- English

- Italiano

- Español

- Français

USDMXN: Will the Peso gains continue?

Last week, rating agency Fitch lowered Mexico’s 2019 growth forecast to +1.6%. That's 20% lower than the +2.0% growth the country enjoyed during 2018. However, it’s still in positive territory and a long way from a recession.

What's more, the Mexican government believes that growth can be maintained at the +2.0% figure in 2019. For comparison, the GDP growth rate in Germany, Europe's powerhouse economy is forecast to slip into negative territory during the second half of 2019.

Last week, the Mexican Institute of Financial Executives (IMEF) said they saw no signs of a recession on the horizon. While smaller economies in central and southern America may have higher rates of growth, they are no match for their northern neighbour, which accounts for approximately 1.85% of total global GDP. That is, the Mexican economy is slowing but still growing and fairing better than some of its developed world peers.

Key partner

We can't talk about Mexico without discussing the country's largest trading partner the USA. The countries share a border and 80.0% of Mexican exports find their way into the USA. USDMXN is, in some respects, a barometer for the health of this relationship but it’s far from the only influence on the USDMXN rate.

Higher real returns

Interest rate differentials are a significant driver of FX prices. Base rates in Mexico are currently set at 8.25% with inflation in the country running at 3.94% per annum. That means a real return on peso deposits of some 4.30%. This figure is looking increasingly attractive to traders and longer-term investors since the US Federal Reserve mentioned that US interest rates are unlikely to rise again during 2019.

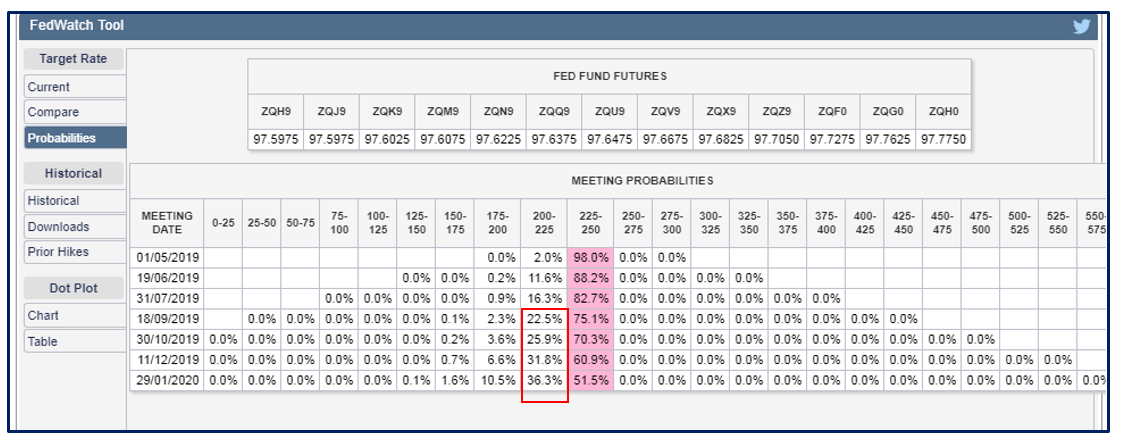

US interest rate futures markets are showing a growing probability of a rate cut from the Federal Reserve in late 2019 or early 2020. I have highlighted these rising probabilities in the red box in the image below.

The graphic shows the probabilities of US interest rate rises or rate cuts out to Jan 2020 as derived from CME Fed Funds Futures.

Markets are forward-looking and money flows to where it can receive the best returns. Investing in Mexico is not without its risks, however, the higher returns available make for an attractive proposition. Markets are also asking themselves what the Fed knows or thinks it knows about the underlying US economy that has changed the central bank’s mind on tightening during 2019.

What the technicals say

From a technical perspective, the peso has broken cleanly below the uptrend line that extended higher from mid-January and has moved below a band of horizontal support found at 19.05/19.00. It has subsequently tested back towards support at 18.80 and both the 20- and 50-day EMA lines are trending lower.

The next test will be support found between 18.75 and 18.725 through which 18.61 looks a likely downside objective as does 18.50. I will be very interested to see if the peso can break and stay below 18.80 because if it can do that, then a continued move lower can’t be ruled out and levels such as the 7th of August 2018 low at 18.40 and the 6th of April 2018 high of 18.35 would be in the mix.

Stop-losses on any short positions could be placed just above 19.00.

The peso currently has downward momentum as part of USDMXN. There are also a number of key macro data releases this week that could act as a catalyst for further peso gains, including the February balance of trade and unemployment data on Wednesday the 27th and the Mexican central bank's interest rate meeting on Thursday the 28th of March.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.