- English

- Italiano

- Español

- Français

The Daily Fix: Trades that catch my eye as we head into Friday trade

Stock indices are higher, with the NAS100 firing up 1.4% and I remain long this index, with no target for now, enthused by the bullish outside day reversal. The S&P 500 has added 0.3%, having made a lower low, yet again the buyers have supported with the S&P 500 tech, and comm services working well, followed by REITS, with financials and energy under pressure. Breadth was poor, with 30% of S&P 500 members closed higher. The Dow and Russell 2000 closed +0.2% and -0.5% respectively, although I like the tape in the Dow, with price opening cash trade at its low and rallying to close near the highs.

There has been some talk of a fiscal compromise, which has been buoying sentiment a touch, at least in equity, with certain factions within the DEMs trying to convince House heavyweights (think Nancy Pelosi, Chuck Schumer, Mitch McConnell and Kevin McCarthy) to tie this weekend’s vote on the USPS bill (in the House) with an earlier restart of fiscal negotiations. One to watch, and naturally the risk manager in me asks if there is gapping risk on this for the Monday open – I suspect it would be low, but the risks are skewed to a positive surprise.

There has been good buying in the US Treasury curve, with UST10s -4bp and that seems a function that the weekly jobless claims came in higher than forecast at 1.106m (vs 920k consensus), although, continuing claims came in better (lower) at 14.84m. The Philadelphia Fed business outlook printed 17.2 vs 20.8 eyed, while we saw another poor bond auction. We’ve also seen inflation expectations falling slightly faster than the move in nominal Treasuries and real yields are up a touch, but it doesn’t seem to have influenced, because as I say tech has worked well.

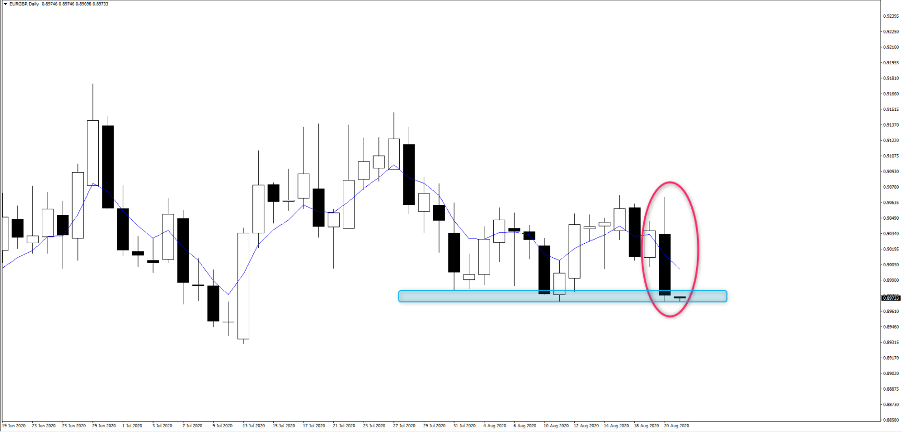

We’ve also seen precious metals catching a bid with gold up 1.1% and silver +2.5% - I would put this down to the USD more than anything, and if I overlap gold with the Bloomberg USD index, which is similar to the USDX, but with more currencies in the basket and a lower EUR weighting, we can see the relationship. I am still not overly enthused to do much with gold here as a trade, as there is a lot of chop in price and the market is having a bit of a debate as to where price is likely to track in the near-term.

Gold vs USD index (blue – inverted)

Do consider that we have had confirmation that Fed chair Powell will speak next Thursday at Jackson Hole and the Fed communication team have said that he will outline the findings of the review on monetary policy. So, this could be a multi-asset volatility event risk and one I will cover in more depth next week. With the market somewhat disappointed by the lack of urgency expressed in yesterday’s FOMC minutes, this could be a more important event and it will be a risk for anyone holding USD, gold, NAS100 exposures, which is pretty much most clients.

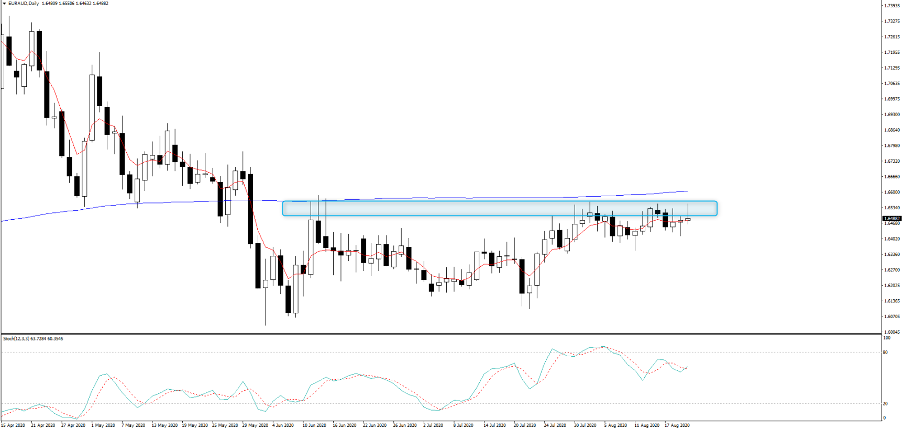

GBPNZD daily

Staying in FX markets and it's been a good day to be long GBP, with GBPNZD the trade of the day having the biggest percentage move in major FX pairs. I like this from the long side for a move into 2.05, although the cross is finding the 61.8% fibo of the April to July sell-off at 2.0239 a tough nut to crack – if this goes then I’ll follow. I am always interested in EURGBP, where the moves on the session have hit my radar, with price firmly rejecting the recent spike highs into 0.9060 and we see a chunky bearish day reversal and price pushing support into 0.8970 – a break here could be interesting and another that I’ll look to be involved with.

I also continue to be frustrated by EURAUD, as price just can’t break 1.6555 and into the 200-day. I’ve had this on the watch list for a while now and every time it hits the ceiling it sells off – I have been waiting for the breakout, seems my strategy has been wrong and fading into the top of the range has been the trade. I still think when this goes it will trend.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.