- English

- Italiano

- Español

- Français

Key event risks to watch for at the Jackson Hole symposium

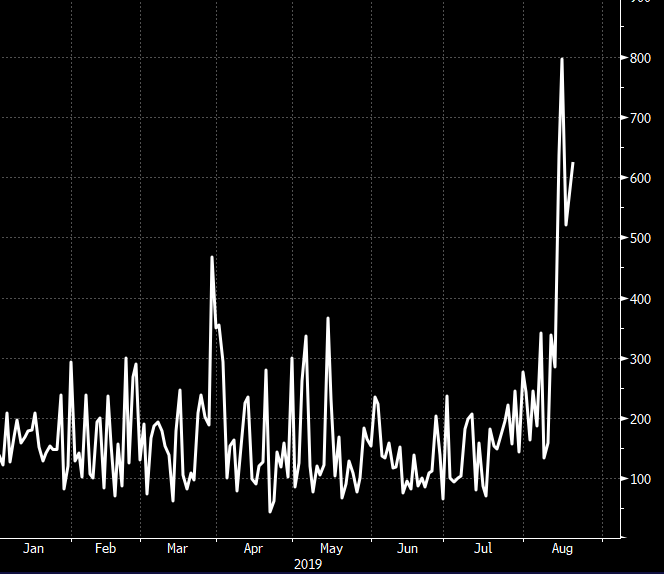

The broadening global slowdown is making everyone nervous. Yield curves have inverted, Fed policy is deemed too tight and the word ‘recession’ is soaring in news stories as traditional economic theory is exhausted and monetary policy is pushed to its limits.

Daily use of the word "recession" in news stories has soared this month

"Source: Bloomberg"

The Jackson Hole Symposium - The event risk to watch

The Jackson Hole symposium is hosted by the Federal Reserve Bank of Kansas City for a discussion of global economic issues. However, it’s not just US central bankers offering insights, but policymakers and academics from both developed and emerging market nations, who come together to speak on pressing global economic issues. The undertones this year are somewhat more grim than usual, with mounting fear of a European and even US recession, and the need for central banks to get ahead of the curve to stave off a fallout in economic activity.

It seems incredibly fitting that the title of this year’s event is appropriately named ‘Challenges of Monetary Policy.’

Investors are looking for reassurance that central bankers still have capacity to fend off an economic downturn. This makes this conference especially important because central bankers will likely use this platform to convince markets they still have the firepower. Financial markets will react according to the level of support they feel is coming and how this support may be implemented.

Listen ‘somewhat’ closely to Powell’s narrative.

Fed Chair Jerome Powell is speaking Friday at 10am ET (Saturday 12am AEST). While we still await the full suite of speakers, including representation from the BoJ, BoE and other key central banks, Powell is seen as the keynote address. It’s expected he’ll assure the markets that the Fed maintains the means to weather a downturn.

The full line-up of speakers will be made known here later today https://www.kansascityfed.org/publications/research/escp

Powell, along with the wider committee has claimed the July rate cut was done as an insurance cut and part of a “mid-cycle adjustment,”. Investors, however, feel we’re closer to a late-cycle and that leave us feeling vulnerable. If he doesn’t walk back this view, which seems likely, then the markets will continue to feel the Fed are behind the curve and this elevated the risk off further bouts of market volatility. Recessions don’t just happen; they are instigated by policy mistakes.

The Fed has a communication problem, and Powell is at the heart of that, with numerous examples this year where markets have been left somewhat baffled by his communication to the market. Confusion has also come from Powell’s senior team, where Federal Bank of NY President John Williams seemingly championed a 50bp cut ahead of the July cut, only for his team to later clarify the statement. They cautioned to not read too much into the remarks and risk to a negative turn.

Will Powell offer insights into potential action for the September FOMC meeting?

The rates market is currently pricing just over two further rate cuts (64bp) for the end of 2019. For the September meeting, a rate cut is 100% priced in, but a 50bp cut is ascribed a 9% probability. Despite the announcement of staggering 10% tariffs on $300bn of Chinese exports, there doesn’t seem like enough as really changed to warrant a 50bp cut, but Powell will guide the market here.

USDJPY is the best guide here and will be the purest read here, although we’ll see gold, emerging market currencies and the US500 sensitive to his rhetoric.

We feel that should Powell maintain his outlook at that a “somewhat lower rate path is warranted”, then the market should take that a 25bp cut is coming in September. Will that be enough to support risk assets?

How low will Lowe go?

RBA Governor Lowe is scheduled to speak on a Saturday panel at 12:25pm ET (Sunday 2:25am AEST). Speakers on this panel tend to speak on their country’s policy outlook.

The Lowe-led RBA has already cut the cash rate by 50bp, with recent commentary suggesting they are prepared to sit back and wait for new information to emerge. The markets see the next cut in November, taking the cash rate to a record low 1%. The RBA has further indicated it won’t exercise unconventional monetary policy until the cash rate is closer to zero. This was once considered the emergency zone, but anything goes in our low-rate world.

Governor Lowe’s speech this weekend is not expected to provide new insight on the RBA’s policy outlook. The rate cut probability for the September meeting sits at 10%, with October at 53%. With expectations of a near-term adjustment, if the market hears a narrative that suggests a more realistic chance of a cut in September or October, we could see the AUD gap come Monday’s market open. If one of the primary jobs of a trader is to manage risk, the Jackson Hole Symposium is an event risk to focus on.

Ready to trade?

Switch to Pepperstone now and join our global community of over 620,000 traders. ³ Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.