- English

- Italiano

- Español

- Français

As a recap, after a much hotter than expected US JOLTS job openings figure (9.61mln vs. 8.82mln exp.), the greenback popped higher across the board, benefitting once more from a chunky sell-off across the Treasury curve, with yields spiking to new cycle highs, led again by the long-end. Given not only the USD’s gains, but also the close correlation between the JPY and Treasuries, this was enough to push USD/JPY north of the 150 handle for the first time since last October.

That foray above 150 didn’t last long, however, with the JPY rapidly rallying to a 147.43 low (per Bloomberg), before paring just over half the advance.

_1_2023-10-04_07-38-52.jpg)

While the JPY has, at time of writing, been relatively steady since, market participants have been left in the dark around what actually took place.

Though the move had all the hallmarks of an intervention from the MoF, there has yet to be any confirmation of such a move from officials, with a ‘no comment’ stance having been taken since the incident occurred. There have also been no ‘sources’ stories alluding to an intervention having took place, stories which broke within a couple of hours of the prior intervention round in October 2022.

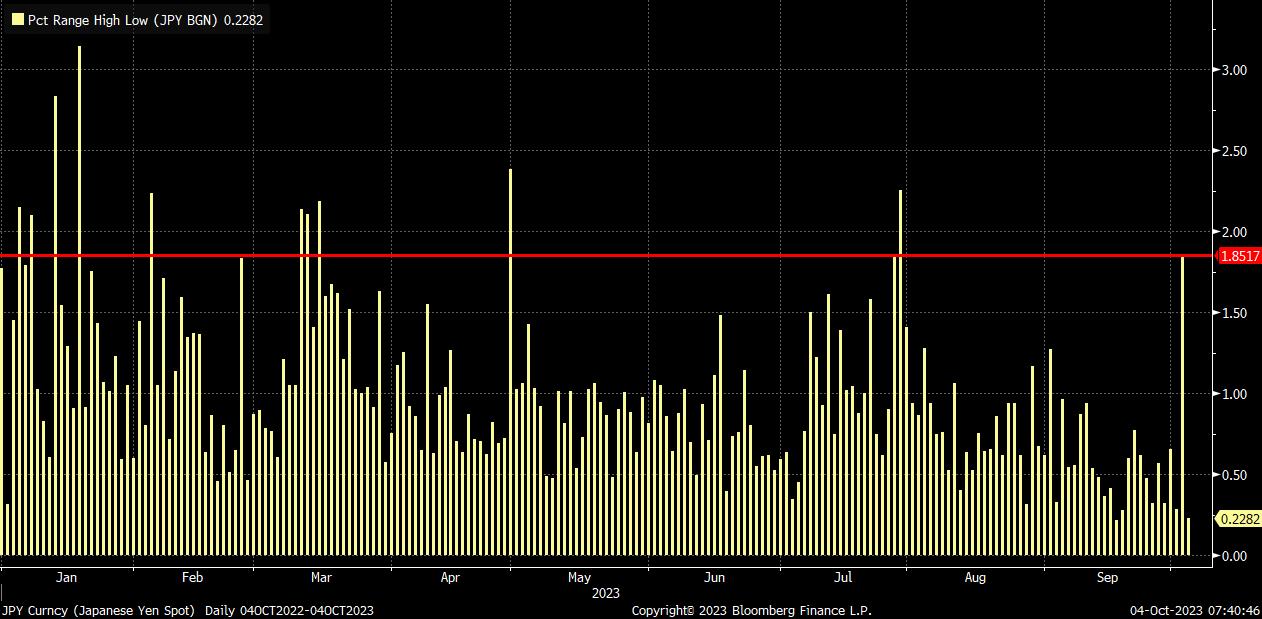

Speaking of prior intervention rounds, the peak-to-trough decline in USD/JPY during confirmed interventions in both September and October last year was around 3.6%; yesterday’s move was just over 1.8%. Perhaps this supports the idea that the MoF, in fact, did not monetarily intervene, and were simply ‘checking rates’ with Japanese banks, a move that often precedes intervention itself. Moves of that magnitude have not been uncommon in USDJPY over the last year, as the below chart shows.

The truth of the matter will likely only come out towards the end of October, when the latest intervention and reserve data is published. However, whether or not this was in fact an intervention, it’s clear that the 150 handle has now been marked out as a ‘line in the sand’ that the MoF desire the JPY to remain below, putting JPY bears on notice.

Said bears, however, are unlikely to take such notice lying down, with prior intervention rounds having seen price rapidly retrace, and subsequently retest, levels traded before authorities stepped in, with markets trying to test policymakers’ mettle. The remainder of the week carries plenty of event risk that could take USD/JPY back towards 150, including the eagerly-anticipated September US jobs report on Friday. Couple this with sizeable, sustained selling pressure across the Treasury curve, where yields are printing multi-year highs on an almost daily basis, and we could be back to the MoF’s ‘line in the sand’ in relatively short order.

_2023-10-04_07-41-27.jpg)

A decisive break above this level, if it were to come, may provoke another – or a larger – intervention from the Japanese authorities, again likely eliciting a sudden and substantial move lower (recall the moves mentioned above from 2022).

Sustained JPY upside, however, seems like it may be hard to come by for now, with weakness in the currency entirely justified by underlying macroeconomic fundamentals – a dovish BoJ showing no sign of exiting ultra-loose policy soon, and continuing to purchase JGBs; continued selling across the Treasury curve; the ongoing US outperformance narrative; and, markets continuing to put increasing amounts of faith into the Fed’s ‘higher for longer’ stance. Thus, for now, the effects of any intervention may be short-lived, with the MoF and BoJ far from working in harmony.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)