- English

- Italiano

- Español

- Français

The Daily Fix: A truly cyclical rally in risk - reflation is on

The equity moves have been solid, notably in Europe where talk of a Franco-German debt alliance has seen some staggering gains in EU stocks, with the DAX closing +5.7%, and eyeing the 40 April swing high – the EU news promoting a chunky 5.4 volatilities move lower in the EU Stoxx VIX index. While in FX, the news has resulted in a 91bp rally in EURUSD, which is the biggest rally since 7 April, with EURGBP getting a good work out too.

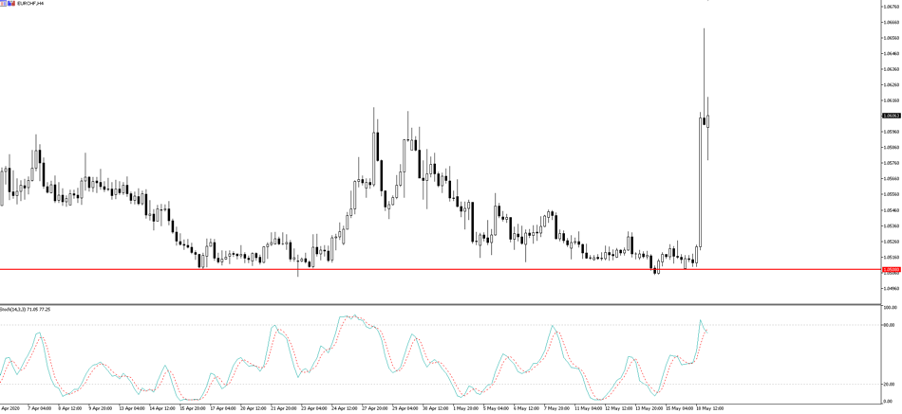

EURCHF had a solid rip, which had a few asking if the SNB has tried to settle the pair higher (from around 1.05), or whether a number of shorts folded at once with algo’s sensing the flow and reacting. Either way, it highlighted the risk of having exposures in this pair.

The S&P 500 is testing the top of its trading range, with a gain of 3.2%, with turnover through the cash markets 14% above the 30-day, although 1.7m S&P 500 futures contracts is lightweight given the extent of the rally. Either way, we hone in on 3000, and while cash volumes have been ok, breadth has been stellar, with 93% of stocks higher, with energy gaining a lazy 7.6%, with strong moves also seen in industrial, financials, REITS and materials. As cyclical as it comes really.

If you want to see the feel that the market is digesting the feel of better US and global economics, then look firstly at the moves in commodities, but then look at the performance of the Dow Transports (+7.2%), and Russell 2000 (+6.1%). We’ve even managed to see a decent sell-off in US Treasuries, with 10s and 30s +8bp and 11bp respectively. Part of the US long-end was driven by a strong sell-off in German bunds (+6bp), again driven by the EU news, and resulting in a sizeable reduction in the BTP/bund spread.

‘Reflation’ has been the buzz word, with inflation expectations have moved sharply higher, with 5-year breakevens +9bp and US 5y5y breakevens +7bp. Interestingly, this is faster than nominal bond yields, so the result has been lower real yields, which typically is the perfect breeding ground for gold appreciation, although gold has reversed after a strong Asian session with gold futures -1.3%.

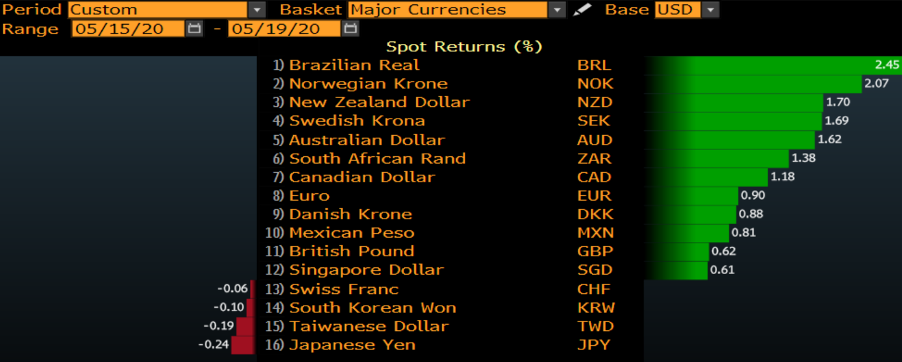

Risk FX has worked well, led by the feel-good factor, with high beta FX working nicely.

Calls for Asian equity markets are predictably strong, and we see Aussie SPI futures breaking out, suggesting we should the ASX200 follow suit.

Headlines that have moved and inspired:

- Fed chair Powell’s Sunday speech – suggested there were “no limits” to the Fed’s firepower and they had more ammunition to throw at the economy – the Fed put is very much alive and well

- Powell and Mnuchin are set to testify tonight (00:00 AEST) before the Senate Banking Committee. However, Powell’s speech has been pre-released. “Willing to use all tools available” is good enough for the bulls

- A new vaccine in the works - Headlines that the ‘Moderna vaccine has promising results in early clinical trial’ – Moderna becomes the new Gilead, although the trials were based on a small sample size (45 participants). That said, the bulls will take it and this sort of news is good for everyone regardless of their position

- Kudlow says he thinks things are starting to turn

- CA (California) GOVERNOR SAYS 53 OF 58 COUNTIES MEET NEW OPENING CRITERIA

- New York (the hardest hit state by the COVID-19 outbreak) is due to open a sixth region today, while providing a green light for major sports teams to play behind closed doors

- Talk that Japan may relax border restrictions allowing Chinese and Korean visitors

- A coordinated push from Merkel and Macron to support a E500b EU joint recovery grant fund, with shared debt responsibility in the EU’s name – shows a commitment and an alliance to avoid any future EU break-up risk

- Reflation is back on? Huge gains in crude, gasoline, nat gas, copper, iron ore – re-openings, OPEC/US producers supply cuts, China demand back to pre-crisis levels.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.