- English

- Italiano

- Español

- Français

A traders’ week ahead playbook – taking a positive stance with risk on a roll

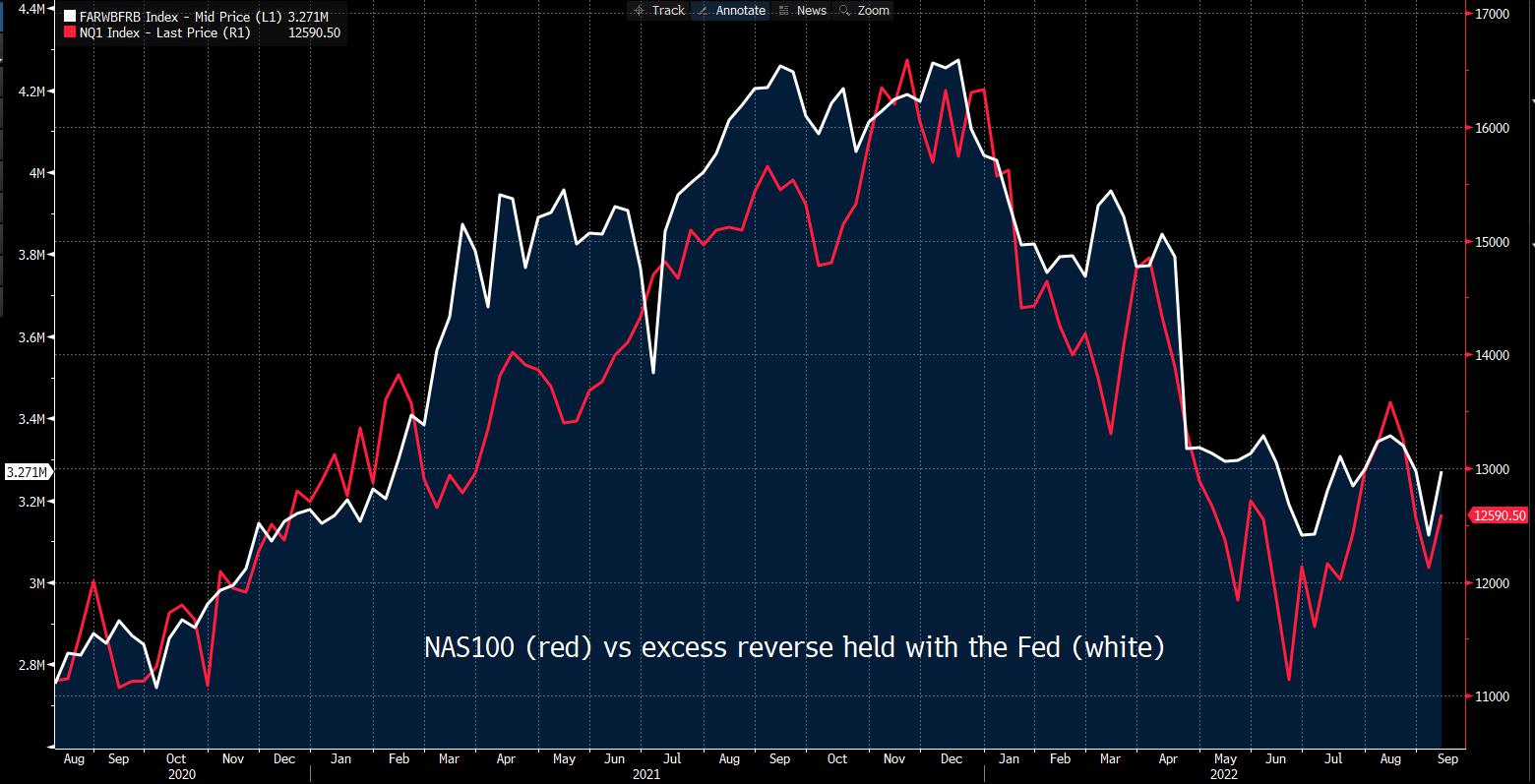

We roll into the new trading week with risk and sentiment on the front foot – a broadly weaker USD, a slight dip in US real rates and a 5% rise WoW in reserve liabilities (on the Fed’s balance sheet) all working concurrently as a tailwind. Certainly, the correlation with reserves seems key and where reserves go risky assets head in obedience – liquidity is always king.

A lower VIX index into 22.8% and a pullback in S&P500 1-month put skew is indicative of funds reduction equity hedges, and we can see 20-day S&P500 realised vitality in decline, which suggests volatility targeting funds are increasing capital into the equity markets – it’s all flow that driving, and when we add in a solid Chinese credit data (August aggregate financing printed CNY2430b from CNY756b in July) and we see the AUD having a staggering move. Crypto too is having some fun, notably Bitcoin which eyes a test of $22k.

We watch for how Asia takes the US lead and runs with it – futures markets indicate Asian equity markets will open c 1% higher, but will traders sustain the bid after the cash market unwinds or will they fade the strength? The early session could hold important intel on market psychology. News of a strong counter-offensive in Ukraine should also support.

As we note below there is a clear focus on US CPI – that is the marquee event risk this week, and while the momentum favours long equity, short USD for a tactical short-term trade, a hot CPI number will hurt. This is a dark sinister market and if you don’t have an open mind and are prepared to react to sentiment that can and will change on a dime, then you’ll feel it if using leverage – which is why we respect it, utilise in accordance to market volatility and accompany with correct position sizing, relative to the size of the account.

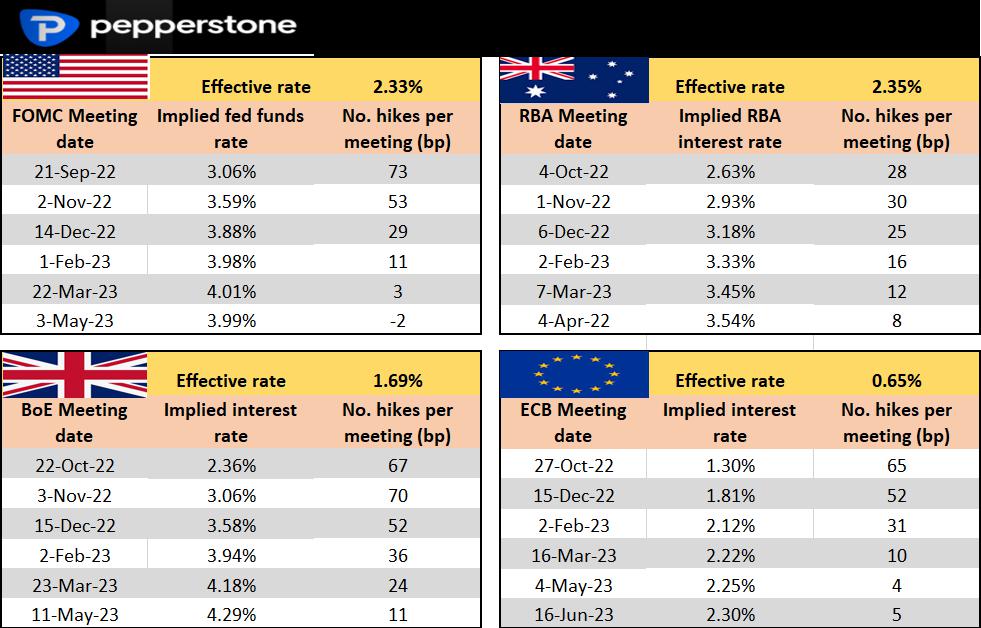

Central bank speeches – the Fed are in a black-out period ahead of the 21 Sept FOMC meeting, where I am sure many in the market will welcome a lack of inputs from the various Fed members. The ECB will, however, be active, with 9 separate speeches that could impact EU assets – the market is already leaning towards another 75bp hike in October (currently there’s a 64% chance of a 75bp hike) - the increasing focus though is on clarity on ECB Quantitative Tightening (QT), a factor that may not come this week, but will almost certainly be the core focus in the 27 October ECB meeting. With that in mind, the EUR should become sensitive to Italian BTP - German bund yield spreads – currently at 232bp, if this spread pushes closer to 300bp (or 3%) then the EUR may attract sellers.

Keep an eye on any further jawboning from the BoJ/MoF, who have done a good job of causing JPY shorts to part cover. I still don’t buy intervention at this stage and feel USDJPY needs to be closer to ¥147.00 to really be in play – we’d need a huge beat to US CPI for USDJPY to march towards that zone and we know any moves into ¥145 will get officials out on the wires, causing some anxiety from funds to hold JPY shorts.

Rates Review – what’s priced into interest rate market and the step up (in basis points) to the following meeting

On the data side – the key event risks:

- 13 Sept – UK jobs numbers (16:00 AEST) – the UK labour market is healthy at present, and we see no reason for that to change just yet – watch weekly earnings with expectations the 3m/YoY pace rises to 5.1% (from 4.7%) which supports the argument for higher inflationary forces. Unless we see a big miss/beat, the labour market data is unlikely to move the GBP too intently.

- 13 Sept – German ZEW Survey (19:0 AEST) – the market expects further deterioration in the ‘expectations’ survey (-60 from -55.3) and the ‘current situation’ survey (-52.1 vs -55.3) – which could have a modest impact on the EUR and GER40 but hard to see a huge vol move.

- 13 Sept – US CPI (22:30 AEST) – the marquee event that could rock all markets – the consensus expects a -0.1% MoM, which if true would be the first decline since May 2020 - this would lead the year-on-year CPI clip to fall to 8.0% (from 8.5%) – the economist’s range of estimates sits between 7.9% and 8.3%. Psychologically, a number below 8% could offer relief for risky assets, even if core inflation should increase though a touch to 6.1%. Watch shelter inflation closely for trends here. With 73bp of hikes priced for the 21 Sept FOMC meeting, the market is feeling confident that even an improved CPI print would not deter a 75bp hike – a view installed by Fed member James Bullard on Friday. Still, a headline CPI print below 8% and the USD should fall, and gold, crypto and NAS100 should rise strongly. A print above 8.4% would send risky assets lower.

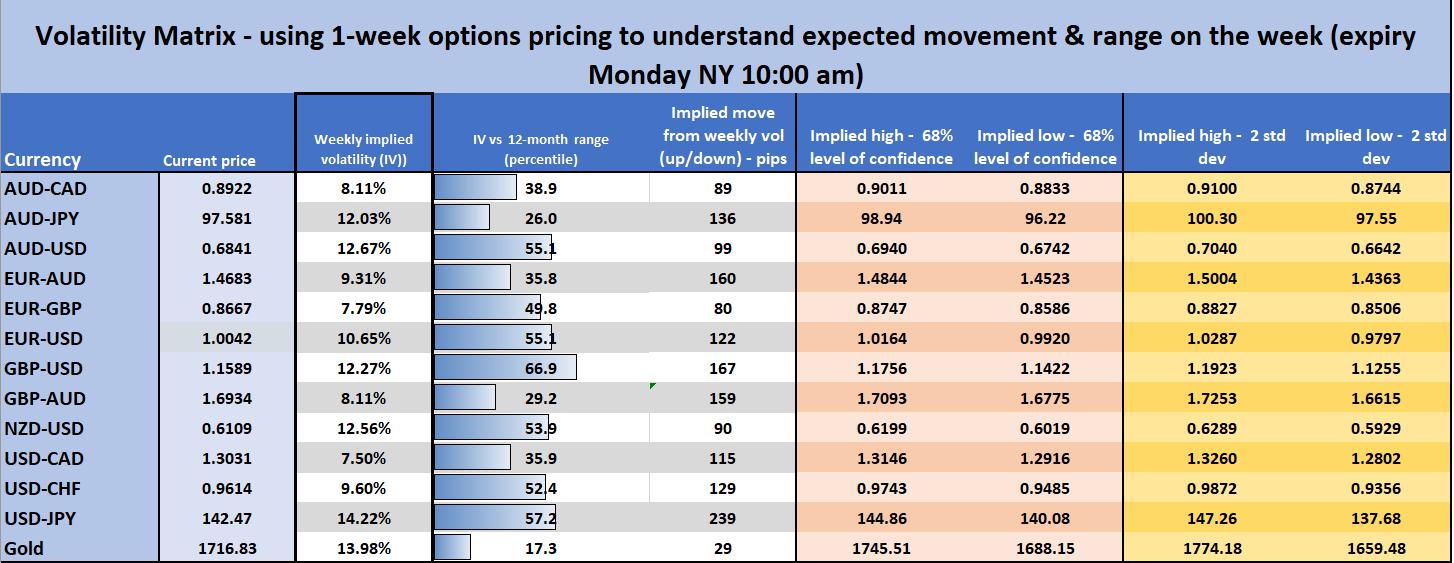

- 14 Sept – UK CPI (16:00 aest) – the market is eyeing UK CPI to remain unchanged at 10.1%, with the range of estimates seen between 9.7% to 10.8% - the market is pricing 67bp of hikes at the 22 Sept BoE meeting (i.e 68% chance of a 75bp hike), so the inflation print could clearly affect that pricing. GBPUSD has rallied nicely off the March 2020 lows of 1.1412, but the upside should be capped into 1.1760 this week. GBPUSD 1-week implied vols closed at 12.27%, which offers a 167-pip move (higher or lower) on the week. GBPAUD shorts look a better play, especially if we get a weak US CPI, where a downside break of 1.6870 could start a bear trend.

- 15 Sept – Aussie jobs numbers (11:30 AEST) – the market is expecting 35k net jobs to be created in August (economists’ range is 110k to 10k jobs) – the U/R is expected to remain unchanged at 3.4%, but obviously that will be driven by the participation rate (consensus 66.5%) – The AUD obviously most sensitive here, where the risks are for a bigger negative reaction. With the labour market in good health, it's hard to see a number that price ‘expectations’ closer to 50bp for the 4 Oct RBA meeting.

- 16 Sept – ChinaIndustrial production (consensus at 3.8% vs 3.8% prior), retail sales (3.2% vs 2.7% in July) and fixed asset investment (5.5% vs 5.7% -all 12:00 AEST) – China's growth has been a clear issue, so these data points will be watched closely. Also, during the week (no set time) the PBoC may disclose changes to the MLF (Medium-Lending facility) – the consensus is the 1-year facility rate is unchanged at 2.75% - risky assets would welcome a cut here.

- 17 Sept – US Uni of Michigan survey and 1- & 5-10-year inflation expectations – the market expects a slight lift in consumer confidence, while 1-year inflation expectations are eyed to fall to 4.6% (from 4.8%), and longer-run inflation to remain at 2.9%. USD longs may cover hard if we saw a 5-10yr print below 2.7%, although their confidence will be shaped by the CPI print on Tuesday.

Implied volatility matrix – using 1-week implied volatility we look atwhere the market sees the weekly move and project a potential trading range with a 68% and 95% level of confidence.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.