- English

- Italiano

- Español

- Français

An impending global recession? Short commodities are the default trade

Germany has been heavily reliant on Russian gas imports and the flow-on effect is we could be looking at gas rationing through the European winter and a potential bailout of Germany’s largest gas importer (Uniper).

A recession in Europe looks all but certain this year, and this makes the ECB’s life incredibly challenging – they have a deteriorating growth outlook, very high and persistent inflation and worries about peripheral bond yields blowing up. EU Nat gas (NG) prices are not something they can control, and we’ve seen prices rally 100% in the past 16 days, so this is a brutal juggling act for Europe – Europe is in the eye of a storm right now, especially with China maintaining a strict line with its Covid zero policy. News that airline SAS has filed for bankruptcy won't help matters either.

Europe may command the closest attention, but this is a global problem. In a world of rising interest rates and central banks hellbent on putting the inflation genie back in the bottle, we’ve seen clear evidence of demand destruction – commodities have been the default expression of this thematic and right now there is just no visibility on growth or what changes the trend – even though the market lives in the future, it feels like this gets worse before it turns around.

The result is no one wants EURs, or GBPs, and commodity currencies (AUD, NZD and NOK) find few friends either – the trend really is one’s friend and everyone asks when EURUSD hits parity.

So the USD reigns supreme, not just from a relative growth perspective but from an attractiveness as an investment destination. Right now, aside from the USD, only the JPY looks like a compelling long in G10 FX. What’s clear is that the USD strength is feeding back again into negative commodity price action – commodities face a war on two fronts – demand destruction and king USD and this is causing some intense bear trends in commodities, and it wouldn’t be a stretch to think the systematic trend-following crowd would already be running hefty short positions in Copper, Silver, Gold, US gasoline and AG’s like Wheat and Soybeans.

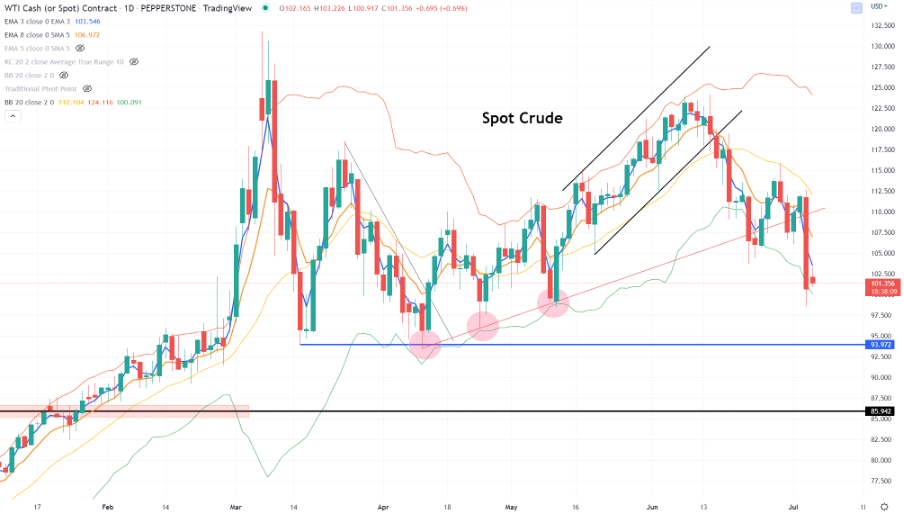

(Source: TradingView - Past performance is not indicative of future performance.)

Until we see signs of a turn in the USD then rallies in all these markets will likely be jumped on by the short-sellers. That even includes XAUUSD, which is trading at YTD lows and sold consistently into the 8-day EMA – Until these dynamics change then it feels like gold is destined for $1750. If the USD remains bid, perhaps look at gold exposures in AUD or EUR (XAUAUD or XAUEUR) and there may be scope for a topside range breakout. However, even then, I will want to wait for a move to take place and let the market reveal itself.

The elephant in the room, aside from EU NG is crude – Our SpotCrude price briefly traded below $100 and SpotBrent into 103.53, although have been supported below the figure. Headlines that one US bank is projecting that Brent crude could head to $65/bbl in a recession may have impacted, but it’s the demand side of the supply/demand equation which is being examined and we heard concerns of falling demand from Vitol Group (one of the world’s largest oil traders) on Sunday. The world could use a weaker crude price, although from a risk perspective it's better if it’s driven by additional supply and not falling demand – the issue with supply is that OPEC is struggling to meet current quotas as it is so additional supply seems a tall order.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.