- English

- Italiano

- Español

- Français

The big unknown, of course, is how China financial markets trades and ultimately respond to a show of force from the PBoC who have inject $174b into the financial system through reverse repo, and while much of this will be used to cover a chunk of short-term maturities, the net effect is $21.7b massaged into into the financial system. There will be some focus then on the rates market and shibor rates, although for those who can’t see this then USDCNH is our best guide, although it’s unclear how this trades as textbook theory would suggest liquidity is bad news for the yuan. However, in this case, any news that is beneficial to the Chinese economy may indeed strengthen the yuan and that seems to be the case with USDCNH trading a touch lower in interbank FX trade.

For those watching the yuan, do consider the daily CNY mid-point fixing at 12:15 AEDT, which could offer some good insights. Any news of cuts to Reserve Ratio Requirements (RRR) or lowering of various instruments used through their open market operations could be well received.

If we look at moves in AUDJPY in early interbank trade, we see small gains here suggesting the market is somewhat enthused by actions from the PBoC, as sideways in this cross is in many ways the new up, given the horrible price action of late. The moves in AUDJPY also suggest S&P 500 futures may open on a stable note, although, I’d be waiting for clarity from mainland China, as the tape here will spill over into sentiment more broadly.

So, we watch the re-open of the Chinese equity markets which falls somewhat inconveniently around the third quarter of the Super Bowl. One guide that has been widely used has been the 7.3% net percentage change in the A50 futures index from the close of the CSI 300 and Shanghai Composite cash market close on 23 January (18:00 AEDT), which has led us to believe the mainland equity markets will be taken to the woodshed on open at 12:15 AEDT, with the bond market another guide, opening 30 minutes earlier. That said, we know the Chinese authorities have curbed short selling, which is an act of desperation in any jurisdiction, while there seems a strong risk we will see the powers that be instruct local banks to support the equity market.

The fact that the China Securities Regulatory Commission (CSRC) have detailed they see the impact of the Coronavirus as “short-lived” is designed to install confidence. Whether the market feeds off this optimism is another thing given the spread of the virus is still in its exponential stage, and worryingly we have seen the first death outside of China, amid the multitude of countries imposing travel restricting to and from China. There is still such little clarity on the fallout on China’s economy, although, we know it's going to be brutal and traders naturally are working this into its key trade partners.

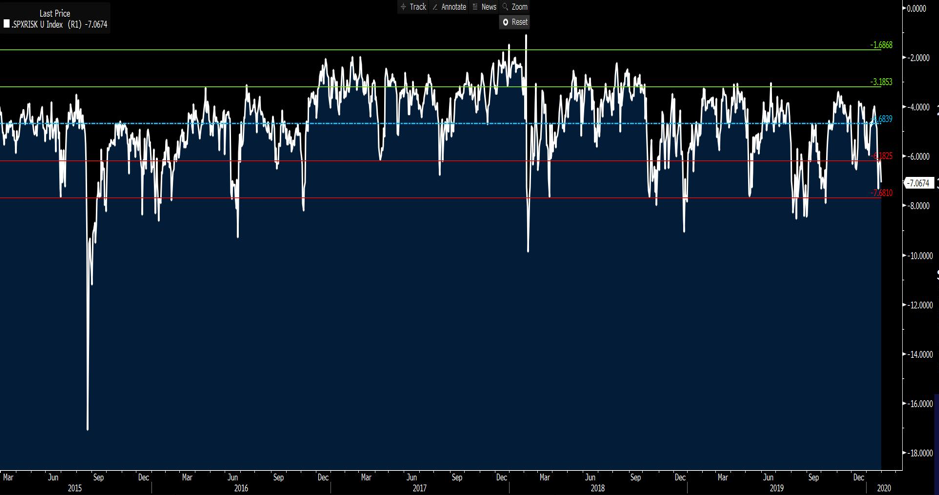

There has been sizeable hedging activity playing out, not just traders closing core equity positions, or selling copper and crude, or hitting the bid on JPY, CHF and US Treasury’s. But in the volatility space, there has been decent interest in the VIX index (closing at 18.84%), with solid buying S&P 500 25-delta 1-month puts, where the implied volatility has risen from 20% - the highest since October. If we look at the skew of 1-month 25-delta calls minus puts, we see this sits at a 7 vol differential, which is close to 2 standard deviations (of the five-year range) and shows the demand for put volatility over calls is reaching extremes and a solid guide to semantics.

We could look at the put/call ratio sitting at 1.03, where moves above 1 generally don’t last long.

Another aspect I am watching closely is the reaction in the rates markets to this tightening of financial conditions. We have the RBA meeting tomorrow and it would be a huge surprise if they moved on rates, and for those looking to sell AUD, my trade is to hold off, ideally using any strength to sell into before governor Lowe’s speech on Wednesday (12:30 AEDT). A cut in the March RBA meeting is currently priced at 48% and one suspects it will be just north of 50% and things become interesting. The fact we see a 66% chance of an April cut suggests that.

In the US a cut at the April FOMC meeting is priced at 58%, with a cut fully discounted now by July. We also see two cuts priced through the end-of 2020, up from 1 at the start of the week. The market is once again expecting central banks to resume their easing cycle, and it makes sense to believe Canadian rates will respond after the recent dovish turn from the BoC, where the probability of a cut in the March meeting sits at 27%.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.