CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

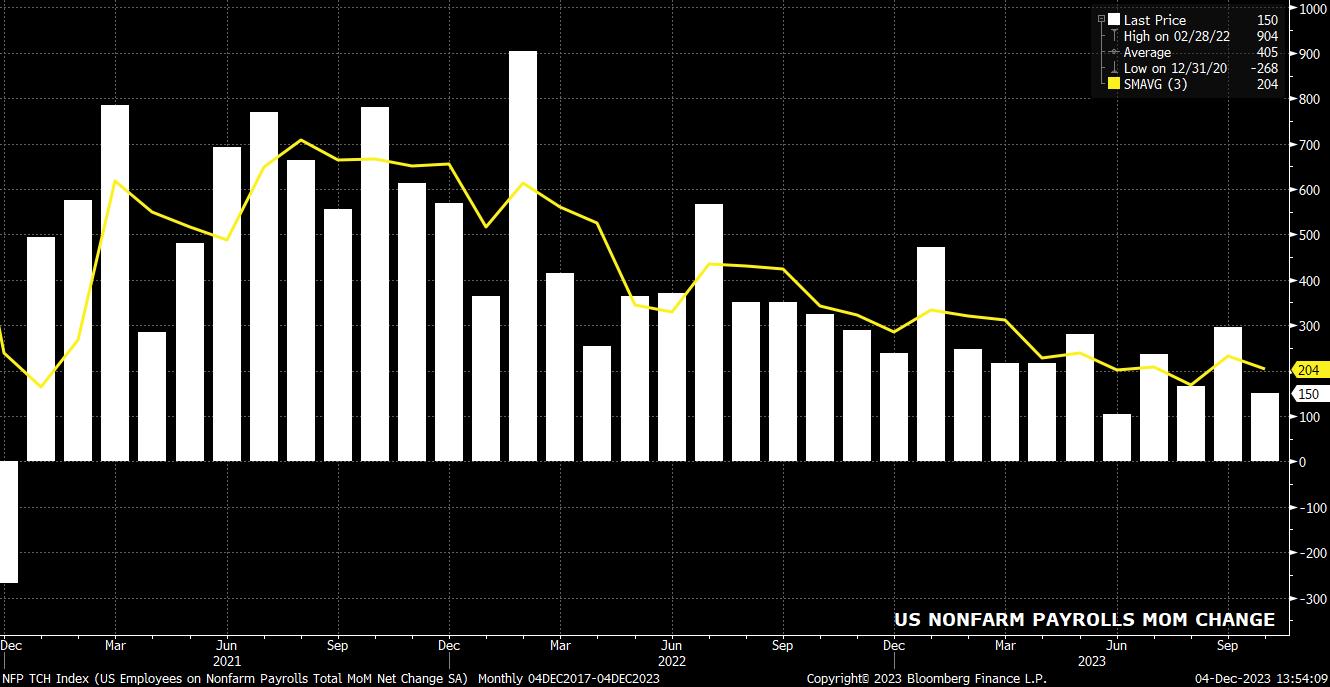

Headline nonfarm payrolls are expected to have increased by 180k in November, a marginal uptick from the 150k pace seen in October, and a pace that is little more than a rounding error below the current 3-month average of job gains, which sits at 204k.

As always, there is a wide range of estimates for the print, between 100k – 240k according to estimates submitted to Bloomberg at the time of writing; I’d argue that a print between around 150k – 210k could be considered as ‘in line’ with expectations, given recent form. Nevertheless, there is perhaps more uncertainty associated with the November NFP print than others in the recent past, with the impact of hiring for Thanksgiving, and the upcoming festive period, often difficult to forecast, along with the return of autoworkers after the resolution of the UAW strikes likely to boost the headline print, at least to some degree.

That said, leading indicators for the print are rather poor, with the employment component of the ISM manufacturing index dipping back below 50 last month – the equivalent services data is due Tuesday – along with continuing jobless claims continuing to rise, touching a near 2-year high in the survey week (that which contains the 12th).

Taken together, this may point towards a notable divergence between the establishment survey (from which the headline NFP print is derived), and the household survey (used to calculate the unemployment rate).

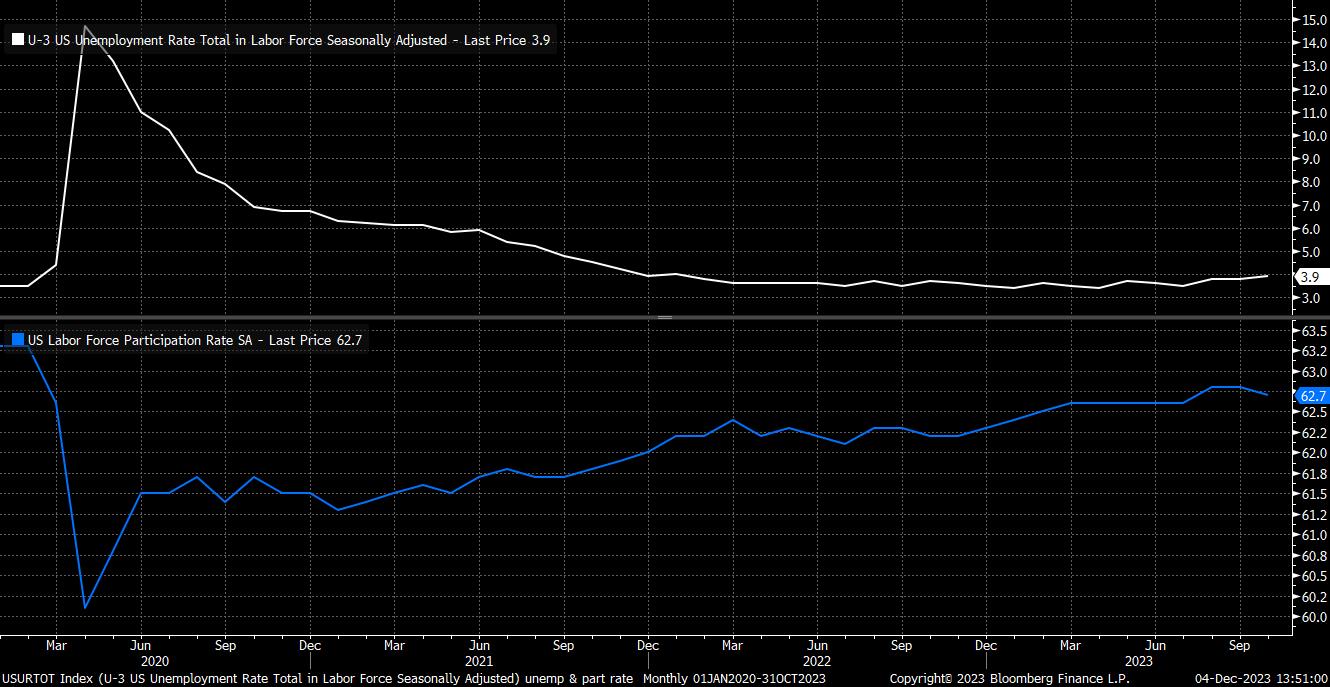

Risks, therefore, to the consensus of unemployment remaining at 3.9% are likely tilted to the upside, with the FOMC’s end-23 unemployment forecast of 3.8% now looking a little at risk. As always, however, the unemployment rate must always be examined in conjunction with the participation rate, set to remain just shy of cycle highs at 62.7%, along with the underemployment rate, which has steadily risen of late to an 18-month high 7.2%.

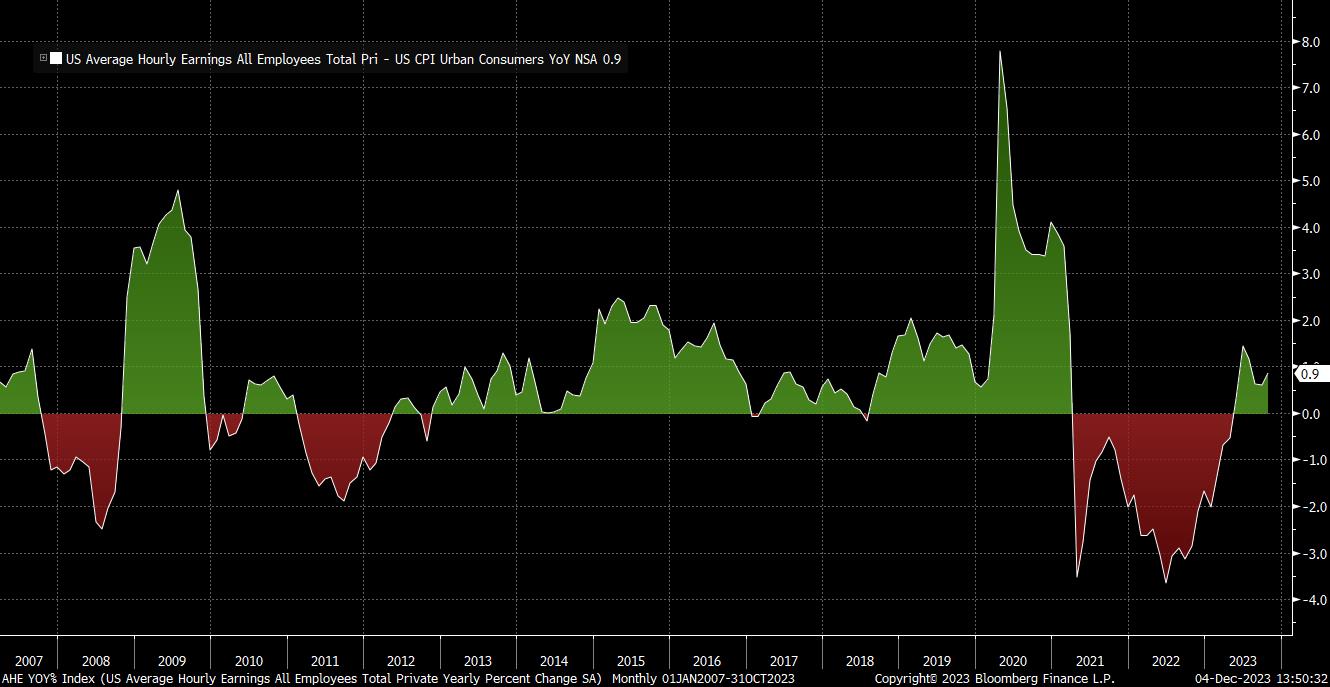

Earnings pressures, meanwhile, are set to remain relatively modest, with average hourly earnings seen rising 0.3% MoM, knocking the annual pace a touch to 4.0%, from 4.1% prior. While such a pace may be a touch too high for comfort among FOMC policymakers, continued real earnings growth should be seen as a positive for the economy, and may in fact help to keep consumer balance sheets in relatively good health throughout much of 2024.

Despite all of this, there are question marks over the impact that the November jobs report is likely to have for monetary policy heading into 2024. It seems unlikely that the data will tell us anything particularly new – either that the steady softening in the labour market that has been underway for half the year is continuing, or said softening has slowed a touch but will likely quicken once more as the lagged impacts of the FOMC’s tightening campaign continue to bite.

One must also consider market pricing, where futures imply over 125bp of Fed cuts being anticipated next year, with the first such cut fully priced for next May – clearly, a very aggressive pace, particularly with all major measures of inflation remaining substantially above the 2% target.

While this pricing should be looked at not as a pre-set policy path, and instead seen as a representation of the distribution of probabilities associated with the economy over the next 12 months, the bar for a further significant dovish repricing seems a relatively high one, even if the data were to miss expectations. The bar for a more hawkish repricing also seems rather high, especially considering the continued disinflation seen in the US economy.

Consequently, it may well be the case that the market implications of the NFP print are relatively limited, particularly when one considers the typically light volumes and thin liquidity associated with this time of year. Barring any knee-jerk move over the release itself, then, it seems unlikely that the jobs report will derail markets from what is becoming a well-embedded ‘path of least resistance’ – softer USD, higher equities/gold/crypto, and lower Treasury yields.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.