- English

- Italiano

- Español

- Français

Making Sense Of A Rollercoaster Week

At this point, it seems remarkable, but the week actually started on rather a positive note, with markets rallying at the Asia open early on Monday morning, seemingly reassured by news that all depositors of Silicon Valley Bank would be repaid in full, while also seeking solace in news that the Fed would be providing a new liquidity facility to US banks if they so required it.

Safe to say, however, that this positivity only lasted a matter of hours, before fear gripped markets once more; fear so strong that Monday saw a whopping 65bps fall in the 2-year Treasury yield, the biggest one-day drop since 1982, at which point 2s were nowhere near as frequently traded as they are now. A dramatic dovish Fed repricing also drove a significant chunk of this move, with markets now assigning a 4-in-5 chance to the likelihood of a 25bps hike on 22nd March, having been pricing a 50bps hike just a week ago.

Monday wasn’t, however, the end of the jitters in the banking sector, with concerns over the future of Credit Suisse suddenly exploding onto the scene on Wednesday morning. Said concern stemmed from comments reported by Bloomberg that CS’ largest investor, the Saudi National Bank, would not be providing additional capital to the bank.

While it was later clarified that this was due to the Saudis not seeing any need to do so, in addition to encountering regulatory hurdles if they were to increase ownership further, the damage had already been done, with CS shares falling as much as 40% on the day; a decline which ultimately necessitated a public statement of support from Swiss regulators, along with an extraordinary 50bln CHF liquidity provision from the Swiss National Bank to stem the bleeding, and ignite a modest recovery.

In the middle of all this, and rather overshadowed by broader developments, but no less important, were a couple of major macro events.

Firstly, we had the February US inflation figures. The message stays the same, inflation remains elevated, and is coming lower in a very bumpy, and slow manner. Headline CPI rose 6.0% YoY last month, while core prices rose 5.5%, both prints being bang in line with market expectations; however, the MoM core CPI figure rose 0.5%, not only hotter than expected, but also the fastest pace in six months, and the third straight monthly quickening. Clearly, while the disinflation process may be underway, the US is far from taming the inflationary beast.

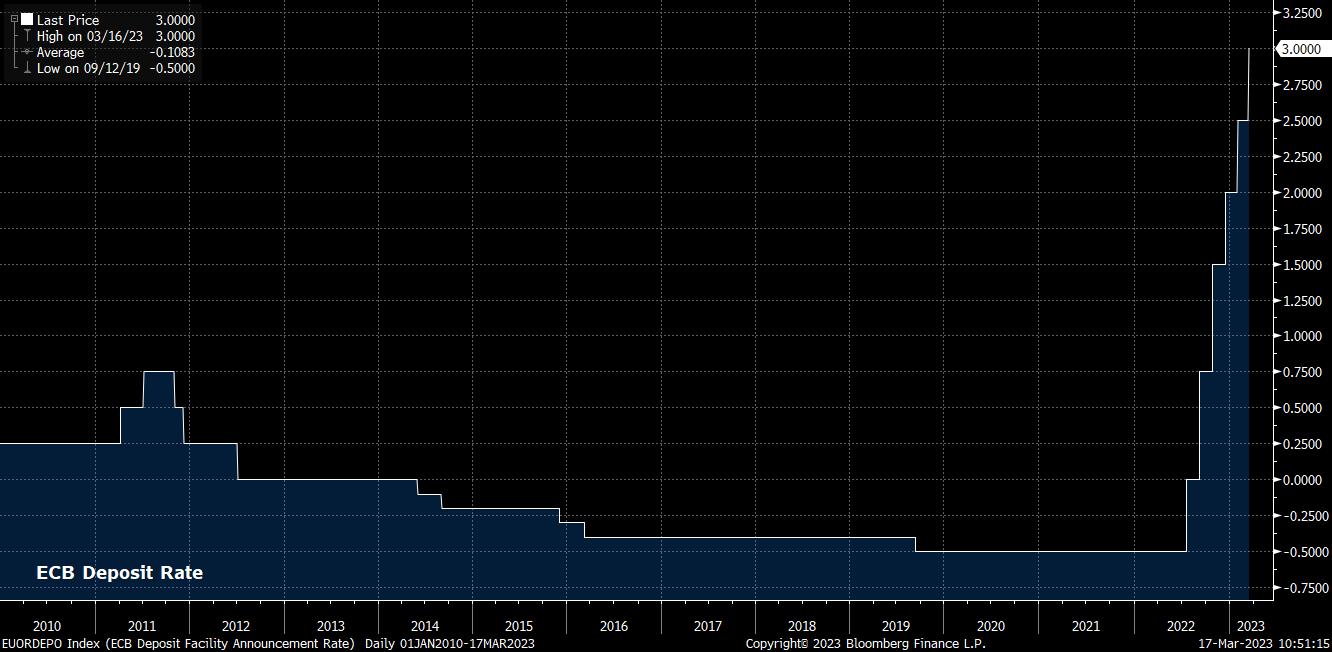

This brings us nicely to the ECB, who are dealing with their own inflation battle, with core CPI sitting at 5.6% YoY, and showing scant sign of putting in a peak. As had been telegraphed, the ECB hiked by 50bps for the third successive meeting, setting aside concerns over financial stability, with the Governing Council instead determining that inflation risks should take precedence.

So, with that said and done, there are two questions left to answer; where does it all leave us, and what should traders have on their radar as we move forward?

To answer the first question, I see four major takeaways from the week that we’ve had:

- Financial stability risks have hugely increased and, perhaps more importantly, have suddenly shot to being front of mind for traders and policymakers alike

- Inflation risks persist, and remain tilted to the upside, with the disinflationary process set to remain a bumpy and sluggish one as the year progresses

- As the saying goes, central banks will ‘hike until something breaks’ – it’s a stretch to say anything significant has broken, but things are certainly starting to creak

- The policy outlook from here on in is suddenly much murkier; as central banks need to balance fighting inflation, and backstopping banks, the balance of risks has started to tilt in a more dovish direction

Taking those into account, we can produce some actionable themes to put onto the radar as we move forwards. Three themes stand out.

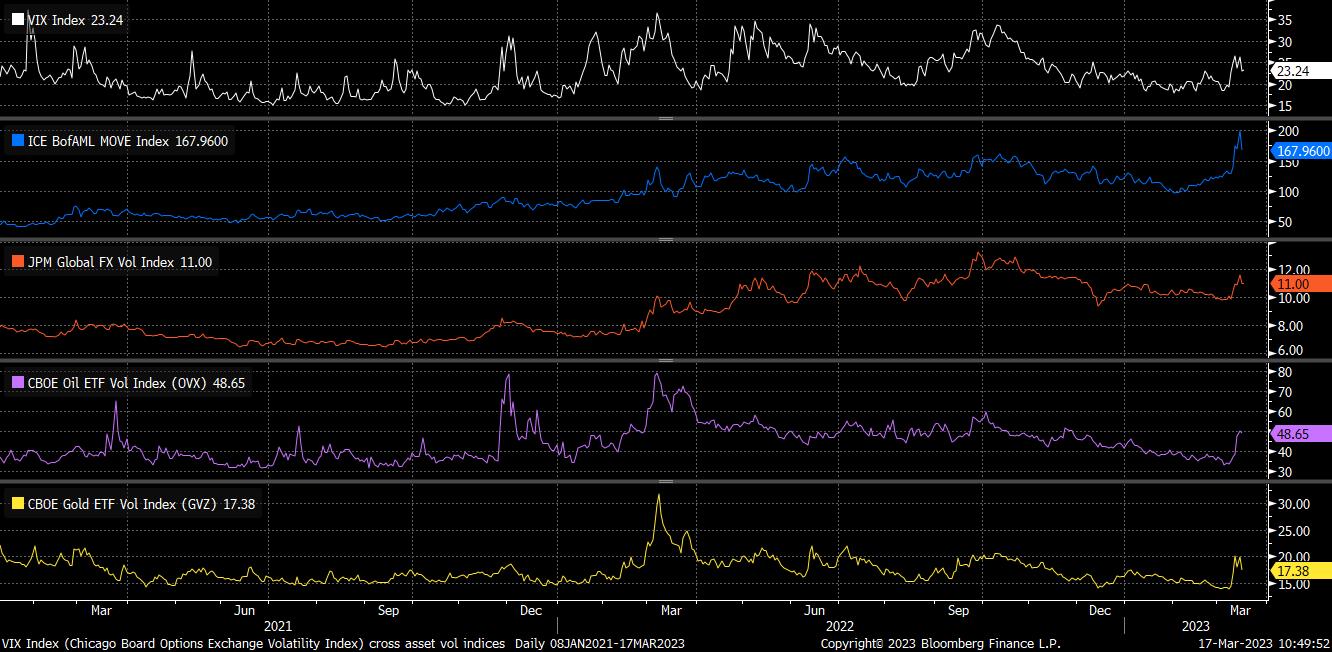

Firstly, cross-asset volatility is set to stay high for some time to come. Markets must not only discount the possibility of contagion risks from the banking shenanigans escalating, investors also need to grapple with an environment in which the policy outlook – both in terms of the pace, and extent of any future rate hikes – is growing increasingly uncertain. With this in mind, risk management considerations take on increasing importance; traders would be prudent to keep a close eye on the placement of stops, and position sizing, in this sort of environment, no matter which assets are being traded.

Secondly, this does not appear to be a full-blown liquidity crisis at this point. Without wishing to tempt fate, the price action seen particularly early in the week, and lack of demand for the USD, is emblematic of a market in which there remains plenty of liquidity sloshing around.

Consequently, this leads one to believe that – for now at least – the path of least resistance is likely to lead to a continued softening of the USD, as we roll towards the next FOMC decision. FX havens of choice are likely to remain the JPY, and in part the CHF, should we see another bout of risk aversion arrive; while the AUD, GBP, and NZD stand to benefit for now.

_T_2023-03-17_10-49-32.jpg)

Thirdly, and taking this a step further, it would appear that the near-term pain for equities may perhaps be at an end.

The technical landscape helps to support this as well, with the S&P 500 having made a closing break above both the 50- and 200-day moving averages, while the Nasdaq 100 has managed to slice north of the descending channel that has been in place since the start of February. While any sudden weakness in hard macroeconomic data poses a risk, things are looking increasingly constructive at this juncture.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.