- English

- Italiano

- Español

- Français

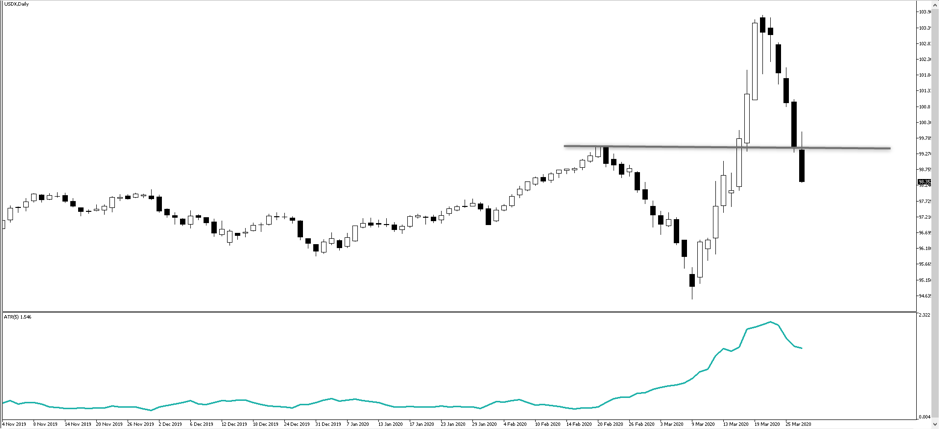

The global economy needs this, especially as the Emerging Market trade was looking ominous. A break of the 200-day MA (at 98.00) would certainly be welcomed, as would extending the swaps line to an increased pool of nations. Where USD funding through swap channels are confined to 14 countries at present, as clearly those countries who have depleted a decent portion of their FX reserves will see it as beneficial.

Daily chart of USDX

Setting the scene for Asia

Staying on the USD vibe, I’m happy to stay short USDJPY given the backdrop of a potentially bearish turn in equity markets this week and it looks as though Asia will feed off the 3.4% drop in the S&P 500 and open on the back foot. Certainly, we see that in futures markets where Nikkei 225 futures closed -3.1%, Hang Seng futures -1.8% - Aussie SPI futures closed a touch higher, but let’s not forget the ASX 200 fell 5.3% in the cash session and fared far worse than other markets.

The fact the Fed disclosed they will slow the pace of asset purchases to $60b from 2-3 April caused a jolt of de-risking into the equity close. Although, the fact traders were keen to reduce exposures into the weekend to avoid gapping was also in play. The question of course, is whether after a 20% run in global equities, this is the time to fade the rally for a possible grind back towards the 23 March lows, or have global central banks and government done enough to keep business afloat until the virus dissipates.

Additional bearish factors

The bulls will not be enthused by the 4.8% decline in crude, the 53bp widening of high yield credit CDS index and we don’t like the 3.6bp move in 3-month FRA/OIS to 54.8bp. Bond markets told us how they felt too, with US Treasury 10s -17bp, with declines seen in inflation expectations. Implied volatility in equity markets has pushed higher, with the VIX now sitting at 65.5% and pricing a 4.1% daily move in the S&P 500.

The virus count is central to market moves

The markets are fully focused on the virus count, which after so many programs from central banks and governments, is the dominant driver of sentiment. Data is just too hard to forecast, and to be fair, we’ve priced in a poor Q1 and a disastrous Q2, so we should have some cushion to this week’s ISM manufacturing PMI (expected at 45.0) and payrolls (100k jobs lost) – the script is set to try and understand the transition from Q2 to Q3, with the market factoring in a resumption of economic activity and a snapback in growth – if that gets called into question I see a leg down in risk.

It’s not overly positive then that the UK’s deputy chief medical officer has suggested it may take six months before we're “back to normal”. In the US, traders are now focusing on the US on a state-by-state basis and not just Washington and NY. Although, NY continues to be at the heart of the concerns, where we’ve seen 965 new cases on Sunday, although the pace of growth has slowed. We’ve seen worrying increases across American states though, with big increases in Chicago, New Jersey, Pennsylvania and Detroit.

The fact well-watched disease expert, Dr Anthony Fauci has talked about up to 200,000 Americans potentially dying from COVID-19 and the markets will not be compelled by that.

If testing the public is key to flattening the curve, it feels that FDA approving Abbotts COVID-19 test, that offers results in as little as five minutes seems like a game-changer. Will be watching ABT’s shares on the open in US trade.

If we’re talking FX moves on the open, it's ZAR that steals the limelight after Moody’s cut its sovereign rating to junk and put its outlook on negative. USDZAR has pushed up 2.0% to a new all-time high above 18.00 – one for the breakout traders. It’s the NOK, which is opening on the strongest footing and has been a momentum play all week, with 5-day gains vs the USD now +11.2%.

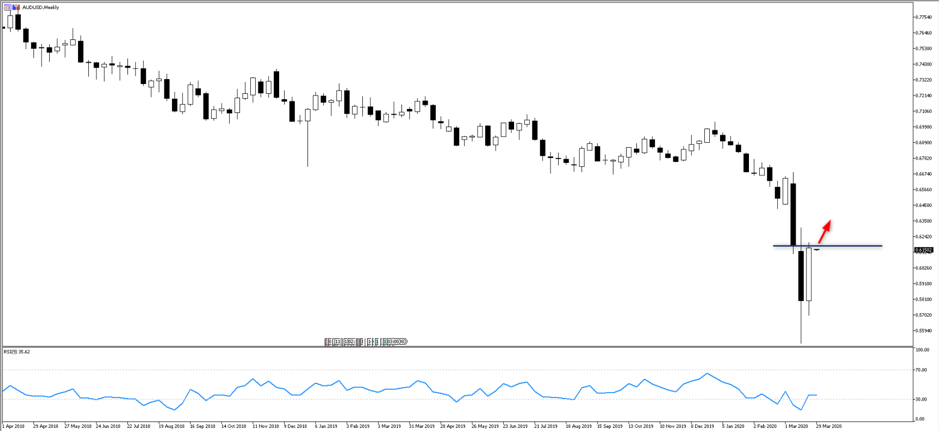

AUDUSD is interesting despite opening on a flat note finding sellers here, with traders discussing the possibility of a re-test of 0.6200. It's more USD weakness than anything Aussie centric, but there seems like scope for further covering of shorts, especially as we watch China today. A daily close above 0.6177 would be positive for me and suggest a run into 0.6250/.6300, although buying the AUD just never feels right to me.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.