When does a margin call and stop out occur?

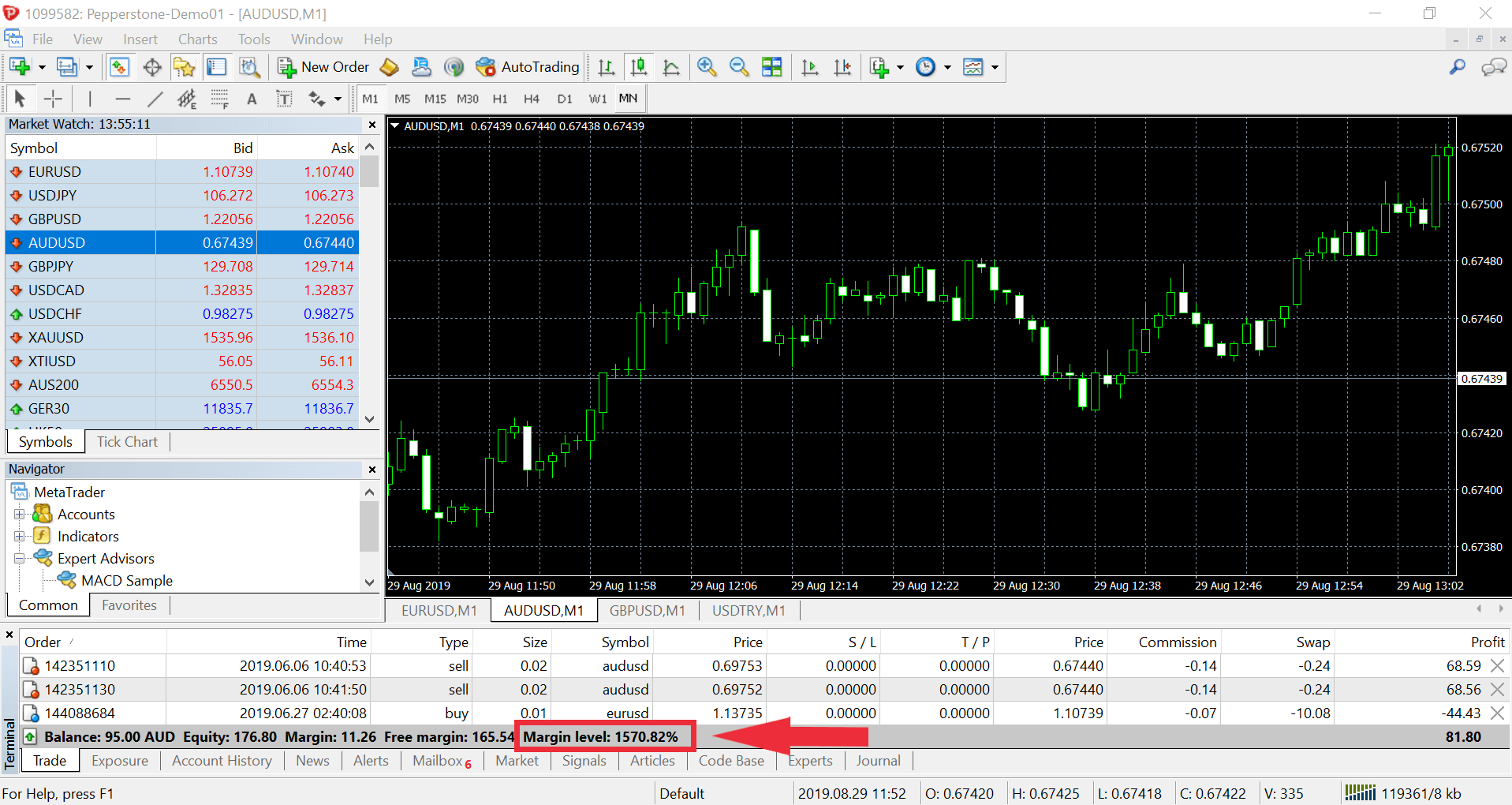

For the MT4/5 platforms a margin call occurs when equity on the account falls below 90% of the margin required for maintaining your positions and an automatic stop out will occur when account equity falls below 50% of the margin required for the trades.

This percentage is constantly calculated and updated on your platform and is called 'margin level'. If your equity (balance plus/minus open profit/loss) falls below 50% of the margin required to maintain the open position(s) they will be automatically closed. This is calculated as follows:

Margin level (equity / margin) = < 90% (margin call warning)

Margin level (equity / margin) = < 50% (stop out) for Retail Clients

Margin level (equity / margin) = < 20% (stop out) for Professional Clients

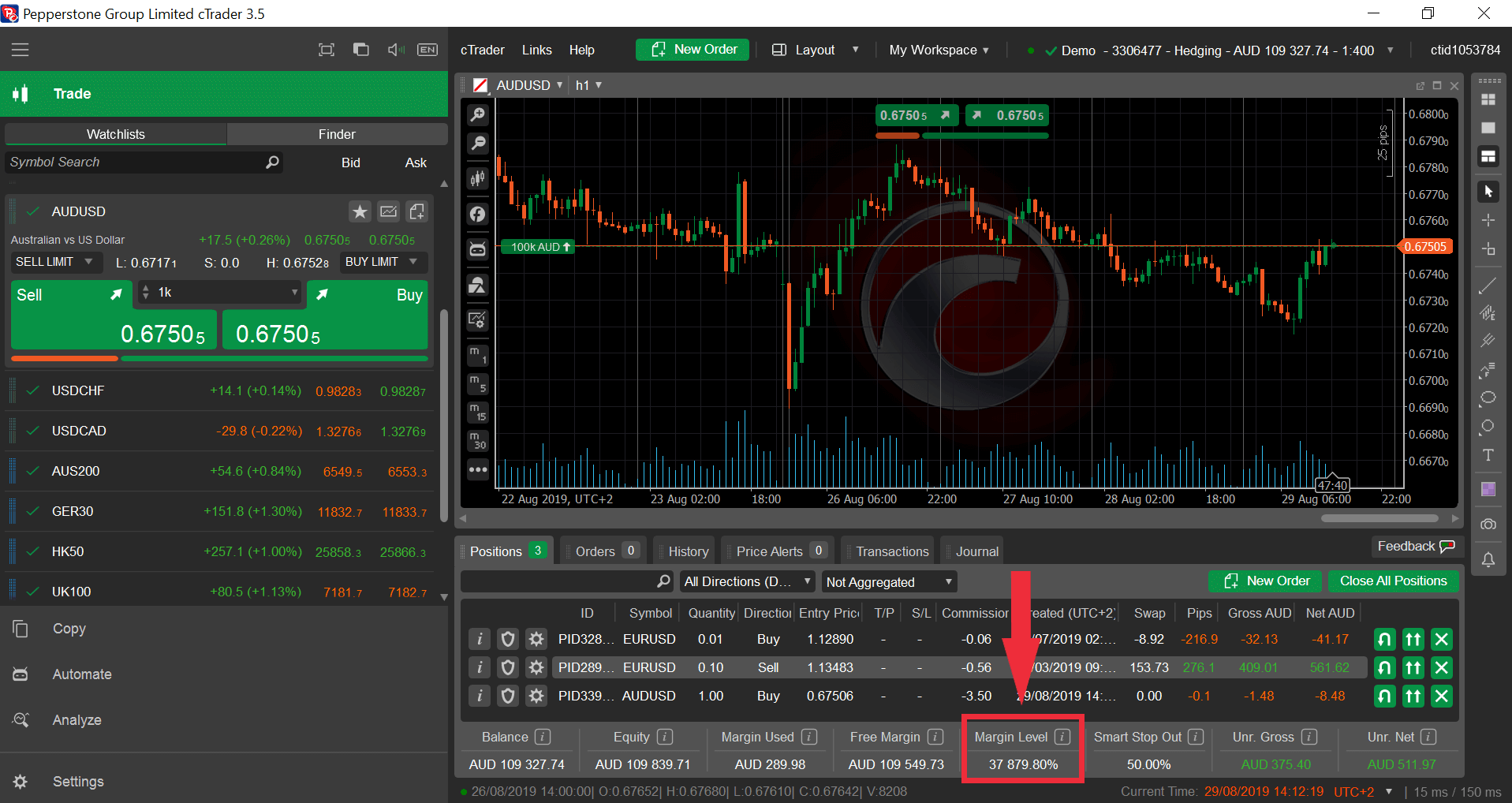

On cTrader, the margin call settings can be adjusted to your preferred margin level but are set by default at 500%, 100% and 80%. Smart stop-outs occur when equity falls below 50% of the margin required for open trades on the account.

Margin level (equity / margin) = < 50% (cTrader stop out)