ECB Playbook – Still The Most Determined Hiker in G10

Rate Outlook

Both such moves are full priced in by money markets, with the Governing Council having been resolute in guiding towards this relatively aggressive pace of tightening. A slew of speakers have rammed home President Lagarde’s guidance to this extent at the December press conference, while it was remarkable how rapid and decisive the ECB were in pushing back on ‘sources’ reports that a 25bps hike may be considered in March. In contrast to most, almost all, other G10 central banks, the ECB’s desire to continue tightening financial conditions is clear for all to see.

This desire stems from two sources – economic output proving significantly more resilient than had been expected at the end of last year, and core inflation remaining elevated, even as headline CPI continues to roll over. Taking both of these factors into account, it seems rather unlikely that more dovish members of the Governing Council are likely to secure any concessions for now, with the prior guidance of the deposit rate rising to 3% at the March meeting likely to be reiterated.

It is the rate path beyond March that is likely to attract significantly more market attention, and be the primary driver of any volatility in the EUR and euro assets more broadly. Our expectation is that the ECB deliver one further 25bps hike in May, before hitting the pause button to assess the impact of the full tightening cycle on the bloc’s economy; it’s worth noting that both household and business borrowing costs don’t yet appear to fully reflect the impact of the 250bps of tightening delivered since last summer, let alone any further hikes. Consequently, the ECB could remain at their terminal rate for longer than their G10 peers.

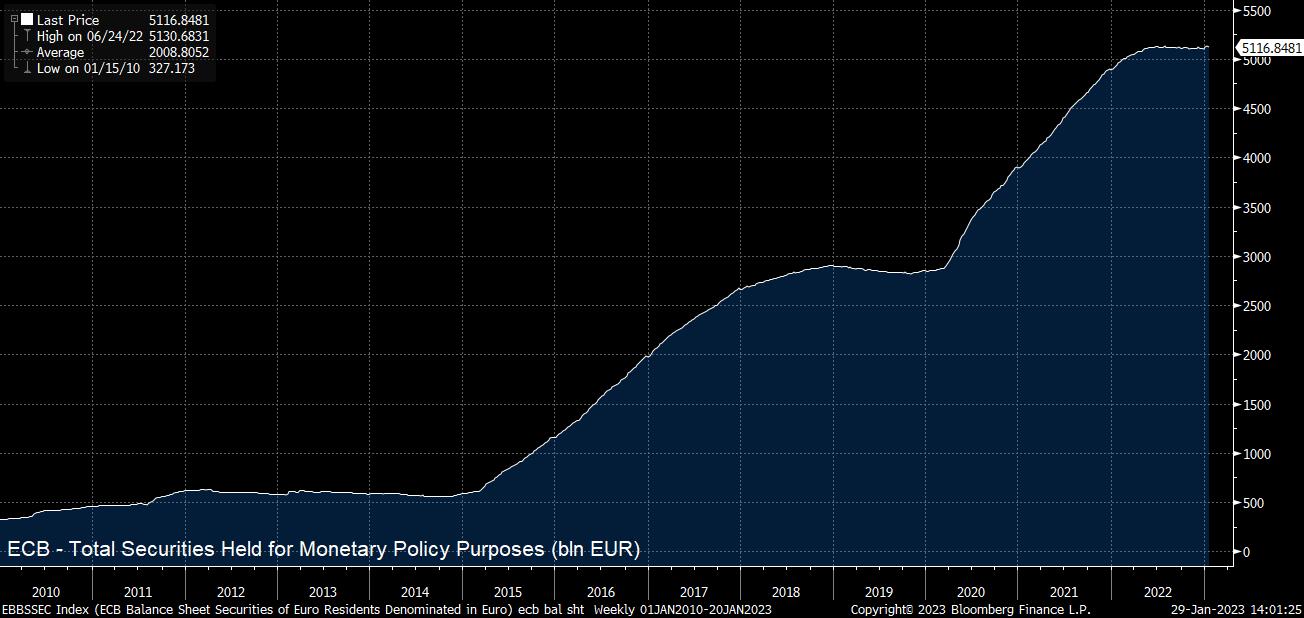

The Balance Sheet

Of course, rates are not the only area of consideration, with the mammoth €5tln balance sheet also likely to be under the microscope.

At the December meeting, the Governing Council noted that further information would be provided at the start of this year as to how the quantitative tightening process will unfold. While we are already aware that approximately €15bln worth of bond holdings will roll off from the portfolio each month during the second quarter, it is not yet clear the exact composition of said maturing bonds, particularly the national split of bonds which will be jettisoned each month/quarter.

Given the importance of core-periphery spreads in ensuring accurate and reliable policy transmission across the bloc, this often-overlooked area of policy will likely attract significant attention. Were we to see a more aggressive pace of asset rundown than markets expect, or a portfolio reduction weighted more heavily than expected towards periphery economies, this could threaten stability in the bloc – sending the BTP-Bund spread back above 200bps, and posing another communications challenge for the ECB.

Incoming Data Permits Aggression

Despite some potential trepidation around embarking on balance sheet reduction, and the exact manner by which this will take place – outright asset sales are of the cards for now – incoming economic data permits the ECB to retain an aggressive stance for now.

Incoming reports have consistently beaten expectations since the turn of the year, with economic activity having proved more resilient than consensus expected largely by virtue of the warmer than expected weather avoiding the full-blown energy crisis that some had predicted. Consequently, it now seems highly unlikely that the bloc will experience the winter recession that many had expected, while the latest PMI figures point to the economy actually having expanded once again as 2023 got underway.

Meanwhile, on the inflation front, although energy prices have significantly rolled over, and a clear peak has now formed in headline CPI, core inflation continues to rise, having hit a record high 5.2% in December, and being expected to sit at or around this level for much of the first half of the year, with underlying price pressures intensifying across much of the services sector. This should give the Governing Council enough ammunition to retain their present hawkish stance for at least the next quarter or so, even if the next round of economic projections (due in March) are likely to show a chunky downgrade from the 6.3% headline inflation rate previously forecast for year-end.

Trading the EUR

One can’t consider the ECB meeting in isolation when looking at the EUR this week, with decisions also on deck from the FOMC and BoE which must both be factored into a trading plan. Personally, from a more fundamental view, EUR/GBP looks like a simpler trade – pitting a determined hiker in the ECB, against a reluctant hiker with the potential for dovish surprise in the form of the BoE.

The cross currently trades in a relatively tight range between the 50- and 100-day moving averages at 0.8735, and the 0.89 figure. A break to the top of said range seems a reasonable expectation over the course of the week, particularly with 1-week implied volatility pricing a range of +/- 360 pips during the next 5 trading days.

Long EUR/USD could also be considered, and would become more attractive if Wednesday brings a dovish Fed surprise, though the bulls are unlikely to become seriously interested unless and until we have a closing break above 1.0930, the top of the recent range.

Trading European Indices

European indices will also likely experience a sizeable degree of volatility over the ECB decision. The pan-continental Stoxx 50 is presently butting up against the top of its recent range, with a closing break above 4195 opening the door to a return to the 4300 level that proved rather sticky in December 2021, before last year’s bear market began.

Other European indices demonstrate similar characteristics from a purely technical point of view – with both the DAX 40 & CAC 40 also butting right up against the top of recent trading ranges. Given the broader US to Europe rotation currently taking place, it would be no surprise to see all three of these major European benchmarks end the week at new 12-month highs.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.