- English

- Italiano

- Español

- Français

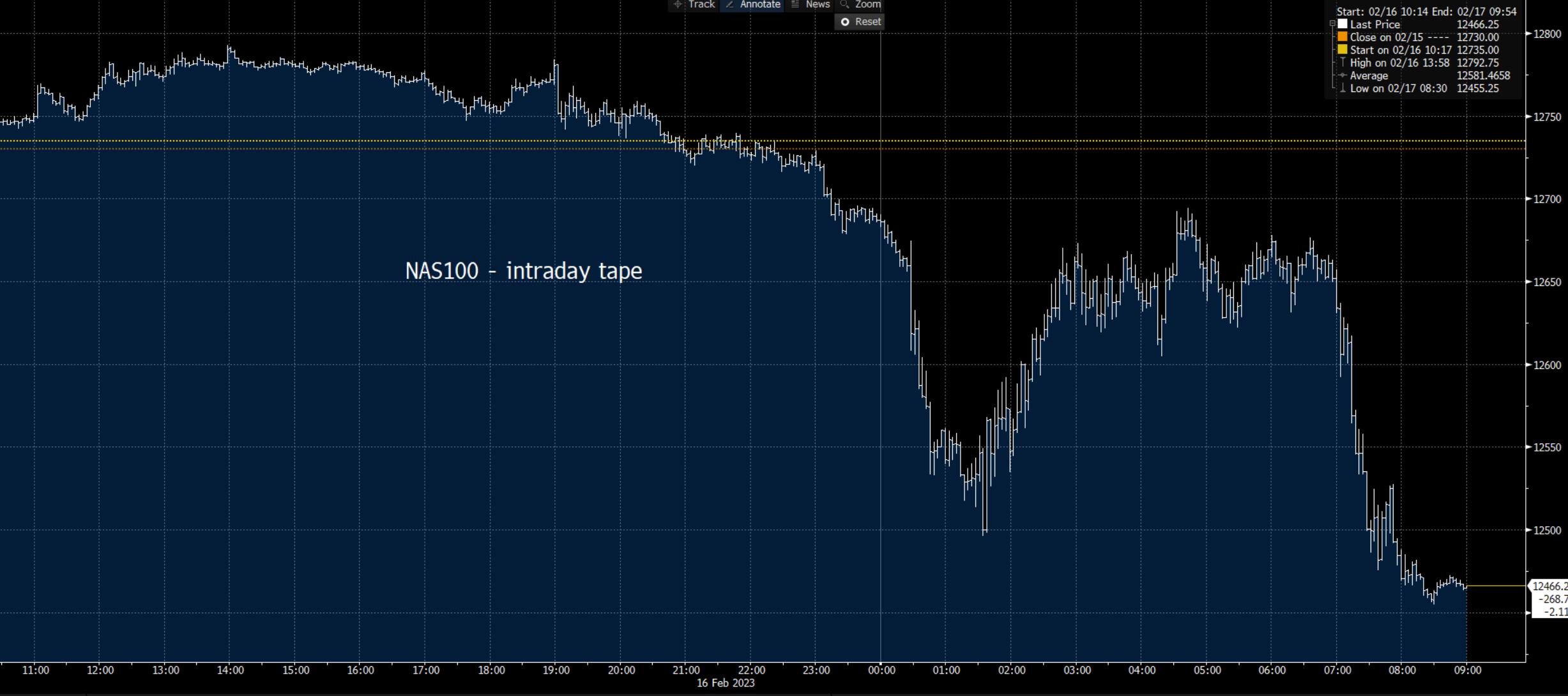

Personally, I'm not sure we learnt anything new from Bullard's comments – he’s a known hawk and a non-voter in FOMC meetings this year – maybe this was a market already nervous after the 6% YoY US PPI print and positioned aggressively in short vol exposures - as the market moved, they were forced to cover these positions, and this was reflected in a pronounced a rapid move. With all the talk of 0DTE options and traders selling calls which had suppressed cross-market volatility, it is understandable that we could get a punchy move in US equity markets – consider in the sharp equity move, the moves were more contained elsewhere and US 2’year Treasury yields gained a mere 4bp and the USD added just 0.3%.

We come back to our friend flow – sometimes while we try and justify price action, it doesn’t always have to make sense – there is a mountain of hedging activity, volatility and options-related positioning that is quick to move when price goes on a run – a lot of this is very opaque.

So, the question of whether this last-minute US equity vol shock has further to run is going to be one that Asia could enlighten on – our NAS100 cash index may get a look in here, and this is a priced off the Nasdaq 100 futures, so activity to keep selling this one lower could be worth putting in front of the screens. The USD is threatening a bullish breakout of the 8-day consolidation phase – the USD index is just creeping higher, and I question if implied vol starts to rise and we see better-trending conditions – USDCNH could be central here and if the USD rallies against the yuan, then we could see that USD flow in a weaker AUDUSD and EURUSD.

One swallow doesn’t make a summer, and while the craze to trade 0DTE and suppress volatility may not fade initially, if the USD starts to bull trend, then I’d argue that the likes of the VIX index are likely going one way and we should see range expansion across markets – something many of the day traders would be hoping for.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.