- English

- Italiano

- Español

- Français

FX Outlook: What does G20 really change?

Given Trump’s general unpredictability, even if tariffs are delayed, they remain an ongoing threat to Chinese and global growth. So, unless we’re wrong and Trump announces a reduction in tariffs over the weekend, the corresponding rally in the US dollar and improvement in risk appetite will be short-lived. USD/JPY, AUD/USD and other major currencies could receive a lift from a delay in tariffs, but the outlook remains unchanged because delaying additional tariffs isn’t the same as lowering or removing them. China wants more. So, if Trump and Xi clash at the meeting and walk away with no meaningful progress, the bulls are in big trouble because USD/JPY, AUD/USD and other major currencies could crash lower.

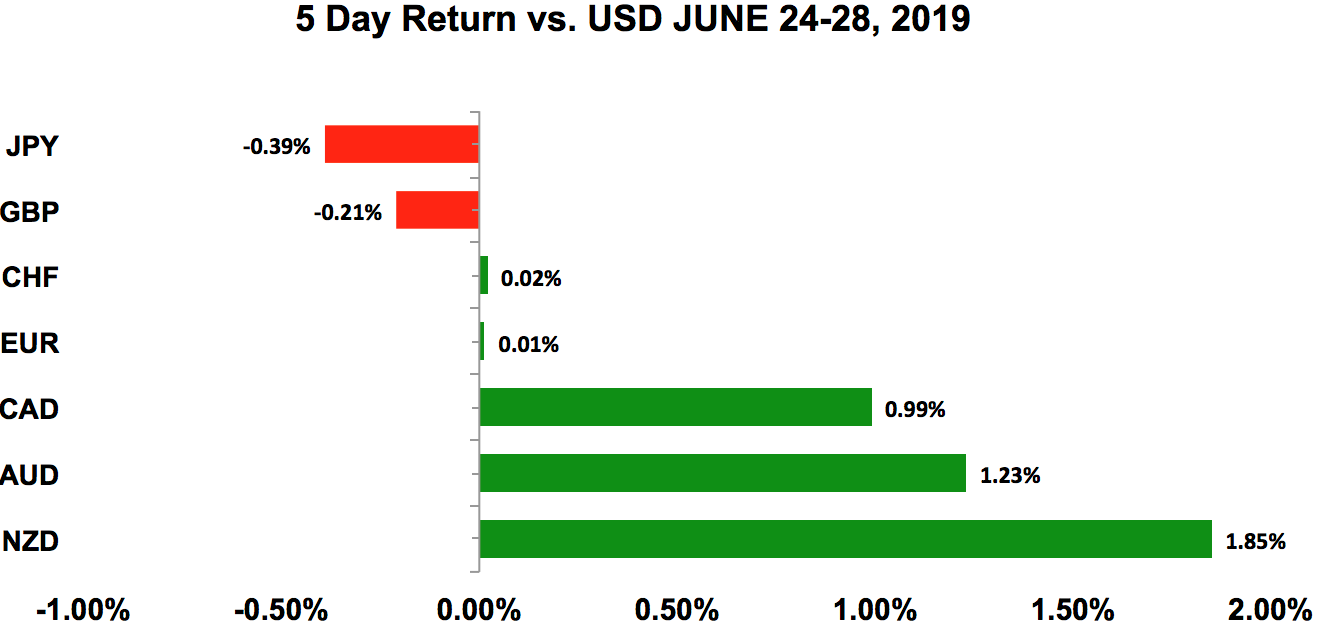

The US dollar rebounded against most of the major currencies last week, with the New Zealand and Australian dollars leading the gains. This price action is consistent with trade-talk optimism, which means the near-term sustainability of their gains in the coming week hinges on whether investors are satisfied with the outcome of G20.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- S&P Case Shiller house prices 0% vs 0.1% expected

- Richmond Fed Index 3 vs 2 expected

- Conference Board consumer confidence 121.5 vs 131 expected

- Durable goods orders -1.3% vs -0.3% expected

- Durable goods orders ex transport 0.3% vs 0.1% expected

- GDP Q1 revised 3.1% vs 3.2% expected

- Trade balance -$74.5bil vs -$71.8bil expected

- Jobless claims 227,000 vs 220,000 expected

- Pending home sales 1.1% vs 1% expected

- Personal income 0.5% vs 0.3% expected

- Personal spending 0.4% vs 0.5% expected

- PCE deflator 0.2% vs 0.2% expected

- Revisions to University of Michigan index 98.2 vs 97.9 prior

Data preview

- ISM manufacturing: likely to be weaker given the decline in manufacturing activity in the New York, Philadelphia and Dallas regions.

- Trade balance: We’ll have to see how the ISM index fares, but trade activity is likely to be softer given broad-based weakness in manufacturing.

- ISM non-manufacturing: The Federal Reserve’s dovishness suggests weakness in manufacturing and service sectors.

- Non-farm payrolls: Fed officials have suggested that NFP will be stronger after last month’s disappointing release.

Key levels

- Support 106.50

- Resistance 108.50

US dollar: time for non-farm payrolls

For the US dollar in particular, the Fed’s plan for monetary policy is more important than G20. Last week, Fed Chairman Jerome Powell said the case for easing has strengthened because trade concerns are up substantially, and the inflation undershoot may be more persistent than they hoped. He’s, however, made it clear that the timing of a rate cut hinges on incoming data and uncertainties. G20 will most likely end with a small reduction in uncertainty, because there’s a very good chance that the US and China will reopen trade talks, easing some immediate concerns for additional tariffs. That leaves incoming data as the main focus, and there are a lot of economic reports scheduled for release this week — manufacturing and non-manufacturing ISMs on the calendar, along with the June non-farm payrolls report.

How quickly the Fed lowers interest rates hinges entirely on this Friday’s jobs report. Last month’s release was surprisingly weak with only 75,000 jobs created in April against a forecast for 180,000. It was one of the first signs of slower growth in the economy. According to Fed President James Bullard, jobs should rebound, but the key is how much. Economists are looking for non-farm payrolls to rise by approximately 163,000, which is still modest but, if met, will boost the dollar and pare expectations for an immediate cut. If, however, payrolls rise by less than 125,000, then expectations for a July cut will rise, causing USD/JPY to sink.

Yet, regardless of how strong the NFP report is, the most important thing to remember is that a rate cut this year cannot be ruled out. The Federal Reserve put it on the table with the expectation that job growth will rebound in June, and many policymakers view a move as an “insurance rate cut” and not a necessary step to turn the economy around.

AUD, NZD and CAD

Data review

Australia

- No data

New Zealand

- RBNZ leaves interest rates unchanged at 1.5% and talks of more easing

- Credit card spending 6.6% vs 4.5% prior

- Trade balance 264,000 vs 250mil expected

- ANZ Business Confidence -38.1 vs -32 previous

- ANZ Consumer Confidence 2.8% vs -3.2% previous

Canada

- Wholesale sales 1.7% vs 0.2% expected

- GDP MoM 0.3% vs 0.2% expected

- GDP YoY 1.5% vs 1.6% expected

Data preview

Australia

- RBA is expected to cut interest rates again, but it’s a close call and their guidance is key

- PMI manufacturing: Given the slowdown in China’s economy and the RBA’s rate cut, manufacturing activity should have slowed, too.

- PMI services: Given the slowdown in China’s economy and the RBA’s rate cut, services activity should have also slowed.

- Building approvals and trade balance: Trade activity is likely to be weaker given slowdown in China and Australia’s economy.

- Retail sales: Rebound is expected given the strong labour market, but we’ll have to see how services sector fares.

New Zealand

- No major economic reports

Canada

- Trade balance: potential upside surprise given improvement in the internals of last month’s IVEY PMI.

- Employment report: Labour market has been very strong, but eventually job growth will have to slow.

- IVEY PMI Index: potential downside surprise because, given the slowdown in the global economy, Canada’s manufacturing sector is bound to be hit by softer demand.

Key levels

- Support AUD .6950; NZD .6650; CAD 1.3050

- Resistance AUD .7050; NZD .6750; CAD 1.3250

RBA: back-to-back rate cuts, then what?

Commodity currencies have been on a tear, with the New Zealand dollar leading the gains. What’s remarkable about the recent moves in the Aussie and the Kiwi is that they’re rallying despite the firmly dovish biases of their central banks. AUD/USD rose eight out of the last nine trading days. But the move in NZD/USD was even stronger, with the pair hitting a three-month high after rising for nine straight days. The Reserve Bank of Australia cut interest rates in May, and is widely expected to lower rates again this week. A move is largely discounted, so the primary question is: What happens next? Do they shift from dovish to neutral bias, or they leave the door open to additional easing? Judging from the price action of the Australian dollar, investors don’t expect the RBA to be excessively dovish because the market is only looking for one more move from the central bank this year.

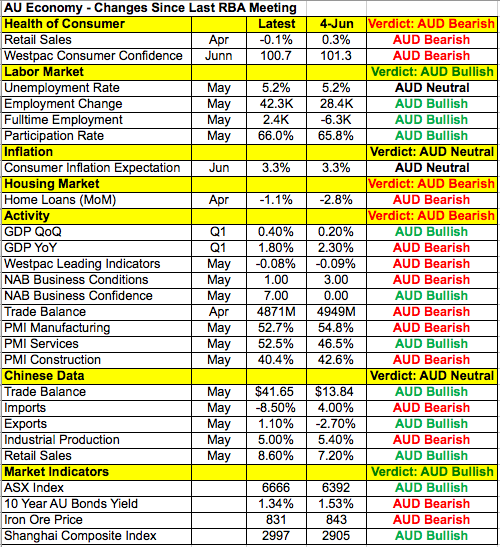

At the start of last week, RBA Governor Philip Lowe openly mused about the effectiveness of more rate cuts if “everyone is easing.” This is an awkward comment, because, while it may be true that contemporaneous reduction in rates could result in exchange rate parity, lower borrowing costs goes a long way in helping businesses and consumers domestically. According to the table below, the RBA could wait for more evidence before easing. Retail sales and manufacturing activity are weak, but the labour market is strong and activity in the service sector growing. So, if the RBA cuts and indicates that it’s satisfied with the moves taken so far, AUD/USD could extend to 71 cents. If they keep rates unchanged, the rally could be even stronger. However, if they cut and suggest that rates could go even lower, we’ll see a sharp reversal that could drive AUD/USD below 69 cents.

The New Zealand dollar rallied despite the Reserve Bank’s worries. While they left interest rates unchanged last week, the RBNZ said lower interest rates may be needed given the downside risks. They felt that the global economic outlook has weakened, and there’s risk of ongoing subdued domestic demand. Softer house prices could also dampen spending, while uncertainty weighs on business investment. NZD/USD fell immediately after the rate decision but recovered in a matter of minutes. The only reasonable explanation for this reaction is that the RBNZ didn’t signal an immediate cut. Interest rate futures are pricing in a 66% chance of a cut in August, and 79% chance in September, which is not much different from the week prior. All of this allowed the market to focus on G20 and the possibility of a positive turn in trade relations.

The Canadian dollar is trading at its strongest level against the US dollar since October. There are no shortages of factors driving the loonie higher from risk appetite, US dollar weakness, trade talk optimism, rising oil prices, and the general robustness of Canada’s economy. GDP growth beat expectations while wholesale sales rose strongly. Canada can’t be immune to slower global growth forever. This will be a busy week for Canada with trade, employment and IVEY PMI numbers scheduled for release. If any one of these reports surprises to the downside in a meaningful way, we could see a nasty short squeeze in USD/CAD.

EURO

Data review

- German IFO business climate 97.4 vs 97.4 expected

- German IFO expectations 94.2 vs 94.6 expected

- German IFO current assessment 100.8 vs 100.3 expected

- EZ economic confidence 103.3 vs 104.8 expected

- German CPI 0.3% vs 0.2% expected

- German CPI YoY 1.6% vs 1.4% expected

- EZ CPI Core YoY 1.1% vs 1% expected

- EZ CPI estimate YoY 1.2% vs 1.2% expected

Data preview

- German employment report: PMIs report strong labour market conditions. Job growth rose for a record 68th straight month, and job creation was stronger than long-run series but unchanged from May’s three-year low.

- EZ PMI revisions: Revisions to PMIs are difficult to predict, but changes can be market-moving.

- EZ PPI: potential downside surprise given lower German PPI

- EZ retail sales: will have to see how German retail sales fares

Key levels

- Support 1.1300

- Resistance 1.1400

Euro: itching for a breakout

Unlike most of the other major currencies, euro didn’t participate in the broader risk rally. Instead, the currency consolidated in a tight 60-pip range. The latest economic reports weren’t terrible — German business confidence eased slightly, but the current assessment component increased. Inflation also ticked higher. However, with the European Central Bank talking about easing, and President Trump criticising Germany for being a security freeloader, investors have been reluctant buyers of euros. Outside of Germany’s labour market report, there’s very little market-moving data from the eurozone this week. So, while the euro is itching for a breakout, the move will only happen on the back of the market’s appetite for risk or the US dollar. The eurozone economy is weak, but if investors are satisfied with US-China trade talks, EUR/USD could hit 1.15. If risk appetite turns into risk aversion, on the other hand, EUR/USD could drop below 1.13.

BRITISH POUND

Data review

- CBI distributive sales -42 vs -5 expected

- GfK consumer confidence -13 vs -11 expected

- Q1 GDP revisions 0.5% vs 0.5% expected

Data preview

- PMI manufacturing: potential downside surprise given sharp drop in Confederation of British Industry index

- PMI services: potential downside surprise given ongoing Brexit drag

- PMI composite: PMI manufacturing and PMI services report will tell us how the composite index will fare.

Key levels

- Support 1.2650

- Resistance 1.2850

Ongoing Brexit uncertainty keeps pressure on sterling

Sterling also struggled to extend its gains. But unlike the euro, the few pieces of data released last week were very weak. The Confederation of British Industry’s distributive sales survey dropped to its lowest level since 2009. This isn’t a closely followed report, but it has a strong correlation with the broader retail sales index. So, when combined with the drop in consumer confidence, we have reasons to believe that spending contracted for the second month in a row. All three PMIs are scheduled for release this week, and the risk is to the downside.

Ongoing Brexit uncertainty discourages business investment, which comes at a bad time because global growth is slowing. On the political front, the Tories are still whittling down their candidates, but Boris Johnson is the most likely choice. Investors don’t seem all that pleased because he supports a no-deal Brexit. Johnson claims that the majority of Parliament supports this option, but that’s highly unlikely. The scariest part of all this is that, while most of Parliament opposes rather than supports no-deal, Johnson refuses to rule out proroguing (a tactic that involves suspending) Parliament to force through a no-deal exit. He’s already in the process of preparing an emergency budget plan to support the economy in the event of a no-deal exit from the European Union.

With only four months to go before the UK is scheduled to leave the EU, investors are becoming increasingly aware of how fast the clock is ticking.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.