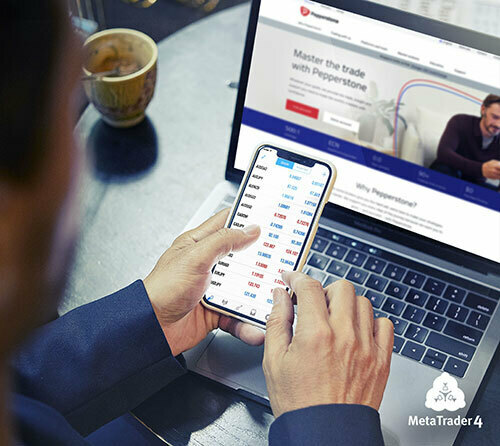

Why choose MetaTrader 4?

MT4 enhances your trading experience with live quotes, real-time charts, in-depth news and analytics – as well as a host of order management tools, indicators and Expert Advisors.

Header 2

Header 3

Header 4

Header 5

Heading 6

This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text This is a normal text

This is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quoteThis is a quote

This is a unordered list (H3):

- Item 1

- Item 2

- Item 3

- Item 4

- Item 5

This is a ordered list (H3):

- Item 1

- Item 2

- Item 3

- Item 4

- Item 5

This is a video caption

| This is a table header | This is a table header | This is a table header |

|---|---|---|

| Cell | Cell | Cell |

| Cell | Cell | Cell |

| Cell | Cell | Cell |

Confiado en todo el mundo

Procesamos un promedio de 125 500 millones USD en operaciones diarias, lo que nos hace uno de los brókers de divisas más grandes del mundo.

Tenemos la confianza de más de 89.000 operadores en más de 150 países.

Además de estar regulados por ASIC, SCB, FCA, DFSA, CMA, BaFin y CySEC, separamos los fondos de nuestros clientes con los bancos de primera línea y ofrecemos una gama métodos para realizar depósitos sin cargos.

Trading platform support

Included across all accounts

We know that every trader is different. However, there are some things that all our clients look for in a trading account.

Column 1

Minimum 0.01 lots trading size

Maximum 100 lots trading size

Available leverage up to 500:1

AUD$200 minimum account opening balance

Base currencies available: AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD and HKD

Column 2

Scalping allowed

Expert advisors allowed

Hedging allowed

News trading available

No dealing desk execution

Important: These tools have been produced by third parties and we don't make any representations or warranties that they'll be accurate or error-free. Nothing on this page is to be construed as an offer, recommendation or solicitation to buy, sell or to participate in any particular trading strategy. We're not taking into account your personal objectives, financial situation or needs in making these trading tools available to you. You're solely responsible for any transactions entered into as a result of using any of these tools. We encourage you to seek independent advice before using trading tools.