- English

- Italiano

- Español

- Français

A traders' week ahead playbook - will relief come the bulls way?

Macro trends in focus

- Central bank (over-tightening) and the prospect of a policy mistake – the Fed sense peak inflation but they will keep the peddle down – this isn't the time for the pivot

- The USD continues to be a central thesis for everything – the USDX is testing the 2020 highs, but you can't keep it down at the moment and that's impacting risk sentiment. US real rates have been at the backbone of the move, with US 10yr TIPS +26bp last week, while growth and the expected pace of hikes also support

- Stagflation is clear, but what's the correct probability of recessionary risks, not just in the US but other DM countries?

- China’s economic slowdown on the tracks of its ‘covid zero’ policy. Will we see more targeted policy measures due this week to support economics?

- Will we see relief in equity markets this week? We’ve seen the NAS100 down for five straight weeks, the worst showing since Nov 2012. A weak CPI print this week could cause solid short covering

- We’ve seen huge short-selling activity in HK50 of late – a weaker USD would clearly help promote a solid short squeeze here

- Geopolitics – the invasion of Ukraine has moved off the radar to an extent for traders, but could we see it make a return this week - notably with Putin due to speak this week

- Crude moves – an upside break in crude is looking probable, and one questions if this promotes trending conditions – hard to see that being a positive for risk, so if this kicks higher watch inflation expectations

- The performance of trend-following CTA funds in March and April has been solid – buy strong and short weak is the way to go at this juncture.

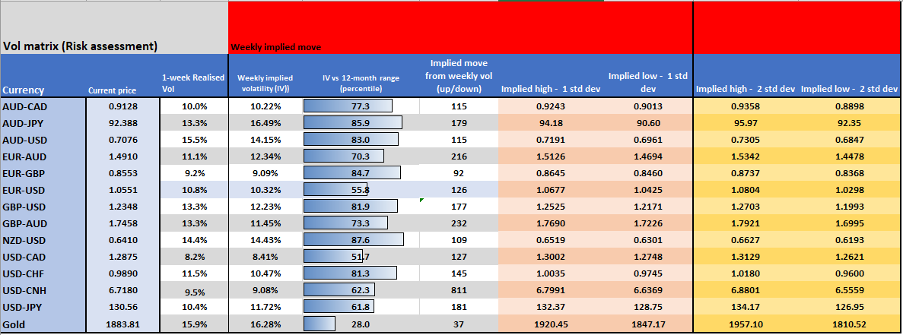

Implied volatility matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

Event risk navigator - What to watch in the week ahead

- US April CPI (Wed 22:30 AEST) – the market expects the YoY pace to moderate to 8.1% (from 8.5%), with core CPI into 6% (6.5%) – arguably this is the marquee event risk of the week. The range of estimates sits between 8.5% and 7.9%, with the market questioning if this marks the peak in price rises, with base effects to kick in. A 7-handle could see a well-loved USD negatively impacted and see some of the 200bp of hikes priced through to end-2022 coming out of the rates market – this would give huge tailwinds to the equity story, with the NAS100 down for five consecutive weeks and dealers very short gamma, which could keep equity markets lively due to hedging flows

Naturally, a hot CPI number should keep the USD bullish trend intact – long USDCHF and short GBPUSD have been the trades of last week, and trend-followers would be well set in these pairs

- US PPI final demand – Thursday 22:30 AEST) – consensus 8.9% (from 9.2%) – not typically a market mover, but given the importance of inflation right now, this should come up on the radar

- US University of Michigan 1yr and 5-10yr inflation expectation (Sat 00:00 AEST) – the 1yr expectations should stay elevated at 5.4% - the Fed do look at this, so it makes sense that traders do too – unlikely to move the dial too intently, but again worth being aware of

- 10 Fed speeches – Williams, Barkin, Waller, Kashkari, Mester, Bostic, Daly – again, while we need new data to roll in for the Fed to make sense of these changes, the market will feed off their level of concern and be keen to understand more on where each speaker sees the neutral fed funds rate

- US 10yr Treasury auction – prior bid/cover was 2.43x – with 10yr Treasury yields in a strong trend higher, will US and foreign pension funds see greater attractions in buying the 10yr here? With US bond markets so influential in driving the USD, this could get some focus from FX traders

- Australia Westpac consumer confidence (Wed 10:30 AEST) – with rate hikes underway in Australia, and price pressures increasing at a fast clip, we look for signs that consumer sentiment is being impacted. The market is pricing in a further 268bp (or 10) of hikes through to the end-2022

- RBA deputy gov Michele Bullock speaks (Friday 12:00 AEST) – not expected to be a vol event for the AUD

- China aggregate finance (no set time this week) – the market expects this to fall to RMB2200b, with M2 money supply eyed at 9.9% (from 9.7%) – no set time, which makes it hard for traders to trade – but with China’s underwhelming support for households and businesses in full view, we’ll look out for signs of credit creation

- China trade balance (Monday, no set time) – exports are expected to rise 2.7% in April, while imports are eyed at -3% - the import number should reflect the slowing economy given its ‘covid zero’ policy and weakening internal demand – It feels like the market is pricing China’s 2022 growth closer to 2% at this stage and most struggle to find how they’ll meet the 5.5% GDP target – I watch USDCNH, but CHINAH looks interesting into the 6603 pivot, where a break could take the index to 6034, where I think the prospect of coordinated support from Chinese officials could offer a solid buying opportunity here

- China PPI/CPI (Wed 11:30 AEST) – consensus expects 7.8% and 1.9% respectively – a weak CPI print would give increased scope for a weaker yuan. So, if USDCNH can maintain its current bull trend, and much resides with the US CPI print, then the USD should stay supported vs G10 FX – a key FX cross rate

- UK Q1 GDP (Thurs 16:00 AEST) – 8.9% YoY, 1% QoQ – gets a bit of attention in the media but old news, let us move forward so unlikely to move the GBP unless it's a really big miss

- ECB speakers – Nagel, Guindos, President Lagarde (Wed 18:00 AEST), Vasle, Knot, Schnabel, De Cos, Centeno – with the market pricing some 22bp of hikes from the ECB in the July meeting the respective comments should see trader massage that pricing which should keep the EUR lively. Keep an eye on the Italian 10yr BTP yield vs German 10yr bund spread – this has blown out above 2% and could start to weigh on EURJPY. EURUSD is consolidating in a range of 1.0635 to 1.0480 and needs a spark

- German ZEW survey of expectations/current situation (Tue 19:00 AEST) – the market expects another weak read here, with the expectation survey eyed to drop from -41 to -43. Again, not one that should cause an immediate impact on the EUR, but could it depend on the print and the extent of beat/miss.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.