- English

- Italiano

- Español

- Français

Well, that school of thought has been blown out the window and rate hikes are now once again being priced to rise. The question, it seems, from purely observing market pricing, is whether we see a hike in November, and then a pause, or we see back-to-back hikes in November and December.

The recent RBA minutes detailed that slower progress in getting to their inflation target (2-3%) would not be viewed favourably. This view was reinforced by RBA gov Bullock's speech (on Tuesday) when she detailed the bank won’t hesitate to hike if there is a material upward revision to the outlook on inflation.

Consider the RBA forecast (in August) headline Q3 CPI at 4.5% and core Q3 CPI at 4% by December. So going off today’s numbers, with headline CPI at 5.4% and trimmed mean inflation at 5.2%, the prospect of a revision to the bank forecast in the upcoming Statement on Monetary Policy (on 10 Nov) is clearly very high – whether it is ‘material’ is a point of debate.

Granted, inflation continues to moderate, but the pace of the decline would be frustratingly slow in the RBA's view. We can also add the Q3 CPI print to a better-than-expected Q2 GDP print (at 2.1%), September unemployment at 3.6% and house prices further rising, and the RBA may see a hike as a necessary evil.

Market reaction

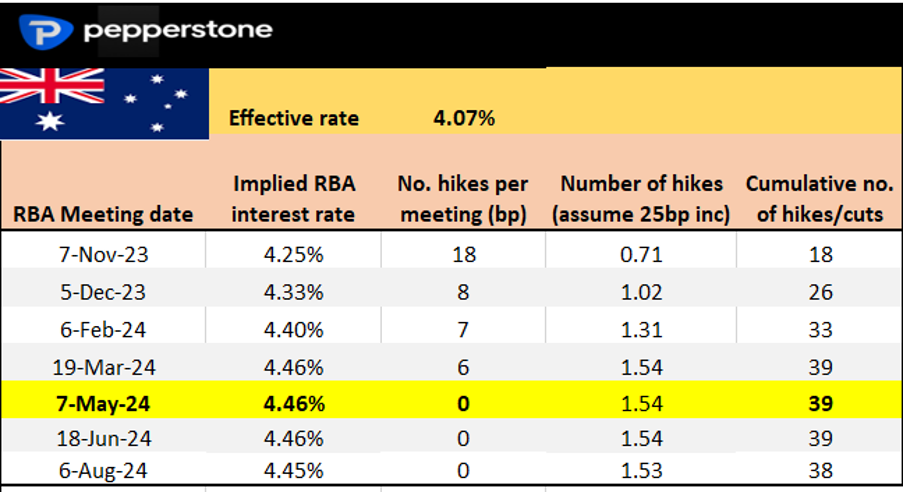

Australia's 30-day interest rate futures have reacted quite aggressively to the CPI data, and we now see the 18bp of hikes priced for the 7 Nov RBA meeting; equating to a 73% chance of a hike. If they don’t hike in November, December is priced at 100%. In fact, there is a small premium we could see at a 25bp hike in November and another 25bp hike in December.

The rise in the market interest rate expectations, with a spike in Aussie 3yr govt bond yields from 4.18% to 4.28% has been good for 40 pips in AUD, with AUDUSD pushing to 0.6400. AUDCAD has been the biggest percentage mover on the day and has broken the October highs. AUDNZD has been a tear of late – and remains one of the cleanest expressions of Aussie rates – with price breaking through 1.0900 and into a big supply zone seen since June.

In equities, we’ve seen the AUS200 falling from 6876 to hit a session low of 6832, although we’re seeing better buyers off these lows. ASX200 banks are heavy, as are REITS – consumer stocks are holding in remarkably well at present.

Upcoming event risk for AUD and AUS200 traders

While the Q3 CPI was always the big event risk, if we look at data ahead of the 7 November RBA meeting, we only see retail sales (on 30 Oct) that could affect market pricing, but sales would need to be very weak. Developments in geopolitics and broad risk sentiment in markets could also play a factor, but again, it seems unlikely to derail market pricing/expectations.

Governor Bullock speaks again tomorrow along with assistant governor Christopher Kent (09:00 AEDT), so this could give us a clear understanding of how the core of the RBA sees the CPI print – they could essentially guide to a hike here.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)