- Español

- English

- Italiano

- Français

A little bit of information about the FTSE index

Before we investigate spread betting on the FTSE, let us look deeper into what the FTSE is. FTSE is an acronym for the Financial Times Stock Exchange. The London Stock Exchange owns the FTSE Russell group along with other bourses and financial companies.

They provide various indices, the best known being the FTSE100. When you hear someone talking about trading the FTSE (Footsie), there is a very good chance they are referring to the FTSE100.

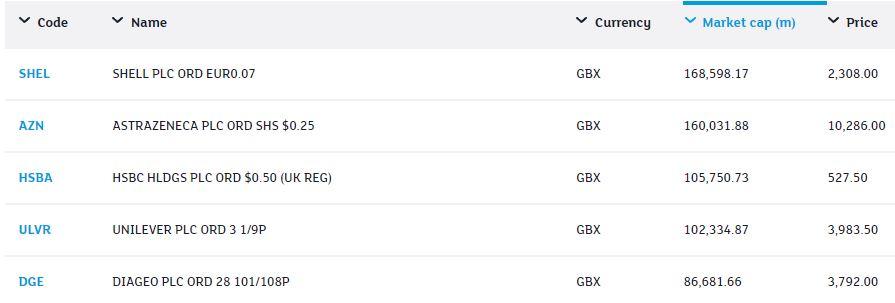

The FTSE100 tracks the performance of the 100 largest companies listed on the London Stock Exchange by market capitalization. The largest company in the FTSE100, with a market cap of £168,598.17 million, is Shell plc.

Figure 1 londonstockexchange.com 14/09/2022

Spread Betting the FTSE

Spread betting the major indices from around the globe is very popular with investors and especially day- traders. There is one solid differential between the FTSE100 and other bourses. Let us take a closer look.

The DAX40, this is the main German Index. It is like the FTSE100 and is made up of the largest 40 listed corporations in Germany. It is a good bellwether of the German economy.

The difference with the FTSE100 is that most of the corporations within the index have significant presence outside of the UK. This means that the index isn’t a true reflection of the UK economy.

The price of the FTSE100 is greatly affected by the GBP, the Great British Pound. A weaker GBP making services and products cheaper to overseas buyers.

Competitive spreads with no commission

You will hear traders talking about the different spreads of various products that you can trade. As a rule, the more liquid the market the tighter the spreads. The Footsie is a very liquid market.

The spread is the difference between where you can buy a product and where you can sell. For day-traders who are in and out of trades regularly, this is an important factor that can affect their overall profits or loss (performance).

Spread betting indices with Pepperstone

Pepperstone offers trading on some of the most popular indices from around the globe.

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.