- English

- Italiano

- Español

- Français

Week Ahead Playbook: Tariff Threats Dominate With Busy Data Week Ahead

The Week That Was – Themes

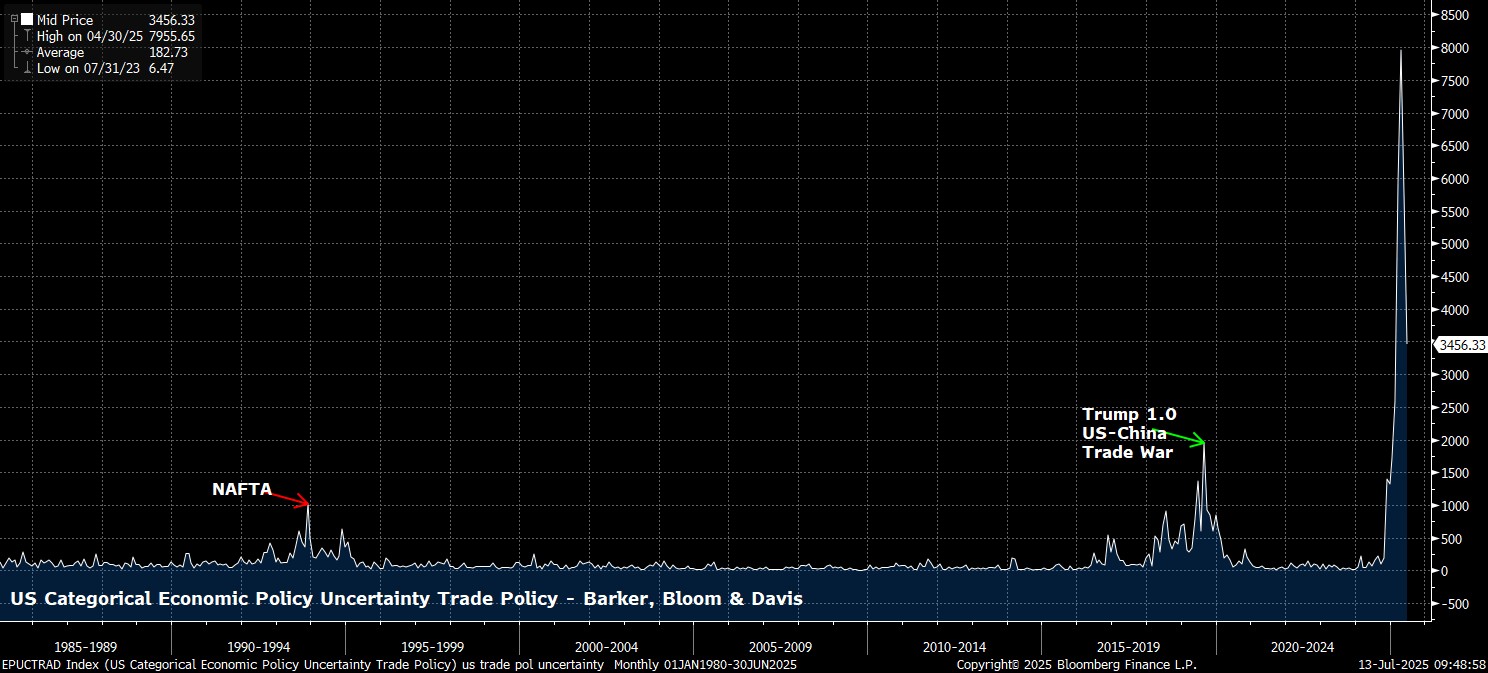

Tariffs were again the main theme of the week, as the deadline for the expiration of the pause on ‘Liberation Day’ tariffs was extended, albeit while President Trump decided to set fresh tariff rates for a host of US trading partners, effective 1st August.

These new rates appear to have been determined by a random number generator, with some above, and some below, the initial levels set at the start of April. Of note, Japan and South Korea have been slapped with a 25% levy, Mexico and the EU a 30% tariff, Canada a 35% duty, and Brazil with a whopping 50% fee. Setting aside this latter level, which seems more politically-motivated than anything else, when these higher tariff rates are coupled with the 3-week deadline extension, it all seems to be setting us up for another example of the ‘escalate to de-escalate’ (aka TACO) strategy with which all market participants have now become incredibly familiar.

The issue of sectoral tariffs, however, is a much more complex one, and has also shot back to the forefront of participants’ minds over the last week, after the announcement of a 50% levy on copper imports. This, clearly, is less likely to be a negotiating gambit, though there remains the potential for carve-outs from this tariff to be agreed in all of the various country-by-country negotiations which are still ongoing.

That said, taking things as they are right now, with just 2 (UK & Vietnam) trade deals having been agreed, the average effective tariff rate is, in three weeks, due to return to the mid-high teens % seen during that turmoil in early April. Participants sanguine tone about this is pretty clear evidence that there is no belief these tariffs will ultimately come to pass which, given recent form from the Oval Office, seems like a logical bet to me.

All of this tariff uncertainty, though, continues to have real-world economic impacts, even if last week’s data docket was rather devoid of anything especially interesting.

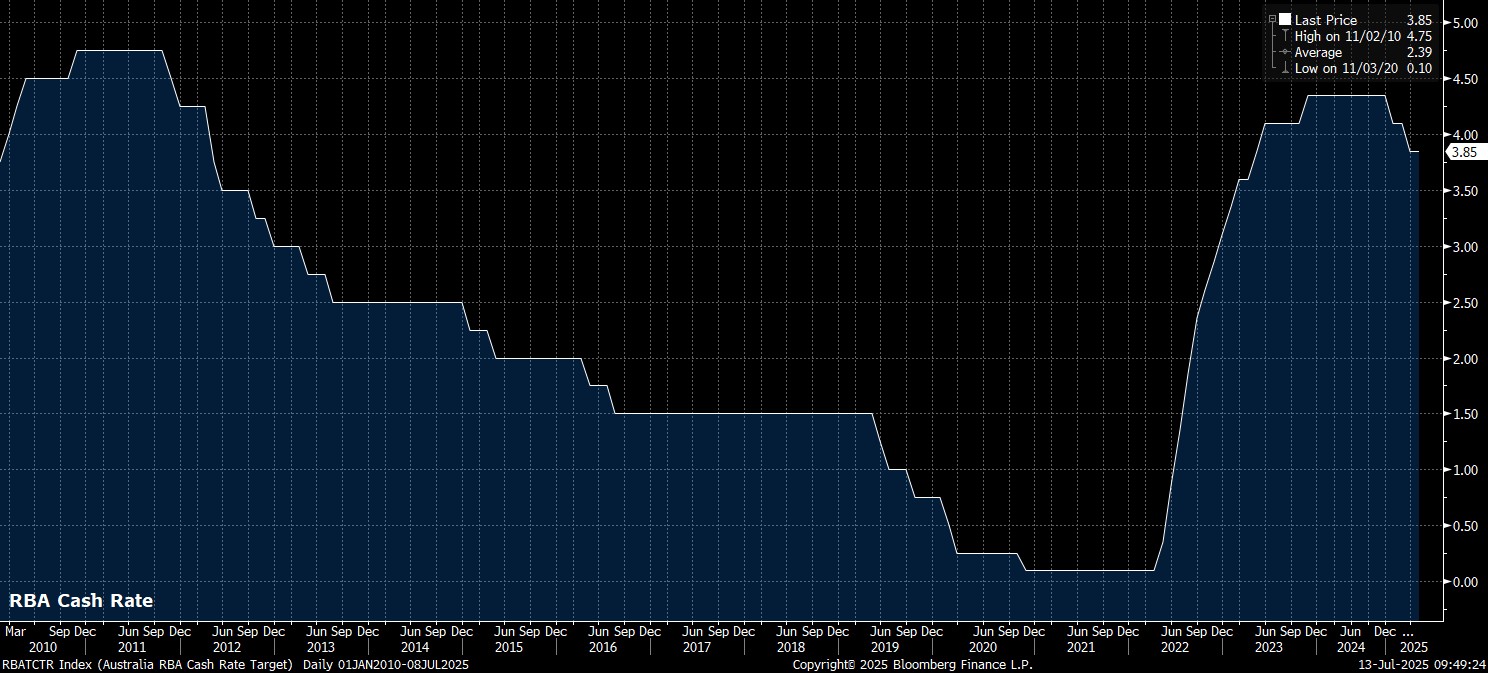

We did, though, see both the RBA and RBNZ hold rates steady, the former in what proved to be a hawkish surprise, defying expectations for a 25bp rate cut. That, though, is more a case of cuts ‘delayed’ than being scrapped entirely, with the RBA simply wanting to wait for further confidence in the disinflationary outlook, likely after receiving the Q2 CPI report, before pulling the trigger on another rate reduction.

Stateside, Fedspeak was surprisingly subdued, though the release of minutes from the June meeting brought little by way of surprises. ‘Most’ participants were said to see a risk of tariffs having a persistent upwards impact on inflation, while ‘a couple’ of members reportedly saw the case for a rate cut at the next meeting later this month. These two are, quiet obviously, Governors Bowman and Waller, who have said as much in recent remarks, even if the solid June jobs report released a week or so ago has killed the chances of any easing before the summer is out.

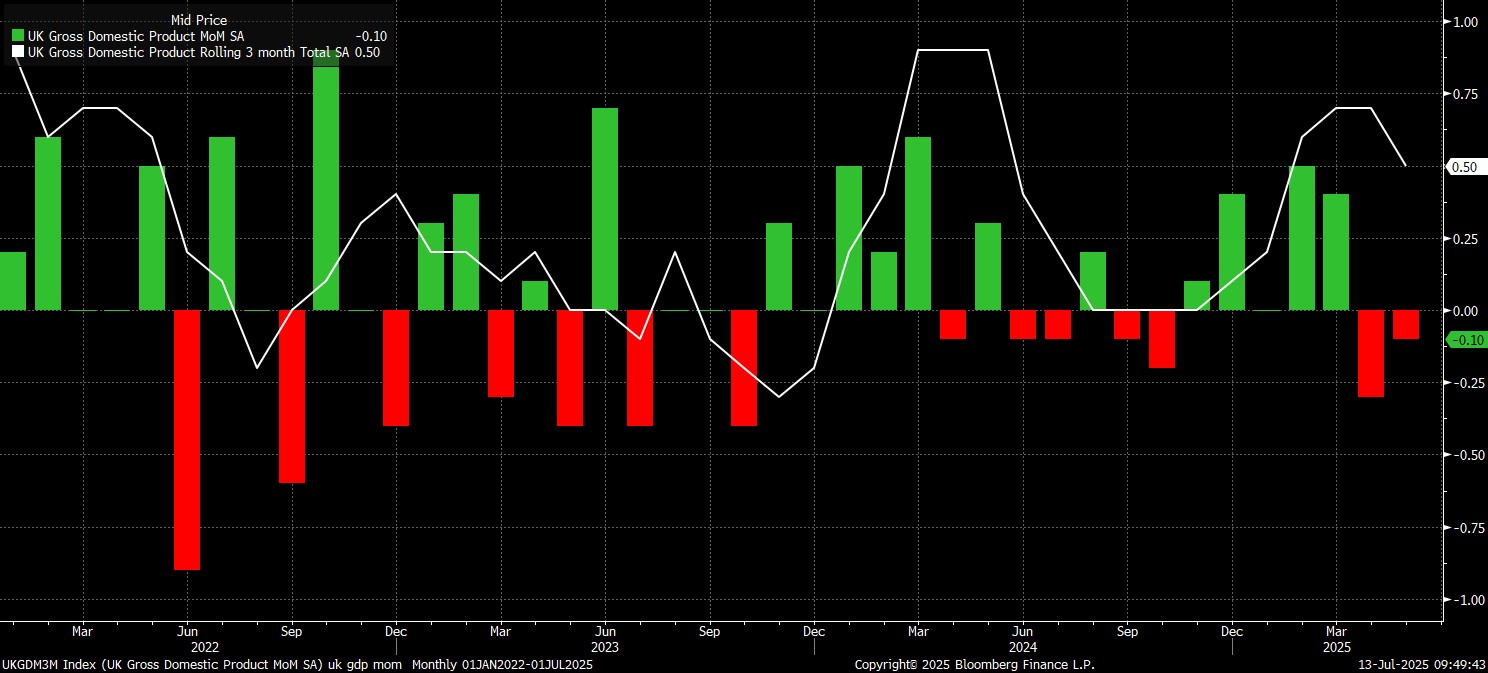

On this side of the pond, Chancellor Reeves received further unwelcome news, not only amid the OBR forecasting a debt/GDP ratio north of 270% within the next half a century, but also after the economy unexpectedly contracted for a second straight month in May.

While the monthly GDP data is incredibly noisy, when working with as thin margins as the Chancellor currently is against her fiscal rules, any downside growth surprises, no matter how small, will have a significant impact in terms of increasing the degree of revenue raising measures (aka tax hikes) required in the autumn Budget. It’s still too early to have seen any of the traditional pre-Budget trial balloons just yet, the fact remains that Reeves is stuck between backbench MPs who will reject spending cuts on one side, and a Gilt market incredibly sceptical of tax hikes on the other. Her tenure, hence, is still very much on borrowed time.

Elsewhere, news-flow out of the eurozone was relatively thin on the ground, even if ECB President Lagarde, and most of her colleagues, continue to tell everyone that will listen policy is in a ‘good place’. Further cuts, hence, are probably off the cards, though at least one 25bp reduction could come in the autumn, if policymakers seek to tamp down on EUR strength.

That’s also starting to become more of a theme in APAC, where sources suggest that the PBoC have been probing recent USD weakness, seemingly getting rather jittery over the recent CNY/H strengthening. Given that spot hasn’t even traded below 7 yet, those worries seem somewhat premature, though also cast further doubt on the idea of any mutual Sino-US FX pact being agreed any time soon.

The Week That Was – Markets

We’ll return to FX momentarily, but begin with equities, which saw divergent fortunes on each side of the Atlantic.

On Wall Street, benchmarks notched their first loss in three weeks, though both the S&P 500 and Nasdaq 100 ended in the red by less than 0.5%, hardly a move worth worrying about. Some of this downside may have been a little de-risking into Q2 earnings season, which gets underway this week, though the longer-run path of least resistance continues to lead to the upside, with both earnings and economic growth remaining solid, and as the direction of travel on trade still seems to be one towards deals, and further negotiations taking place.

Here in Europe, there was green on the screen everywhere one looked, with the DAX rallying back above the 24,000 mark, and the FTSE 100 notching fresh all-time highs, closing in on 9,000 for the first time ever.

To be clear, this latter milestone is no reflection of a sudden burst of positivity when it comes to UK Plc, and is much more a function of a weaker GBP helping to propel the FTSE higher. Nevertheless, at this stage, we’ll take any good news that we can get here in the City!

_Dail_2025-07-13_09-50-15.jpg)

Speaking of the pound, that GBP weakness was not based on any idiosyncratic factors, and was much more so a reflection of the broad-based USD demand which has dominated the last week or so of trade in the G10 FX complex.

The dollar index (DXY) notched its best week since mid-May last month, around the time of the US-China trade truce being struck, as well as its first weekly gain in three, reclaiming the 98 figure in the process. Naturally, this leads to the question of whether this is the beginning of a change in the dollar’s trend, though I very much doubt that, particularly with the erratic nature of tariff-related decision-making serving to only further strengthen the case for capital outflows from the greenback over the medium-term.

Weakness at the long-end of the Treasury curve, with benchmark 30-year yields rising almost 10bp on the week, also provided a helping hand to the greenback, with this move seemingly driven by a repricing higher of inflation expectations amid the aforementioned tariff letters being sent to countries around the world.

We remain, though, within very familiar ranges across the curve, with benchmark 10-year yields still capped at 4.50%, and benchmark 30-year yields still capped at 5.00%. Both of these regions have proved very attractive for dip buyers in recent weeks, and I’d expect them to remain so, even if the scope for prolonged Treasury upside is somewhat limited given ongoing worries over the US economy’s unsustainable fiscal trajectory.

Those jitters, combined with capital outflows from the buck, mean that the investment case for gold remains a solid one. The yellow metal held above $3,300/oz last week, though remains in a relatively tight trading range. The path of least resistance does still lead higher, though, possibly back towards fresh record highs before the year is out.

_D_2025-07-13_09-51-13.jpg)

Finally, crude also had a solid week, with Brent reclaiming $70bbl for the first time since the Israel-Iran ceasefire was agreed a fortnight or so ago. Though this 3% weekly gain was rather punchy, there seems little by way of fundamental factors to be driving crude upside here, especially with OPEC+ still fully engaged in a war for market share, and with Saudi pumping well above their OPEC+ quota last month. This massively over-supplied market, coupled with a dismal demand outlook, leads to the obvious conclusion that the recent gains are potentially built on sand.

The Week Ahead

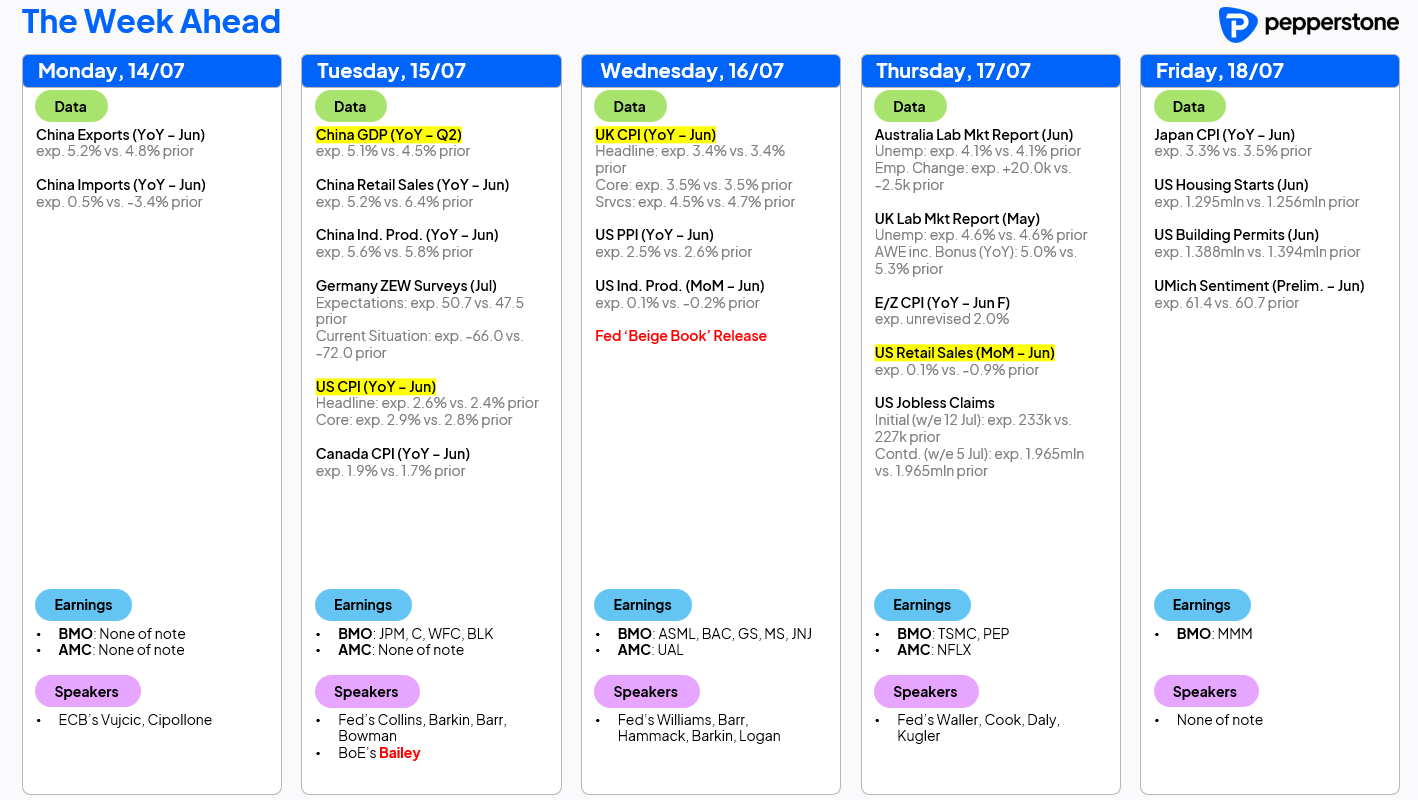

A much busier data docket awaits this week, with plenty of tier-one prints scheduled, and with Q2 earnings season set to get underway.

The latest US CPI figures are the most obvious highlight, with the June report set to show the initial signs of tariff-induced price pressures beginning to emerge. Headline prices are set to have risen by 2.6% YoY, while core inflation is seen ticking 0.1pp higher to 2.9% YoY, both increases which will likely set the tone for a further rise in headline inflation through the summer months, as inventories are drawn down, and firms are left with little choice to pass on higher costs to the end-consumer. Helpfully, we will also get an update on consumer spending this week, with retail sales set to have risen 0.1% MoM last month. I am reminded, here, of the old adage that one should ‘never bet against the US consumer’.

Closer to home, the latest UK inflation figures are also due, though must be taken with a bit of a pinch of salt, given ongoing data issues at the ONS. Headline CPI is set to have held steady at 3.4% YoY last month, though the closely-watched services CPI metric is expected to dip 0.2pp to 4.5% YoY, perhaps reducing some concern about the risks of persistent price pressures becoming embedded within the economy. Those concerns, as I’ve written at some length, seem rather misplaced anyway, especially given the speed at which the labour market is loosening. Unemployment is set to have held steady at 4.6% in the three months to May, though a further substantial decline in payrolled employees is likely, as the impacts of higher employer National Insurance contributions continue to bite.

Elsewhere, this week, a deluge of data is due from China, which needs an even bigger pinch of salt than the UK figures! GDP is set to have grown by 5.1% YoY in the second quarter, though there will be a drag here from lower net exports as the impacts of tariff front-running continue to fade. The latest retail sales and industrial production figures are also due, with the US also providing an update on industrial production this week. Besides that, Aussie jobs figures, and preliminary UMich consumer sentiment stats, may be worth a look as well.

On the policy front, no G10 central bank decisions are due, though FOMC members more than make up for that with not only a deluge of scheduled remarks, but also the release of the ‘Beige Book’ containing anecdotal evidence on the performance of the UK economy. BoE Governor Bailey, meanwhile, is due to give the annual Mansion House speech on Tuesday night.

Lastly, earnings season gets underway this week. The major Wall Street banks kick things off on both Tuesday and Wednesday, before focus moves to market darling Netflix after the close on Thursday, and classic bellwether name 3M on Friday. Per Factset, overall S&P 500 earnings growth should be just shy of 5% YoY in Q2, the eighth consecutive quarter of growth, but if realised, also the slowest quarterly growth rate since the tail end of 2023.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.