CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Netflix’s $83B Bid for Warner Bros: Deal Breakdown, Regulatory Risks & the Tactical Trading Opportunity

With Netflix and WBD now entering exclusive negotiations, the stage is set for a fascinating period marked by intense regulatory scrutiny, shareholder debate, and the possibility of an all-cash counteroffer put directly to WBD shareholders from Paramount, with speculation building that a $30 per share cash deal could be put on the table.

Hollywood and the broader media landscape have reacted with alarm - even calling it a step toward the ‘Death of Hollywood’. The US Department of Justice has already stated it will investigate the merger. While concerns are real, the idea that Netflix would intentionally wind down theatrical releases appears overstated; in fact, Netflix is expected to increase cinema distribution for select titles, not eliminate it.

How the Deal Emerged

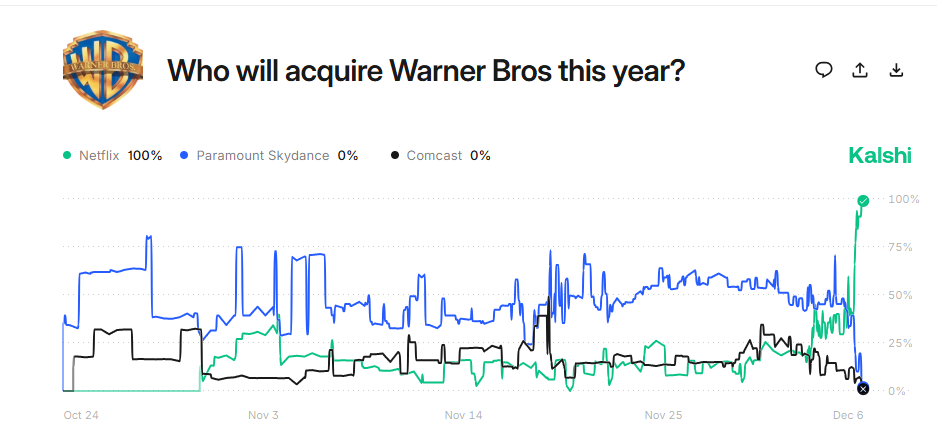

Netflix formally declared its interest in acquiring WBD in November. Initially, no clear frontrunner emerged, and as recently as one week ago, Paramount was widely viewed as the favourite, with prediction markets giving Netflix only a 7% chance of acquiring WBD.

That made Netflix’s $27.75 per share offer (cash + equity) a genuine surprise.

From late October, when news first leaked that Netflix was “actively exploring” a bid, Netflix shares developed an overhang, and led to the share price pulled towards $100 and underperforming the S&P500 and NAS100.

Netflix investors demanded clarity on:

• The strategic direction and how management addressed the execution risk

• The funding structure and the stresses this would place on the balance sheet.

• The valuation needed to top rival bidders - The bid has now delivered those answers, and in doing so, set several precedents.

Key Features of the Netflix Offer:

1. A Near-Record Financing Package - The $83bn acquisition will be funded by a record-scale $59bn bridge loan, one of the largest such financings ever arranged.

2. A Lofty Valuation for WBD - The offer prices WB/HBO at 25× EV/EBITDA This multiple sits at the upper end of historical media M&A deals, but for WBD shareholders, it represents an undeniably attractive valuation.

3. A Historic Breakup Fee - Netflix must pay $5.8bn if it walks away or fails to secure regulatory approval - 8% of the equity value, making it a record-breaking breakup fee. Netflix would not accept this risk unless it felt confident in seeing the deal through.

4. Pressure on WBD Shareholders - If WBD pulls out, it must pay a $2.8bn reverse breakup fee. Should Paramount submit a counteroffer, they would almost certainly need to cover this amount as part of the bid. Market Pricing:

Why WBD Trades at a Discount to the Offer Price

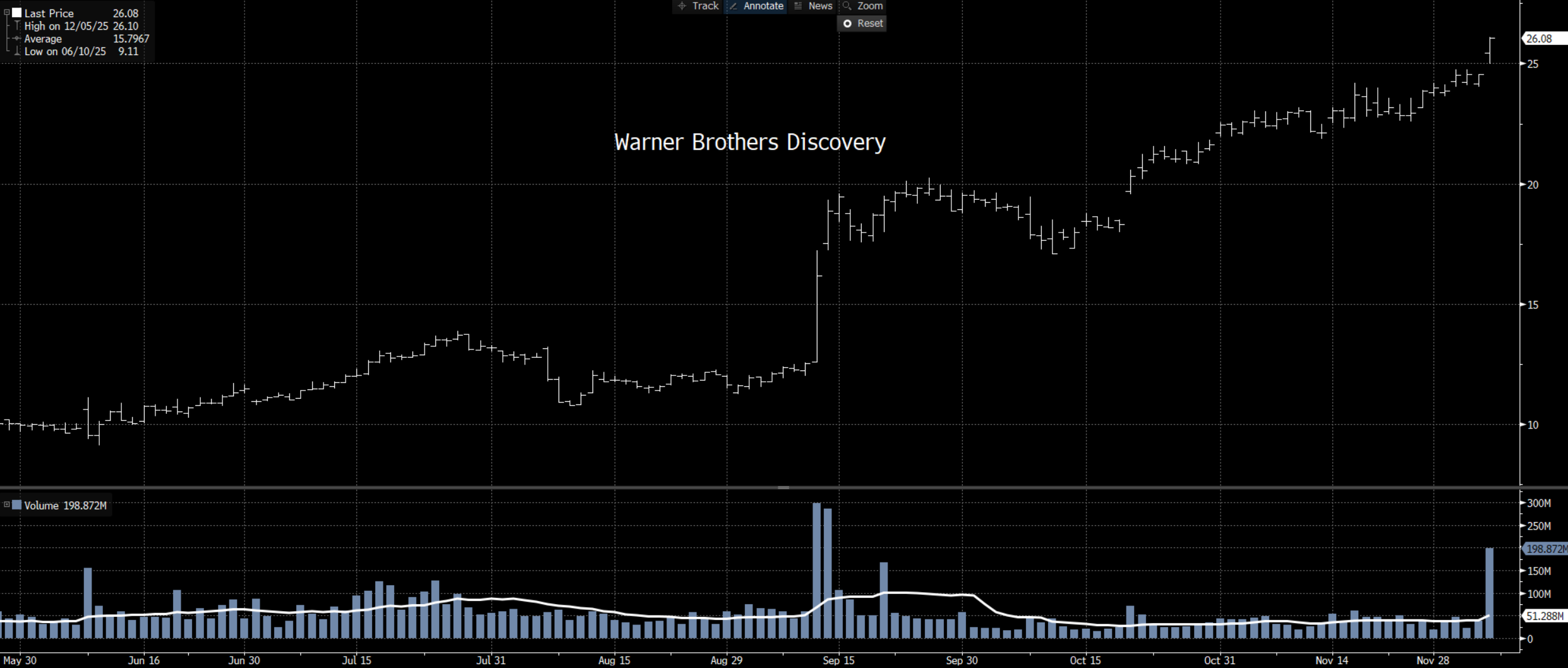

WBD closed Friday at $26.08, a 6% discount to Netflix’s $27.75 offer.

That discount reflects a blend of:

• Regulatory uncertainty - The world’s largest streamer buying a major competitor will draw deep antitrust scrutiny.

• Probability of a competing bid – Paramount could still return with a richer all-cash offer.

• Deal-failure precedents - Given prior case studies of large deals that were blocked or abandoned on antitrust grounds (e.g., Comcast/Time Warner, AT&T/T-Mobile, Viacom/CBS), there are clear hurdles to overcome.

• Timeline risk – There will be pressure to swiftly wrap this up, but the process to sign-off could drag well into 2026.

Arbitrage and Tactical Trading Opportunities

Event-driven traders may look at WBD as a two-way opportunity:

Taking Tactical Short WBD Positions

For traders who see a high chance that the deal collapses - either on regulatory grounds or due to shareholders voting it down – if that was to play out, WBD shares could unwind back towards $20.

Taking Tactical Long WBD Positions

For traders who see a high chance the deal gets regulatory blessing and/or Paramount to return with a sweetened offer, WBD may rerate to $27 The challenge: While Paramount would need to move quickly if it were to counter It may take some time until we and the opportunity cost of capital tied up over many months is significant.

Netflix Shareholders: A Divided Reaction

An $80bn acquisition is transformative and naturally splits opinion:

• Some shareholders fear cannibalisation of HBO/WB’s revenue streams if Netflix folds too much into its ecosystem.

• Others worry about the execution risk, the debt load, or the risk of regulatory intervention dragging on for years. On the other hand, Netflix’s strategic thesis is clear: Deploy WB/HBO’s exceptional content library across Netflix’s global distribution network, reinforcing its position as the dominant streaming platform.

Netflix management claims the deal would be earnings-accretive by year two, supported by:

• Large-scale content synergies

• A strengthened release pipeline • Enhanced global pricing power

• A more diversified revenue profile, including advertising If executed successfully, this would be the most transformative media acquisition of the decade.

Final Take on the Takeover

Netflix has rewritten expectations with a bold, high stakes bet on owning one of Hollywood’s most powerful content engines. The offer is rich, the financing is lofty, the regulatory path is uncertain, and the strategic consequences for the global media landscape are profound.

While there are significant execution risks, if Netflix can pull it off, the synergistical and strategic benefits could be well worth the risk - and potentially defining for the next era of streaming dominance.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.