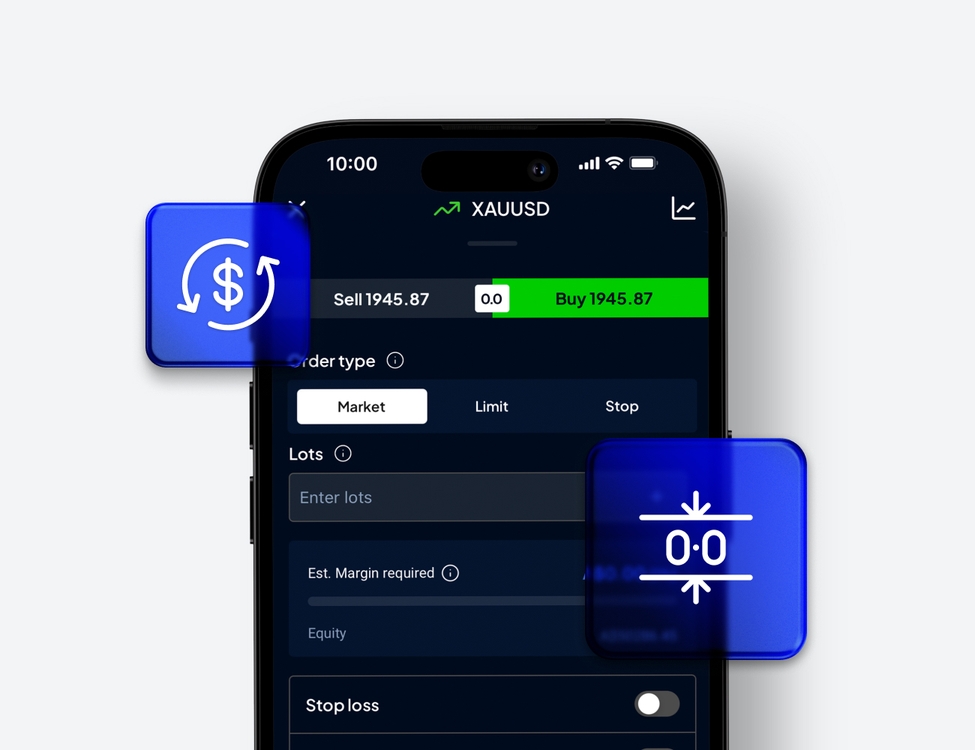

The tools you need to reach your forex trading potential

MARKET NEWS & ANALYSIS

Sharpen your forex trading edge

AWARDED BY THE BEST

Globally, we've been awarded by

*Voted Best Spread Betting Platform in the ADFVN International Financial Awards 2021

^99.90%. Fill rates are based on all trades data between 01/10/2023 to 31/12/2023

*All spreads are generated from data between 01/03/2024 and 31/03/2024

~The Pepperstone group of companies have clients in over 160 countries.

**In the UK spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

24 hour trading:

^24 hour trading 5 days of the week. Trading begins on Sunday at 20:00 ET and ends on Friday at 17:00 ET. After hours begin from 4:00 AM ET to 9:30 AM for pre-market and from 4:00 PM to 8:00 PM ET for post-market. Over night hours are between 8:00 PM to 4:00 AM.

*For exact timings, please refer to the instrument specifications within the trading terminal. 24-hour trading on select US stocks only