- English

- Italiano

- Español

- Français

The USD gained vs risk FX and in commodity markets, WTI crude closed -0.9% and copper, while only -0.2%, looks to be putting in a double top, with a nasty looking candle on the daily.

Further negative news on Florida’s case count (+7.8% vs 7-day average of 4.1%) hit home, with Arizona’s case count moved up 5.4% (7-day count of 2.9%), while Texas moved to close bars and limiting dining capacity to 50%. Then you hear stories that 5% of NBA players have COVID19 and its aspects like that that remove the bid from the market.

The question of whether we could see a re-run today of Thursday’s move, where we’d seen a solid risk-off Wednesday only for the market to see more positive flow the following day is one we’ll be watching. Notably, as many would have de-risked exposures going into the weekend to avoid any gapping risk on the open today, and that seems prudent and if I look at the news so far it is hardly encouraging. Although, we’re not seeing any clear trends in the early FX moves, with small selling in the antipodeans yet better buying in the Petros.

The weekend news flow perhaps not hitting home at this stage.

- California has followed Texas lead and instructed seven counties, including LA, to close bars

- The Texas governor has said COVID19 has taken a “very swift, dangerous turn”

- Total cases in the US increased by 44,703 – Florida up a further 6.4%

- Chesapeake Energy has filed for Chapter 11 bankruptcy

I can go on, but it feels like futures will open on the back foot here, as we head in month- and quarter-end and the notion of money managers squaring risk exposures. Let’s also not forget it’s a big week for event risk, both on the economic data front but political too.

Clearly, the news flow around the COVID19 spread is front and centre and unlikely to reverse course through this week, but as we’ve seen the market will increase and decrease its sensitivity to it on any given day.

The big picture catalysts

Many are watching for plans from the Republicans on Phase 4 fiscal proposal, although any concrete proposals are more likely from next week – with a major focus on the renegotiation of the CARES Act, where many US citizens currently get unemployment benefits of $600p/wk – this gets incredibly interesting as the Trump Admin wants to encourage people back to work by reducing benefits, however, if they go too early they risk a disgruntled voter base, and the risk of a hit to consumer sentiment is real.

If they extend the benefits program it would not only keep the unemployment rate high but offers the Democrats a massive physiological victory. Recall, the DEM’s recently passed the HEROES Act through the House, which contains not only $1200 stimulus checks but unemployment insurance, mortgage relief and rental assistance too.

For the political heads, we’re still on the lookout for Biden’s VP, although again this is more likely next week. Trump continues to lose ground in the polls, with the bookies giving Biden a 59.5% chance for the WH. The race to the Senate is also incredibly interesting where we should see developments in Colorado and Kentucky this week – Looking at the math and it seems a tall order for the DEM’s to get a majority here, especially with DEM Doug Jones expected to lose his Alabama seat – so to win here the DEM’s would need to hold all their seats (up for grabs) and five of the Republicans 23 seats.

Week ahead calendar - What's on the radar?

Monday 29 June

EU – June Economic confidence (19:00 AEST) - The market expects a rebound from 67.5 to 80.0, highlighting the lift in mood post lockdown easing.

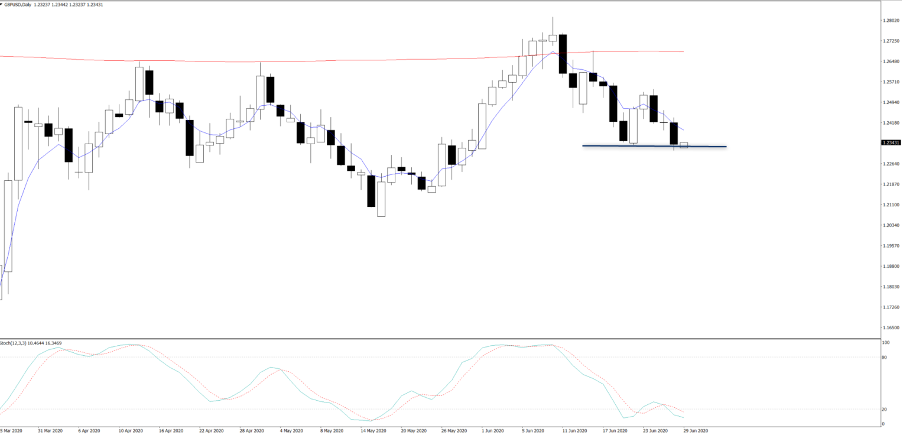

UK – BoE governor Bailey speaks at Climate Finance Event (19:30 AEST), followed by BoE member Vlieghe (22:30 AEST) on ‘Macroeconomic Tail Risk and Asset prices’. Can GBPUSD hold the 1.2335 floor? A break could take us to 1.2150/2100.

Tuesday 30 June

Aus - RBA member Guy Debelle speaks (12:30 AEST) – the market is keen to hear any narrative about the RBA’s balance sheet and future policy measures.

China – NBS Manufacturing PMI (11:00 AEST) – consensus sits at 50.5, highlighting a slight expansion in manufacturing in June (relative to May). We also get services PMI with the consensus at 53.7 (from 53.6 in May)EU – June CPI estimate (19:00 AEST) – the YoY estimate is expected to tick up to 0.2% (from 0.1%), although core CPI YoY is expected to tick down to 0.8% (0.9% in May)

UK – BoE Chief Economist Andrew Haldane speaks (20:00 AEST) – unlikely to hear any new colour on negative rates, but that will be the focus.

Canada – April GDP (22:30 AEST) – the market expects MoM growth to decline 11.8% in April, -16.9% YoY. This shouldn’t be a market mover, but USDCAD is breaking out of the consolation zone and pushing higher and has scope for 1.3815.

Wednesday 1 July

China – Caixin manufacturing PMI (11:45 AEST) – Consensus 53.7, portraying a slight increase in the pace of manufacturing growth (Mom) in the smaller end of town. UK – June Manufacturing PMI (18:30 AEST) – The market expects the diffusion index to print 50.1, which is unchanged from the May read.

Sweden – Riksbank meeting (17:30 AEST) – no change expected, but expect the market to lean into this on the dovish side. How high is the bar for a move back to negative rates?

US – June consumer confidence (00:00 AEST) – the market expects a lift to 90.5 (from 86.6)

US - NY Fed President John Williams speaks on ‘Central Banking in the Age of Covid’ (01:00 AEST)

US – Fed chair Powell and US Treasury Sec Mnuchin speak before House Financial Panel (02:30 AEST) – will get a lot of focus and poses a risk for exposures.

Thursday 2 July

US – June ISM manufacturing (00:00 AEST) – Consensus is 49.5 (May 43.1), which shows manufacturing contracted in June (relative to May), but the pace of contraction has slowed. Expect a reasonable lift in the new orders and production sub-component, with employment likely to move into expansion.

Canada – Markit manufacturing PMI – there is no survey to judge consensus, although the May reading stood at 40.6 US – June FOMC meeting minutes (04:00 AEST)

US - Non-farm payrolls (June – 22:30 AEST) – Consensus is for 3m jobs (economists range +9m to +500k) created in June (2.50m in May) with the unemployment rate to move down to 12.4% (13.3%) and weekly average hourly earnings to remain elevated at 5.3% YoY

US – Initial jobless claims (also 22:30 AEST) – 1.33m (down from 1.48m last week). Continuing claims at 18.9m.

Friday 3 July

Aus – May retail sales (11:30 AEST) – The market expects +16.3%, which was recent pre-released in the preliminary data – unless it deviates from the preliminary data it shouldn’t be a market mover

US – US cash equity markets closed for Independence Day – S&P 500 and commodity futures partial trading hours

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)