- English

- Italiano

- Español

- Français

As it is, the market is pricing the S&P 500 to have daily moves (higher or lower) of 0.8%, yet pricing a move of +/-1.2% for the full week.

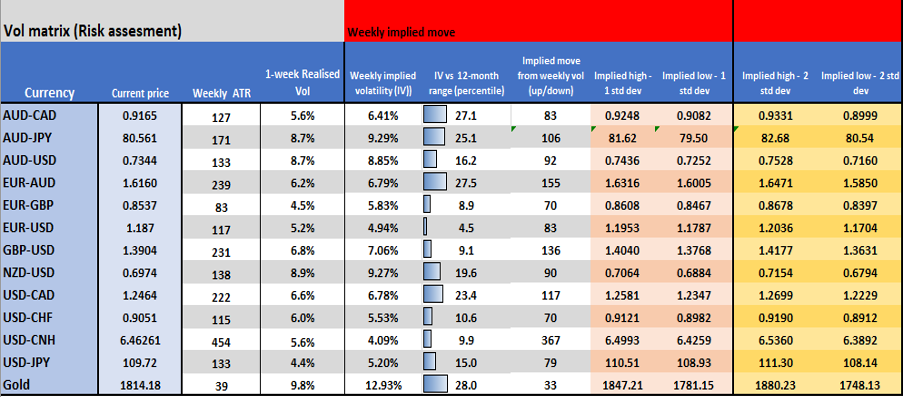

Through the week the implied move in AUDUSD is 94 pips, with GBPUSD at 136-pips and USDJPY 79-pips. Gold is expected to move up or down $33 from Friday's close, putting a range of 1847 to 1781 in play on the week, and we can have a 68% probability of price holding in that range.

Implied vol matrix

RBA – the choice of least regret

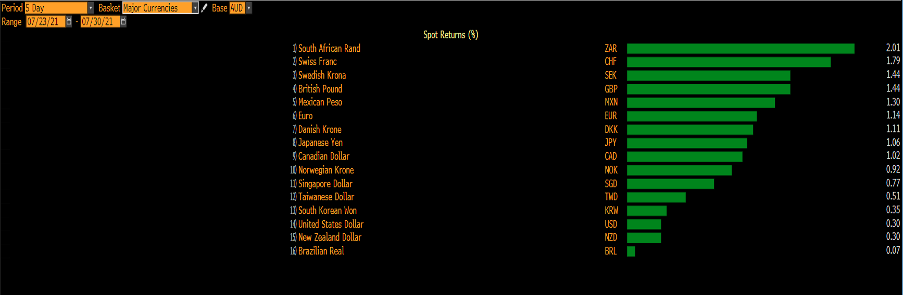

As we see on the chart, the AUD was the worst-performing major currencies last week, so perhaps ‘the Aussie battler’ is already pricing the RBA delaying tapering its QE purchases until later in the year. Maybe the buyers have just had their focus on the Olympics where it’s been an out and out medal fest.

Past 5-day moves vs the AUD

(Source: Bloomberg)

AUDCHF is in freefall at present but is grossly oversold with the 14-day RSI below 25 – for the quants out there, since 2000 there have been 76 occasions when the RSI (on AUDCHF) is <30, 5 days later the cross is higher 56% of the time – not sure how much of an edge that offers, which I guess is why we don’t use oscillators in isolation. That said, the bear trend is powerful, and rallies should be sold.

The BoE meeting in focus

GBPAUD has been a pair I have been calling higher, and it feels like the news flow warrants this above 1.9000. I am concerned the BoE won't be as hawkish as what the GBP is pricing, while I suspect the AUD is pricing in a taper – I agree with Westpac’s logic that they should increase its QE program, an action that should see the AUD crosses lower. If they leave the QE taper schedule unchanged, with the original plan to taper in September, the AUD will fly.

NFPs – will we see the elusive 1m jobs created?

The US payrolls will be a marquee event risk too – of the big macro arguments – Fed policy timing is one of them and clearly driven predominantly by the labour market. Subsequently, if we do see the elusive 1 million jobs created, then calls for a September announcement for tapering the asset purchases program will ramp up. A poor number (relative to consensus), where the unemployment rate fails to materially tick down will push US 10-yr bond yields into 1.17% and, as said before, should bring the 1% level into play – this will support gold, but will no longer support equities - lower yields and flatter curves will start to really negatively impact sentiment.

Looking at the past 10 payrolls, the average move in the S&P 500 is the six hours after payrolls is +0.41%, while the DXY is -0.2% and gold -0.06%, although gold has rallied in each of the past five reports – when we look at the performance one hour after the data gold has rallied consecutively in the past eight payrolls report. Gold is a hedge against a poor payrolls report – what’s poor? Below 700k I’d say.

What’s front on mind this week?

Monday

Aussie earning season – A few Aussie corporates have already reported, but the numbers start rolling in more intently this week. ResMed, News Corp, REA Group, Suncorp and Transurban a few names to go, with CBA the biggy due on 18 August.

Tuesday

00:00 AEST – July ISM manufacturing – the market expects the diffusion index to tick up to 60.9 (from 60.6). I think a reading north of 62.0 would get the USD bulls excited, lift bond yields and may weigh on Gold. While a number shy of 58.0 would see USDJPY and USDCHF underperform, with gold attracting buyers and bond yields falling.

14:30 AEST – RBA meeting – this will be coined the ‘meeting of least regret’ by many and with NSW lockdowns extended until at least the end of August and Q3 growth likely to contract, it’s no surprise that 13 of 18 economists believe the RBA statement will announce a delay in the planned reduction to the monthly asset purchases (to start in September), so one must question how much a delay to tapering is now priced in? Westpac is even calling for the monthly pace to increase to $6b, which would give real credibility to its new flexible stance on policy and could cause the AUD to move 40-50 pips lower. The big reaction comes if they decide to continue to taper to $4b – a scenario that could cause the AUD to rally 50-75 pips off the bat.

Wednesday

08:45 AEST – NZ Q2 employment change – the market expects the employment rate to pull down to 4.4% YoY (from 4.7%) and 0.7% QoQ. A number below 4.3% could get the kiwi flying.

Thursday

00:00 AEST – Fed vice-chair Clarida speaks at the Peterson Institute Event – while we heard the latest Fed statement last week, the market puts clear weight on what Richard Clarida says. So his views on inflation, growth, and any clues as to the start date for tapering QE should attract great attention.

21:00 AEST – Bank of England meeting – After some hawkish rhetoric from the BoE, the market has priced in some 15bp of hikes by mid-2022. This now puts the BoE as the third most hawkish central bank in the G10 FX region, just behind the RBNZ and Norges bank. The potential reaction in the GBP is tough to call as there are cross-currents which are both positive and negative for the UK, and its hard to see any moves being made until at least after the furlough scheme ends in September. Subsequently the consensus in the BoE won’t move to an early end to QE, so GBP is more likely driven by COVID trends – vaccination and self-isolation rates, as well as re-=opening news flow.

Friday

09:00 AEST – RBA governor Lowe testifies to Parliament Committee

11:30 AEST – RBA Statement on Monetary policy – new economic forecasts should justify the actions from the RBA meeting on Tuesday.

22:30 AEST – Canadian employment report – the consensus expects 170k jobs to be created in July, with the unemployment rate to drop 40bp to 7.4%.

22:30 AEST – US Non-farm Payrolls – the median (or consensus) estimate is 900k headlines jobs (economist range is 1.2m to 350k), with the average being 855k jobs - given this average, it would be a surprise if we saw over 1.007m or below 703k and think this is a guide for a strong a positive or negative reaction in the USD. The unemployment rate is expected to drop 20bp to 5.7%, while the participation rate is expected to climb modestly to 61.7%. Average hourly earnings are expected to grow 0.3% MoM or 3.9% YoY. The question we need to ask is what is the jobs print that meets the Fed’s ‘substantial progress’ test?

I’d argue anything over 1m, with a good participation and clear slack coming out of the market should get the market fired up – with higher bond yields driving up the USD and equities. A weak number and the market will increase its speculation we could see 10yr Treasuries eyeing a move to 1% - a factor that could negatively impact equities, high beta FX (AUD, NOK, and NOK for example) and weigh on USDCHF. It would boost Gold.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.