- English

- Italiano

- Español

- Français

Could it be that they spiked simply because they have the same ticker as GameStop in the US? Strange times indeed.

The situation is fluid and evolving by the minute. Discord has closed down WallStreetBets (WSB) and the SEC has made a statement about “monitor ongoing volatility in options and equity markets”. The prospect of intervention here is clearly high, but this will just galvanise the WSB community as it just brings home the feeling of inequality in financial markets – It's fine to prop up zombie companies through Fed actions but if retail follows a path that greatly distorts asset prices by targeting short sellers, then this gets shut down.

Either way, while WSB on Reddit was made private (for a few hours) the numbers in the community has grown to over 100,000 and that could be a lot of new capital ready to deploy when the next ‘hot’ and well-shorted stock is pushed –let’s not forget this model works well because of critical mass. So, the more this stays front page and WSB remains the topic of all market participants discussion, the more followers the community obtains and the greater the potential weight of capital.

It’s ironic that activist short sellers were the original bad boys of markets, the anti-establishment, but now they are the target. They’re the establishment and the enemy. Fundamentals are completely irrelevant, as this is all momentum now and I struggle to see how this movement is stopped. As Anthony Scaramucci (somewhat dramatically) detailed “we are witnessing the French revolution of finance”.

An end to ‘free markets’

It seems unlikely that authorities look at hiking the margins required to trade US options, therefore pricing retail out of the options markets. The SEC will take some degree of action, but what? Perhaps they limit short positions as a percentage of the free float to a lower level. This then brings the equity market into a similar realm as other influenced markets – there’s no real juice in selling corporate credit (the Fed sit on the bid) and bond yields are being kept artificially suppressed through QE. If you want to short US bonds and we see the rate of change in yield accelerate higher then the Federal Reserve will possibly impose yield curve control and subsequently there is a buyer with unlimited pockets capping yields.

I digress. In FX, there's a currency war underway, with central banks trying to limit the upside in their currency and reduce imported deflation. The ECB the latest of the rank ramping up their EUR jawboning with ECB member Knot (a modest hawk) noting there is room for another rate cut.

Equities, while influenced by all of these markets, are one of the few asset classes where you can express a direct bearish view (or hedge). That is now likely to change, but for now equities are the last bastion of ‘free’ markets and the threat of change looms large.

The Fed created this movement

Let’s make no bones about this - the Fed created this evolving juggernaut. Cheap money and liquidity is not supposed to be directed to places that are inefficient and that has played out. The Fed has created a craze in equities, as they are directly targeting financial conditions and installed a belief that equities only go one way. Government policy has given this a tailwind but the emotion of watching your neighbour get rich through stocks has impacted hard.

China is worth watching as the authorities control leverage and trading conditions in the retail trading community incredibly well. However, the backdrops seem very different – Chinese traders are less angry, they work on a more individual basis and not via optionality. If the Fed alter liquidity dynamics they'll not just lose credibility, they'll smash inflation expectations. The very thing they are trying to engineer.

Carnage on markets

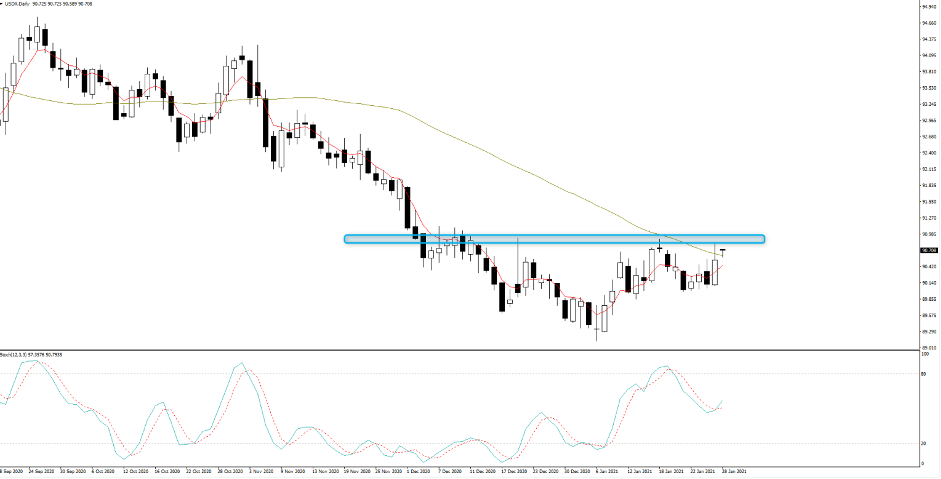

(White – UBS ‘most short’ index, blue – hedge fund holdings index)

(Source: Bloomberg)

Outside the basket of stocks being widely talked about on social, there's genuine carnage on global markets. Hedge funds dumped positions and we saw one of the biggest increases in the investment banks “most short” equity baskets ever. Classic equity benchmarks like the S&P 500 fell 2.6%, which for the statisticians is a 3.3 (90 day) z-score move. Equity implied vol has risen sharply and we see the VIX index rising a massive 14.19 vols to 37.2% - the divergence with S&P 500 1-month realised volatility is now 23 vols – again, one of the highest levels ever. The crux is funds are scrambling for downside protection, they're de-risking in spades and the USD is finding a strong tone, with the USD index eyeing a break of the 18 Jan high.

The Fed made it clear that they see the future as brighter, but they're not taking their foot off the liquidity gas that is bullish for markets. However, there's so much more to this story and the potential for funds to de-risk in the near-term remains elevated. Maybe this is the ‘froth’ that needed to come out of markets.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.