- English

- Italiano

- Español

- Français

Trader thoughts - risk on the front foot as traders anticipate US payrolls

After yesterday’s ISM manufacturing ‘growth scare’, risk has been on the front foot with the US500 pushing higher through cash trade and closing (+0.8%) on its highs – at 4423 the index is not too far off a new record high. Turnover was good through the S&P 500, and some 10% above its 30-day average with 77% of stocks higher on the day. Cyclical areas of the market-led, with energy and industrials working well, while utilities and staples unperformed. The rotation from value to growth, growth to value, defensive to cyclical continues in earnest, and this is reflective of the latter stages of the mid-cycle investment climate we continue to find ourselves in - volatility will remain somewhat elevated in this dynamic, although the VIX has dropped a touch and sits at 18.04% -1.4 vols on the day.

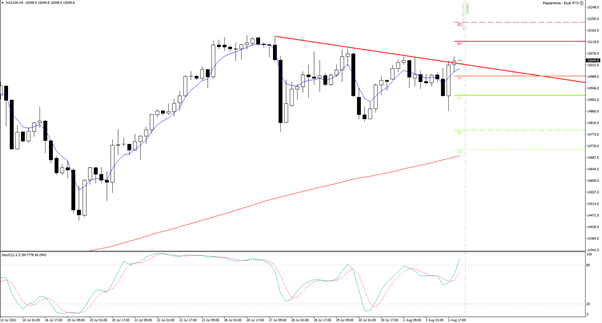

(Source: MetaTrader)

Tech has worked fine, with the NAS100 also closing on its highs. The 4-hour chart shows price pushing through the series of lower highs, so a break of 15064 should take the index into 15160.

In a world approaching late-cycle investment climate, it feels like the hedge fund community is running a barbel approach – being long utilities or defensive names, yet also long cyclical exposure, perhaps financials or energy. Or perhaps being long equity with a US Treasury hedge. The fact we’ve seen Treasury yields falling a tick, while stocks ripped through the US cash trade gives this thesis some validity. US inflation expectations have pushed up a touch, and 10yr breakevens rates are now at 2.37%, with US real rates now -120bp. Interestingly German 10yr real rates (inflation-adjusted) sit -188bp, a 68 discount to US rates and perhaps this is keeping the EUR suppressed.

Crude continues to be quite whippy, with WTI crude hitting a low of $69.36 – this is 50% of the 20-day range. The Bollinger band low of 67.72 could come into play, but I would be using these levels to fade weakness as the 20-day MA is moving sideways and the RSI is almost mid-range – hence crude looks to be a strong mean reversion play.

Staying in the commodities fired and XAUUSD is failing to fire up and has traded an 1815 to 1807 range, and likely a factor that bond markets have not really done much and the USD is unchanged. XAUAUD saw a bit more life, with AUDUSD having a move from 0.7400 into 0.7361 as we moved into the open of US cash trade. Copper is down 1.1% and continues to trade heavily in the wake of the softer global PMI data series.

Soft commodities are also a touch lower, with sellers in soybeans and corn.

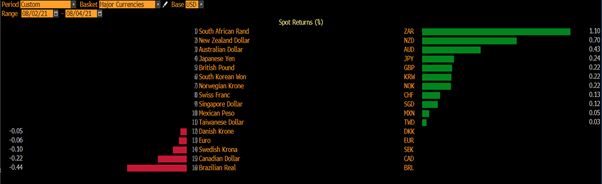

Moves vs the USD

(Source: Bloomberg)

In FX markets, the ZAR and NZD are top of the pile, with traders now eyeing the NZ jobs shortly and after yesterday’s move to look at debt-to-income limits and interest rate floors – measures to cool the NZ property market – an unemployment print lower than 4.3% should get the NZD firing. I wrote in more depth about the RBA meeting yesterday and the playbook of calling for the AUDUSD into 0.7400/10 on an outcome where the RBA left the schedule unchanged worked well.

The GBP has attracted good flow and oscillates between the 50- and 100-day MA. My colleague Luke Suddards wrote this piece on the BoE meeting, which may be of interest too.

Event risk to navigate

Eyes on the USD as we roll into Asia, and especially watching for any movement in markets that may arise from the US ADP private payrolls (22:15 AEST – consensus 683k jobs), and services ISM (00:00 AEST – 60.5). I feel that unless we see a big miss that either data points shouldn’t move the dial too intently. Fed vice-chair Clarida speaks at 00:00 AEST, and his comments could move the dial, although it seems unlikely he’s going to give us new intel and meat on the bone ahead of non-farm payrolls this Friday. Watch USDJPY as this pair looks the be starting to trend lower and trade the potential opportunity with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.