- English

- Italiano

- Español

- Français

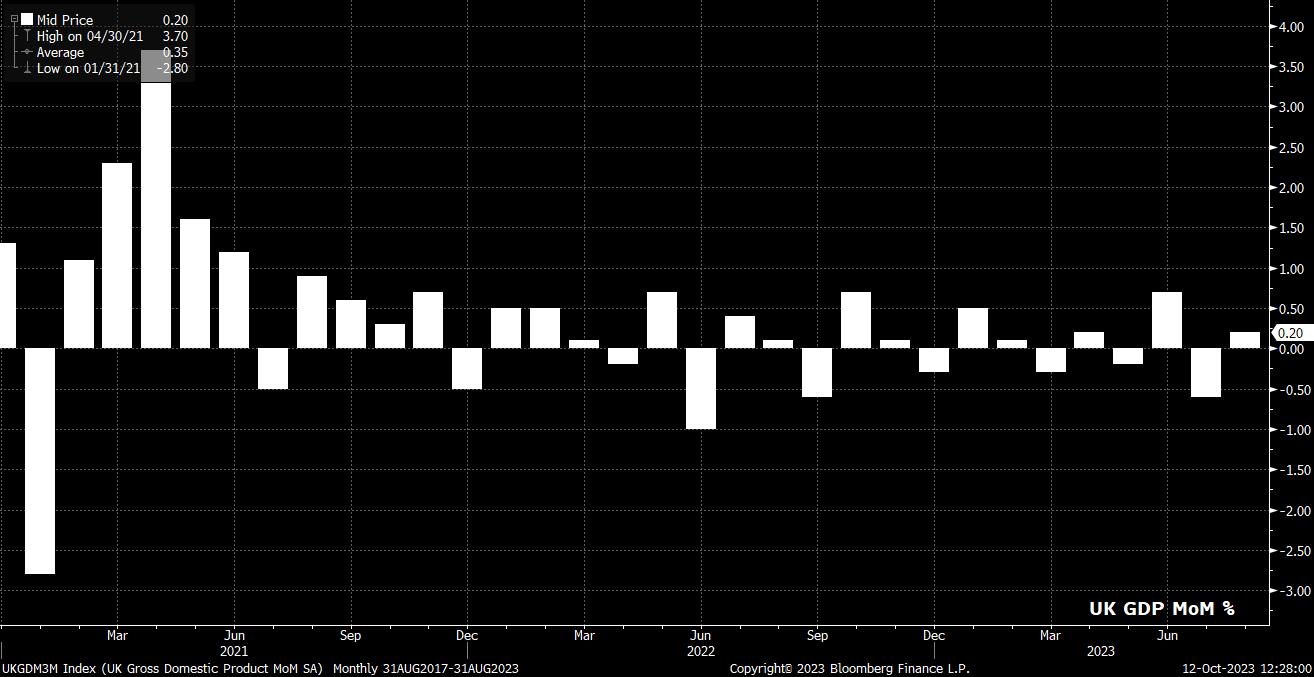

The data deluge has already begun, with the August GDP report. Data printed bang in line with market expectations, showing MoM growth of 0.2%, a recovery from the 0.6% contraction seen in July, while the economy expanded by 0.3% on a 3Mo3M basis.

Nevertheless, while those headline numbers may appear surprisingly resilient, they paper over some cracks that emerge in the details of the report. The contraction seen in July was, in fact, revised 0.1pp lower compared to the initial estimate, while activity in consumer-facing services – a key part of the UK economy dependent on discretionary spending – fell 0.6% on the month. This is likely a further sign of households continuing to tighten their belts, as the impact of interest rate hikes and the remortgaging cliff continue to bite.

Looking ahead, GDP would now need to rise by around 0.2% MoM in September to avoid a quarterly contraction in the three months to September. While a modest figure, such a pace of growth seems likely to be out of reach for the UK economy, particularly with both the services and composite PMIs having slipped further below the 50 mark last month, the former in fact falling to its lowest level since January. Consequently, Q3 GDP is likely to come in below the BoE’s forecast for 0.1% growth, perhaps leading to a further cautious pivot from policymakers, particularly with only around half of the BoE’s tightening having fed through to the economy thus far.

Speaking of the BoE, policymakers will look closely at the upcoming inflation and labour market data, in particular attempting to gauge the persistence of price pressures.

Headline inflation is likely to decline further from the 6.7% YoY printed in August, a downside surprise at the time which was made even more pleasing for policymakers given that disinflation continued despite a significant upward impulse from energy prices. On that note, it is both core CPI, and core CPI excluding services, that MPC members are likely to be paying closer attention to, especially with the core measure having fallen to a 5-month low last month.

With the BoE appearing all-but-certain to have now concluded the tightening cycle, these additional signs of fading inflation persistence will be greeted with glee on Threadneedle Street.

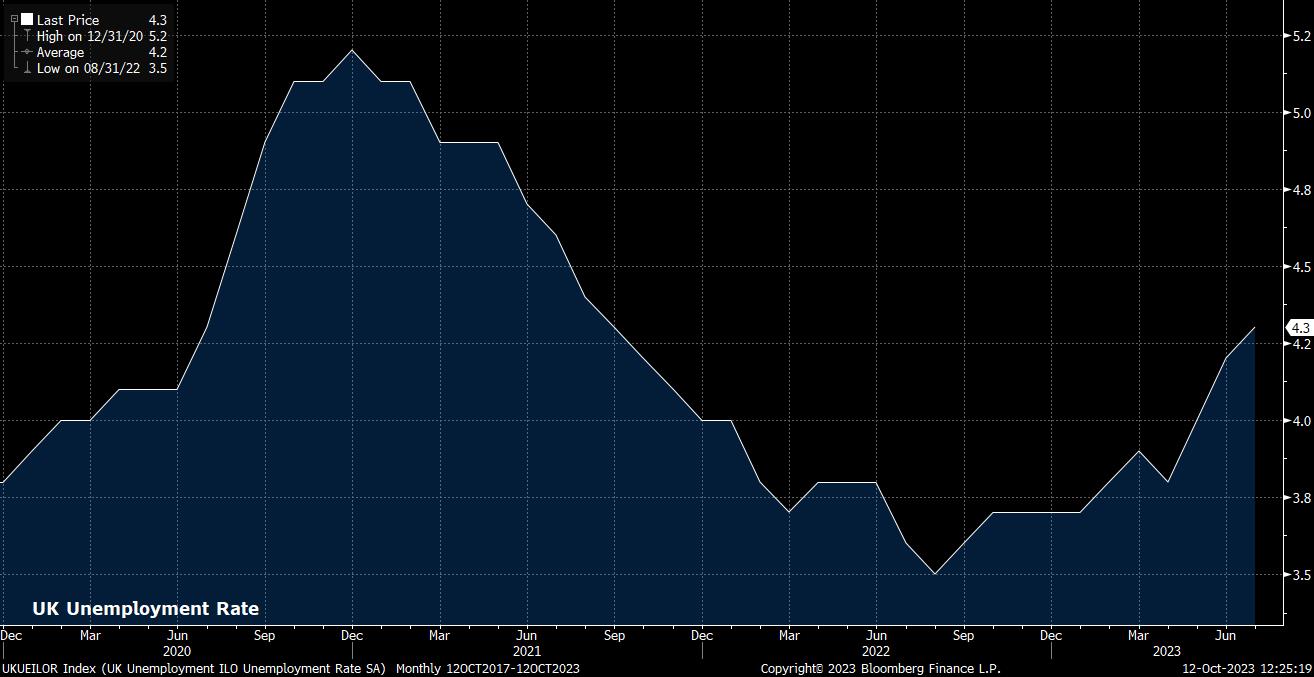

Before inflation, however, we will get our latest read on the state of the labour market. Unemployment is set to remain unchanged at 4.3%, considerably above the BoE’s 4% forecast for the end of this year, and continuing to represent a 2-year high.

Of more concern, particularly in terms of the ‘stickiness’ of inflation, is earnings, with regular pay again set to grow at an annual pace of 7.8%, in the three months to August. A print in line with consensus would represent the third straight month of close-to-8% earnings growth, with prior explanations for such a pace of growth – such as one-off bonuses to civil servants, and the NHS – holding less water by the month. That said, were the labour market to continue loosening as expected, and as the economy slows, this pace of earnings growth is likely to naturally cool into the fourth quarter.

_2023-10-12_12-22-24.jpg)

For the pound, as alluded to above, the impact of the next week of economic releases may be relatively muted, particularly with the market pricing practically no chance of the BoE altering policy any time within the next 12 months. That said, risks appear asymmetrically skewed towards the market pricing cuts sooner than at present on any downside data surprises, taking into account the more cautious tone that some MPC members, such as Huw Pill, have taken on of late.

Consequently, risks to the GBP, despite a recent modest recovery, continue to point towards the downside, with rally sellers remaining poised.

_2023-10-12_12-22-24.jpg)

From a technical standpoint, with cable having recovered back to the 1.23 handle, the market stands at an interesting juncture. While downside risks remain, a closing break above this level could open the door to further upside, clearly dependent on next week’s data, towards the 200-day moving average at 1.2445. However, and a more likely scenario, is that the bulls are unable to gain a strong foothold in the market, meaning spot could return to the low-1.20s in relatively short order.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.