- Español

- English

- Italiano

- Français

Some basic information on GGP

Greatland Gold is a publicly listed exploration company with a key focus on tier-one gold and copper deposits. Greatland Gold share price is listed on the London FTSE AIM market under the ticker code of GGP. AIM is an acronym for Alternative Investment Market.

Greatland Gold GGP has a considerable retail base with the main attraction being the company’s asset in the world-class Havieron gold-copper deposit. This is in the Paterson region of Western Australia.

Latest news affecting GGP share price

On the 25thof August 2022, GGP share price devalued more than 7% on the news that it was to raise at least £25million through a private placing. The funds are being utilised to continue its development of the Havieron project. The placement was not offered to the retail marketplace.

Figure 1 Trading View GGP gap open

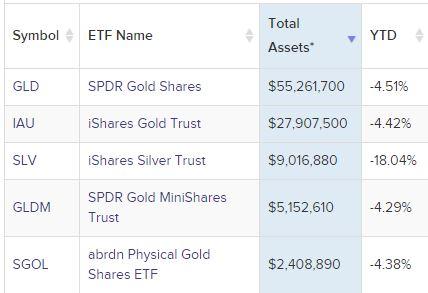

Precious metal ETFs

Let us look at the top 5 precious metals Exchange Traded Funds by total assets. Each shows a decline Year to Date of over 4%.

Figure 2 source: VettaFi ETF database 26/08/2022

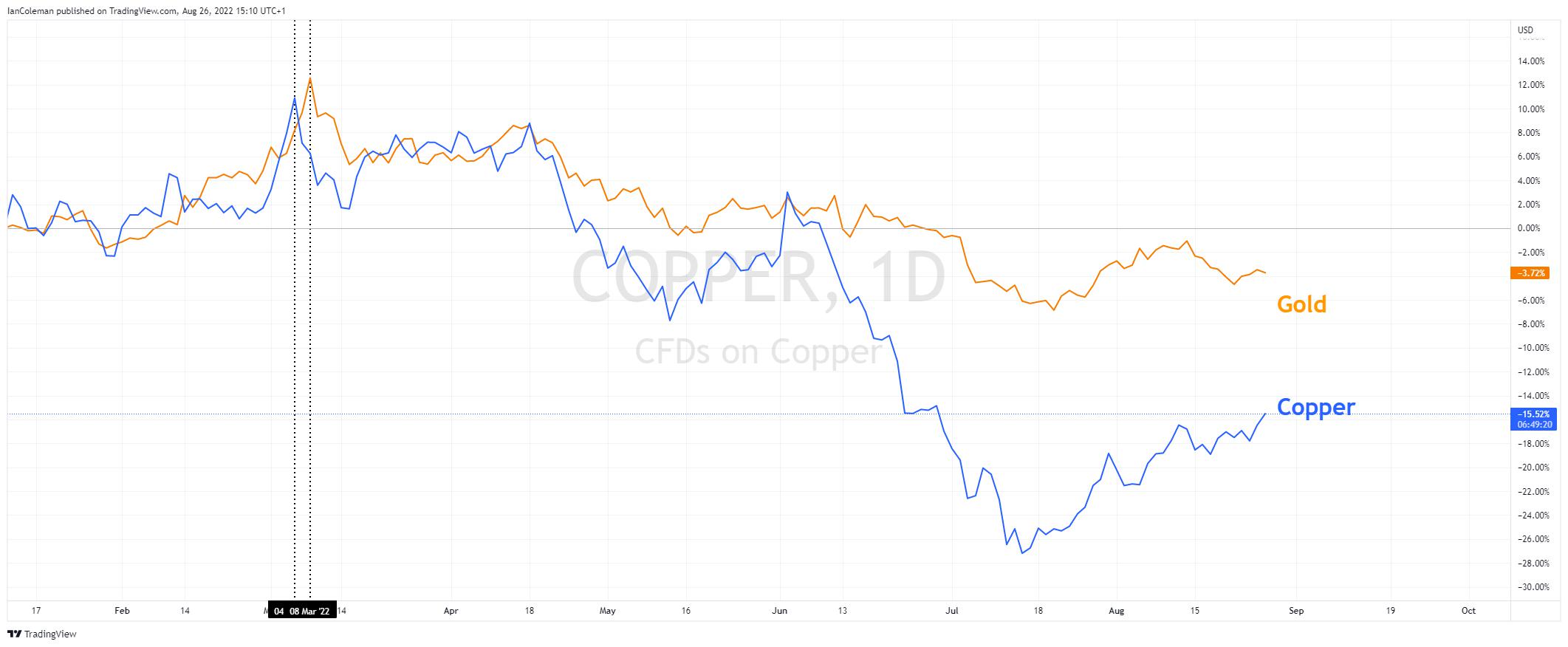

There has also been a notable decline in the price of spot Copper and spot Gold from the March 2022 highs.

Figure 3 Trading View Gold and Copper decline

A look for a technical analysis standpoint

GGP weekly price chart

GGP share price looks to be trading in a solid weekly downward channel. The base of the channel is located at 6.250.

Figure 4 Trading View GGP channel base

GGP daily price chart

The share has a 261.8% extension level at 6.265 (from 13.74 to 10.88). A move to this level and Elliott Wave enthusiasts might consider this to be the end of a 5-wave cycle. They would then look for a corrective move to the upside.

This offers a technical support area at 6.265 (261.8% extension) and 6.250 (trend line support).

Figure 5 GGP 261.8% extension

If you would like to learn more about technical analysis at Pepperstone, click here. Pepperstone offers competitive trading conditions on a vast range of products and through some of the most popular and powerful platforms in the world.

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.