- English

- Italiano

- Español

- Français

Baring a huge shock to the system, a hike in June seems like a lock now. The AUD certainly looks strong and while we can look at all G10 central banks and make a call that what’s priced for the full-year 2022 and certainly 2023 appears unrealistic, we also need to add in Quantitative Tightening (QT) – or balance sheet (BS) reduction, which we’ll explore tonight in the FOMC minutes.

The fact that Lael Brainard has put us on notice for earlier Fed BS reduction is also of interest and the market took her view not just that this could happen in May, but we could see asset sales. The full understanding of QT takes some research and I will explain more about this in upcoming narratives, but there is a difference between passive BS run-off (like we saw in 2018) and actually selling the assets on the balance sheet to a commercial bank – that would be a whole different ball game for the USD and equities, especially if US real rates keep heading towards positive.

For those who missed my quick take on the RBA meeting see our Twitter feed here.

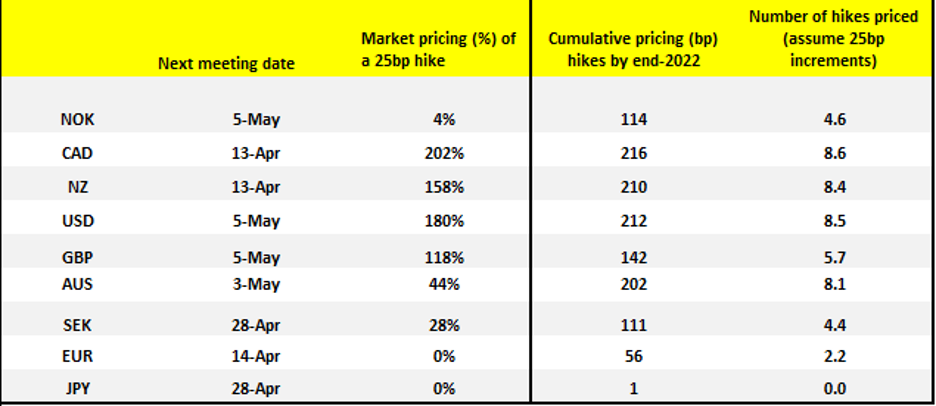

But I now look at Aussie swaps pricing and see a 44% chance of a hike in May and a 20% of 50bp by June (not shown in the chart). I don’t think this is wholly exuberant although looking further out the rates curve and 8 hikes for this year seems rich and 13 by end-2023 is going to cause genuine problems if it comes to fruition – one has to question who is trading these instruments that far out.

Central banks rates matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

One aspect that stands out when I look at the above rates matrix is that there is a 50bp hike is fully priced into Canadian swaps for the next meeting and there’s a 58% chance of 50bp hike from the RBNZ. I think the Bank of Canada will go 50bp, but it's fully discounted. That said, AUDNZD could be a good long here for those who think the RBNZ ‘only’ go 25bp next week – the cross is already a momentum play and an upside break of 1.0910 should see 1.0950 and 1.1000 come into play.

So, what takes us to a hike? Next key dates in Oz

14/4 – Aussie employment

27/4 – Q1 CPI – the market already sees this coming in at 4.2% (from 3.5%), which if proven correct should see a May hike lifts above 50% despite the election

3/5 – RBA meeting – 44% chance of a hike – this is live

May – Australian Federal election

18/5 – Q1 wages

7 June – RBA meeting – 20% chance of a 50bp hike

27/7 – Q2 CPI – obviously a lot of time to pass, but the market feels this prints 4.4% - the hiking cycle is on

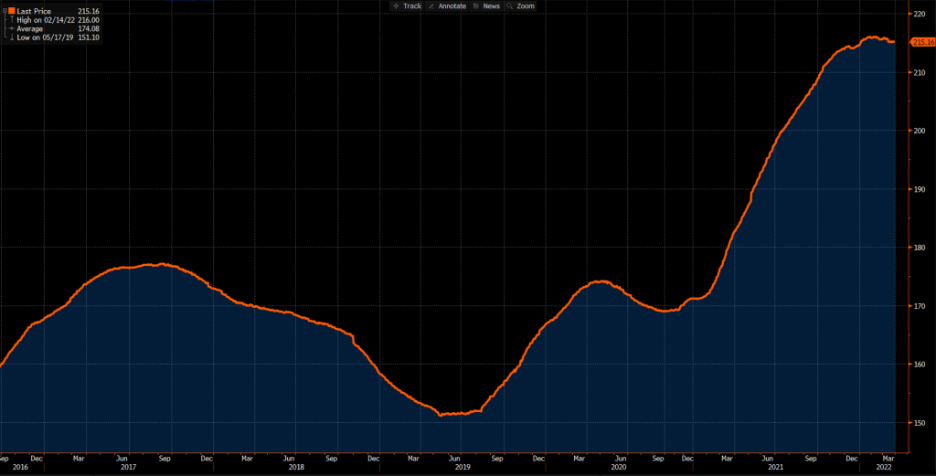

The market now prices 8 hikes this full year and 13 by next year. Some will see this as very aggressive. One chart that springs out is the Sydney house price index – looking vulnerable

(Source: Bloomberg - Past performance is not indicative of future performance.)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.