- English

- Italiano

- Español

- Français

The China CN50 and AUS200 look particularly weak, while EU equity markets are in steep decline, with price breaking level after level. In the US, the NAS100 has fallen for four straight days and sits on a huge support zone seen between 14,560 and 14,430, with the US500 eyeing the 4 Oct swing low at 4200 – if these levels are broken this week and SPX 20-day realised volatility rises, then market chatter will centre on the S&P500 pushing towards 4000.

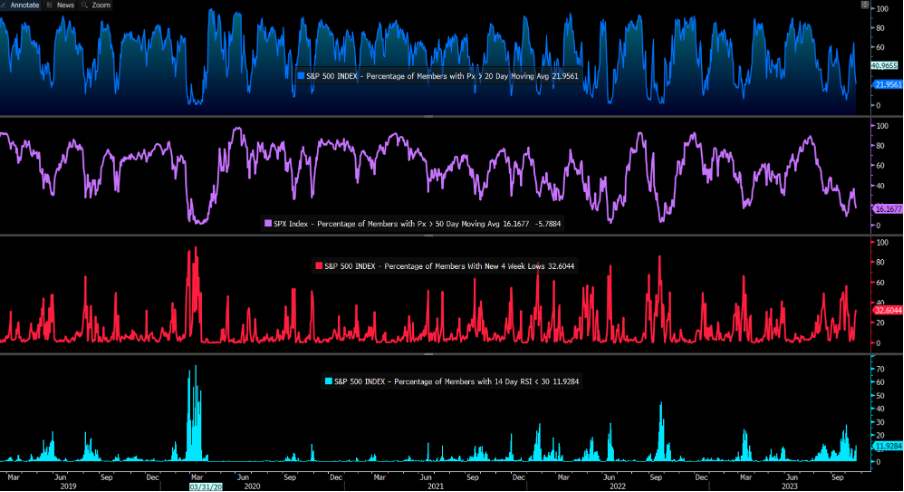

The contrarians have started to look at sentiment and throw out a range of charts, including deteriorating market breadth and the number of stocks (in an index) below the 20-, 50- or 200-day moving average, that have an RSI below 30, or resides at 4-week lows. On current standings we’re not yet near a point of maximum bearishness. The CNN Fear and Greed can do a good job capturing the mood across markets and this says a similar message.

The time for contrarianism is approaching – and who doesn’t love a tradeable V-bottom – but the risk to reward trade-off hasn’t shifted enough just yet.

Maybe corporate earnings can have a more positive effect and stabilise sentiment. Perhaps those who hedged into the weekend will want to part unwind those hedges – we’ll have to assess the news flow as it could lead to a lively open in our equity indices and underlying futures at 09:00 AEDT.

With 43% of the S&P 500 market cap reporting this week, this is the week it could happen, and guidance and outlooks from CEOs can play a more important role. The macro matters though, and we continue to focus on geopolitical headlines, moves in the US 10- and 30-year Treasury, volatility, and energy markets. With bonds offering no defence in the portfolio, traders continue to manage drawdown risk through volatility, gold, and the CHF as the preeminent hedges.

The USD hasn’t performed as well as some had hoped through this period of equity drawdown and rise in long-end bond yields. One factor is that we’re seeing a rise in EU and Chinese growth momentum, so the rest of the world is looking less bad. We also regress and understand that the CHF acts more like gold in times of geopolitical tensions, and after a 7.8% rally between July and October (in the DXY), consolidation in the USD index was always a possibility.

Keep an eye on USDCNH and USDJPY as a guide, and the fact we see both pairs in a sideways consolidation is keeping broad G10 FX volatility subdued and a factor that is holding the USD from moving freely on a broad FX basis.

As many try and pick a turn in equity markets, a bounce in risk this week can't be ruled out, and we need to be open-minded to all possibilities – its fighting evolving momentum though and many will prefer to initiative (or add) shorts into any rallies, rather than fight it. Buying risk when it's darkest and sentiment is rock bottom is a well-adopted market philosophy but I’m not sure we’re there just yet.

Marquee data points for next week:

- EU manufacturing/services PMI (24 Oct 19:00) – the market consensus is we see the diffusion index print 43.6 (from 43.4 in September) and the services index at 48.6 (from 48.7)

- UK manufacturing/services PMI (24 Oct 19:30) -– the market consensus is we see the diffusion index print 44.6 (from 44.3 in September) and services at 49.3 (unchanged 49.3). A better services print could see a big reaction in GBP given how short the market has got.

- Australia Q3 CPI (25 Oct 11:30 AEDT) – the consensus sees headline CPI at 5.3% yoy (from 6%) / core CPI at 5.0% yoy (5.9%). The Aussie interest rates markets price a hike on 7 Nov at a 34% probability- so, if we get a CPI print above 5.4%, we could see the market pricing a hike at the November RBA meeting at or even above 50%. AUDNZD has been the best expression for AUD bulls but is coming into a supply zone around 1.0850.

- US S&P manufacturing/services PMI (25 Oct 00:45 AEDT) – a data point the market could completely ignore or could be the trigger for a sizeable reaction – the consensus is we see manufacturing at 49.9 (from 49.8) and services at 49.9 (50.1).

- BoC meeting Canada (26 Oct 01:00 AEDT) – the swaps market ascribes very little chance of a hike at this meeting, and only 6bp of hikes cumulatively priced through to March 2024 – if the tone of the statement suggests a greater risk of hikes in the future meetings, then the CAD should rally.

- ECB meeting (26 Oct 23:15 AEDT) – the ECB won’t hike at this meeting, so the focus falls on their guidance on the economic outlook and hurdle for hikes in the future. There will also be a focus on the bank’s plans to increase QT, and even look at the timeline on sales from APP and PEPP bond purchase program – if this is brought forward from Jan 2025 the market would see this EUR positive.

- US Core PCE inflation (27 Oct 23:30 AEDT) – US headline PCE inflation is eyed at 3.4% (from 3.5%) and core 3.7% (3.9%) – it would have to be a big number to put a hike at the Dec FOMC meeting on the table – a November hike is not up for debate and the market sees a hold as a full-gone conclusion.

- Chile central bank meeting (27 Oct 08:00 AEDT) – The market looks for a 50bp rate cut, but there are risks for 75bp – can USDCLP print new cycle highs?

Central bank speakers:

Fed speakers – Powell (26 Oct 07:35 AEDT – Powell is unlikely to offer any new market intel at this event). Waller (27 Oct 00:00 AEDT) and Barr

BoE speakers – Cuncliffe (27 Oct 03:45)

RBA speakers – Gov Bullock (24 Oct 19:00 AEDT) & Bullock and Kent both appearing at the Senate testimony (26 Oct 09:00 AEDT)

Marquee US earnings and the implied move on the day of earnings (derived from options pricing) – on the week we see 43% of the S&P500 market cap reporting. Marquee names include - Alphabet (4.8%), Microsoft (4.1%), IBM (2.7%), Meta (8.6%), Amazon (6.4%), Intel (6.6%), Exxon (2.4%)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)