- English

- Italiano

- Español

- Français

Week Ahead Playbook: Stocks Jump But Dollar Stays Unloved As Tariff Deadline Looms

The Week That Was – Themes

Despite being a holiday-shortened week, with the US out on Friday for Independence Day, there certainly wasn’t a shortage of catalysts for participants to get their teeth into.

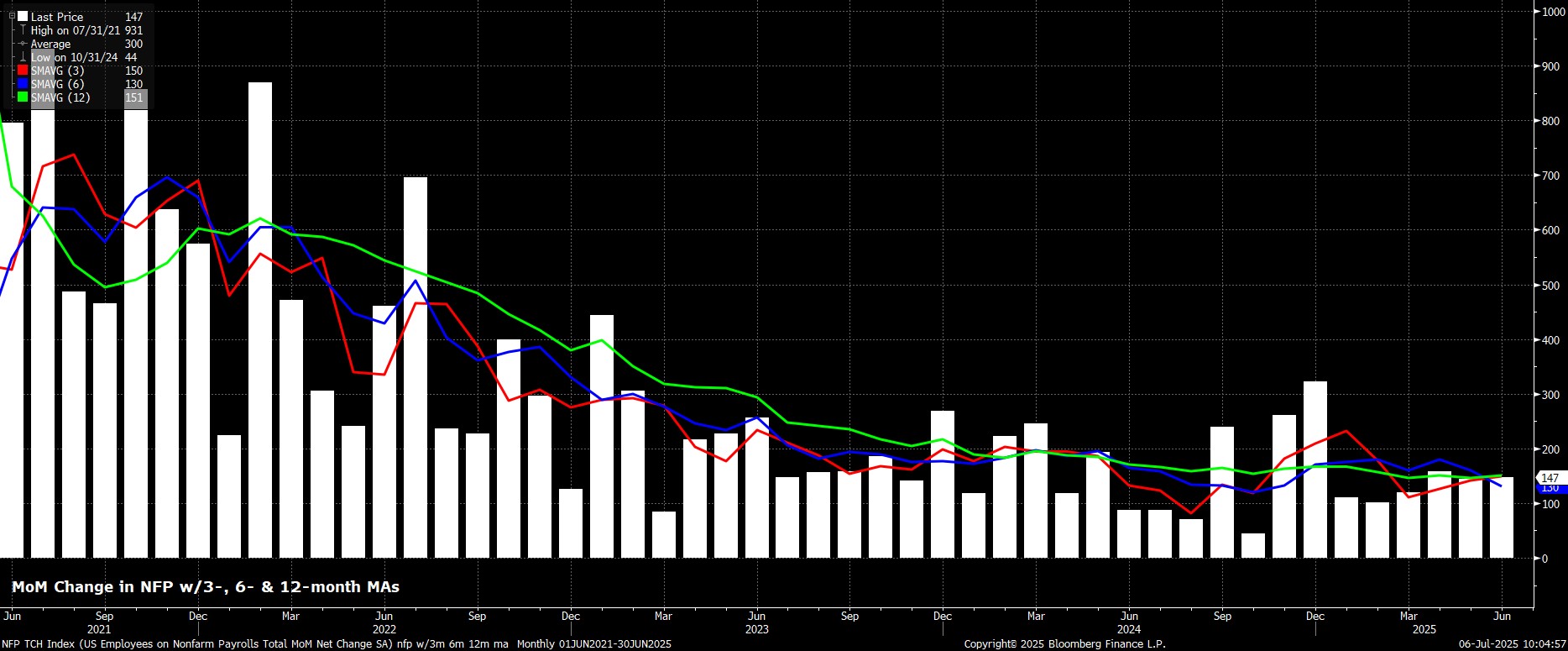

A solid June US jobs report is the obvious standout, with the economy having added an above-consensus +147k jobs last month which, coupled with a net +16k revision to the prior two prints, takes the 3-month moving average of jobs gains to +150k, considerably above the breakeven pace.

Other parts of the jobs report were similarly solid, and painted a goldilocks-esque picture of the employment backdrop – average earnings rose 0.2% MoM, solidifying the FOMC’s view that the labour market isn’t a source of significant upside inflation risks; while, unemployment declined to 4.1%, bucking expectations for an 0.1pp tick higher. The only blot on the copybook here was aa decline in labour force participation, to a cycle low 62.3%, though this was largely, if not entirely, driven by a significant rise in immigration enforcement during the month.

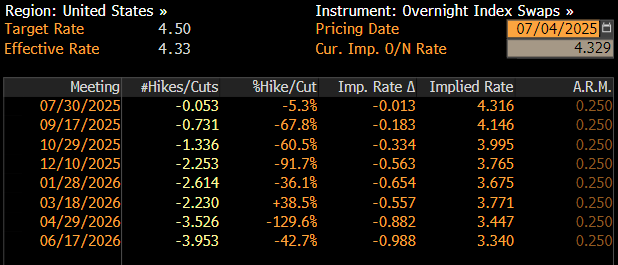

In any case, that impressive slate of data once again points to a labour market where the pace of hiring continues to moderate, but the pace of firing remains well-contained. In other words, things are ticking along ok. Clearly, the report doesn’t scream that rate cuts are required, and money markets reacted appropriately, now discounting just a 5% chance of a July Fed cut, down from about 25% pre-NFP. Solid beats on last week’s ISM manufacturing and services surveys also helped this dovish repricing on its way.

I continue to see two plausible paths for Fed policy over the remainder of the year. If upside inflation risks, primarily stemming from tariffs, do not feed through into price metrics over the summer, Chair Powell will likely use the Jackson Hole Symposium to stage a policy pivot, before delivering 25bp cuts in both September, and December. On the other hand, my base case is that those price pressures do make themselves known, necessitating that the present ‘wait and see’ approach is maintained, and leading to just one 25bp cut this year, in December.

Obviously, all of this is too slow for President Trump, and his acolytes, who continued their rather ridiculous attacks on Chair Powell last week. How anyone can hope to be taken seriously by simultaneously claiming that ~150k jobs being added to the economy is evidence of things going well, yet also calling for 300bp of rate cuts, is beyond me!

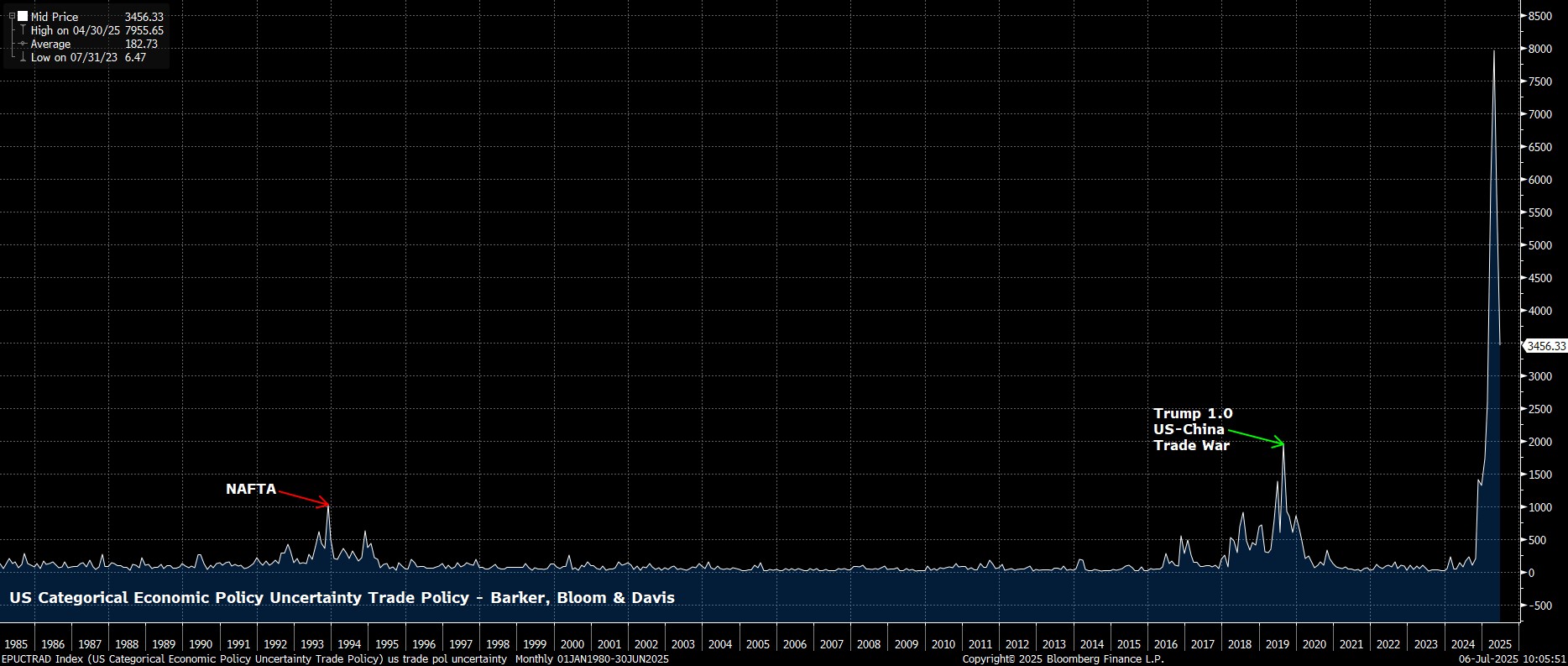

Also obviously, the Fed are in this ‘wait and see’ stance owing to the Admin’s trade and tariff policies, which will likely result in significant price pressures emerging as those tariff costs are passed onto consumers. While last week brought news of a US-Vietnam trade deal, the fate of other ‘Liberation Day’ tariffs remains unknown, at the time of writing, just days before the pause on said tariffs is set to expire.

That Vietnam deal, though, did provide some hints at what the future US trading landscape may look like. Although n=2, not the ’90 deals in 90 days’ we were promised, it appears that the US views a 10% tariff as the floor, and a 40% tariff as the ceiling, with this latter figure being the levy that will be imposed on ‘trans-shipments’ sent via Vietnam, from another jurisdiction. In any case, we await letters that Trump has promised to send outlining the tariffs that other nations will need to pay, if deals can’t be arranged.

Even these, though, appear to be setting us up for another TACO moment, with the letters not only being sent well before the 9th July pause expiry, but the tariffs in those letters not due to take effect until 1st August. Escalate to de-escalate, bring people to the negotiating table, do a deal, claim the win…we’ve all seen it before by this stage.

I thought I’d seen it all here in the UK too, until that is the Chancellor burst into tears in the Commons at PMQs on Wednesday, after PM Starmer refused to unequivocally back Rachel Reeves to remain in her position. Setting aside any personal reasons that may be behind all this, and although the PM’s spokesperson later clarified that Reeves does retain Starmer’s confidence, the damage to credibility had already been done.

Not by the tears, but by events a day prior, where backbench rebel MPs had forced a series of U-turns from the Government, which had the net result of turning a Bill aimed at reducing welfare spending by £5bln, to one which actually increases it by £0.1bln. Clearly, this further raises the prospects of sizeable tax hikes in the autumn Budget, but also reinforces how this is a government unable to govern, beholden not only to their own MPs, but also to Gilt market participants, as the 20-odd bp surge in the 30-year yield on Wednesday proved.

Reeves remains on borrowed time, although participants are clearly concerned that any replacement would be even more market-unfriendly, and even more likely to re-write the fiscal rules, leading to substantially higher borrowing. If this wasn’t all bad enough, we also had news that the UK’s largest listed company, AstraZeneca, may be seeking to jump ship to New York. The reasons to be long Gilts, or long UK Plc, are dwindling rapidly.

_10_2025-07-06_10-06-22.jpg)

Of course, fiscal instability is not a UK-specific problem, as the folks in Washington DC ably proved last week, passing the ‘One Big Beautiful Bill’ into law. The Bill, which extends the 2017 TCJA tax cuts, also raises the debt ceiling by $5tln, and is also set to increase the deficit by over $3tln, taking us well over 7% in terms of the debt/GDP ratio. Clearly, the Trump Admin have given up on any pretence of fiscal responsibility, and decided that it’s easier to just beg the Fed to cut rates instead.

As noted earlier, not only does data not point to the need for a Fed cut, policymakers have also all reiterated their comfort with a ‘wait and see’ approach, as Chair Powell reiterated at the ECB’s annual conference in Sintra last week. That conference didn’t exactly make waves, though the ECB did get some good news in headline CPI having remained at, or around, the 2% target in June. They, incidentally, are probably done and dusted with rate cuts for the time being, barring any external shocks.

The Week That Was – Markets

As I’ve noted many times in recent weeks, rate cuts are not required for equities to rally further, as last week well-evidenced, with the S&P surging to fresh record highs, along with the Nasdaq 100, despite a hawkish repricing of Fed policy expectations.

The bull case for risk here remains a 3-legged one – strong underlying economic growth, solid earnings growth, and calmer rhetoric on trade leading to deals being made. All three of those remain intact, for the time being, leaving the path of least resistance to continue to lead to the upside, particularly when one considers that record highs tend to beget further record highs, as the bulls solidify their grip on proceedings.

That’s not to say risks aren’t present, though besides the aforementioned tariff deadline/potential TACO moment, the most notable risk on the horizon doesn’t come until mid-month, and the start of Q2 earnings season. A drift higher from now, until then, seems plausible, and in any case dips should continue to be viewed as buying opportunities in the meantime, so long as the aforementioned bull case holds water.

In the Treasury complex, meanwhile, it was a case of weakness across a flatter curve for much of the week, with those moves then exacerbated on Thursday after the jobs report.

Still, the selling pressure in benchmark 10- and 30-year yields simply took us to the midpoint of our recent trading ranges, 4.25% - 4.50% in the former, and 4.75% - 5.00% in the latter. A sustained break in either direction seems unlikely for the time being, particularly as fiscal jitters continue, and as a sizeable week of Treasury supply awaits, both of which are likely to limit the extent, and durability, of any gains for the time being.

Worryingly, for dollar bulls anyway, despite the strong jobs print, and higher yields across the Treasury curve, the greenback simply couldn’t hold a bid, losing ground against all G10 peers, bar the embattled GBP which slumped amid the fiscal shambles mentioned earlier on.

_2025-07-06_10-07-10.jpg)

This, naturally, leads one to question that, if the dollar can’t find and sustain demand on a goldilocks jobs report, when will it? I’m struggling to come up with an answer on that front, especially with the Trump Admin continuing to encourage capital outflows amid seemingly never-ending attacks on economic institutions, and a continued erosion of Fed policy independence. Despite the US economy remaining in good nick, a slow but steady drift lower remains my base case, with the EUR at 1.20 and GBP at 1.40 logical medium-term targets.

Gold also stands to benefit here, with the yellow metal notching its first weekly advance in three last week, reclaiming not only the $3,300/oz handle, but also clambering back above the 50-day moving average. Dip demand is clearly strong here, with organic buying demand from reserve allocators seeking to diversify likely to remain solid as well, likely leading to further gains in the months ahead, and potentially even another assault on the prior ATH at $3,500/oz.

The same can’t be said for crude though which, despite benchmarks trading pretty much flat last week, continues to face stiff headwinds, particularly after weekend news that OPEC+ will be adding an above-expected 550k bpd to the market in August. Clearly, Saudi want to unwind all of the voluntary output cuts as rapidly as possible, adding further barrels to a market that is already massively over-supplied, as focus remains on a war for market share, and on punishing non-compliance with those cuts, as opposed to propping up prices. With demand remaining ropey, the near-term direction for price seems rather obvious – lower.

The Week Ahead

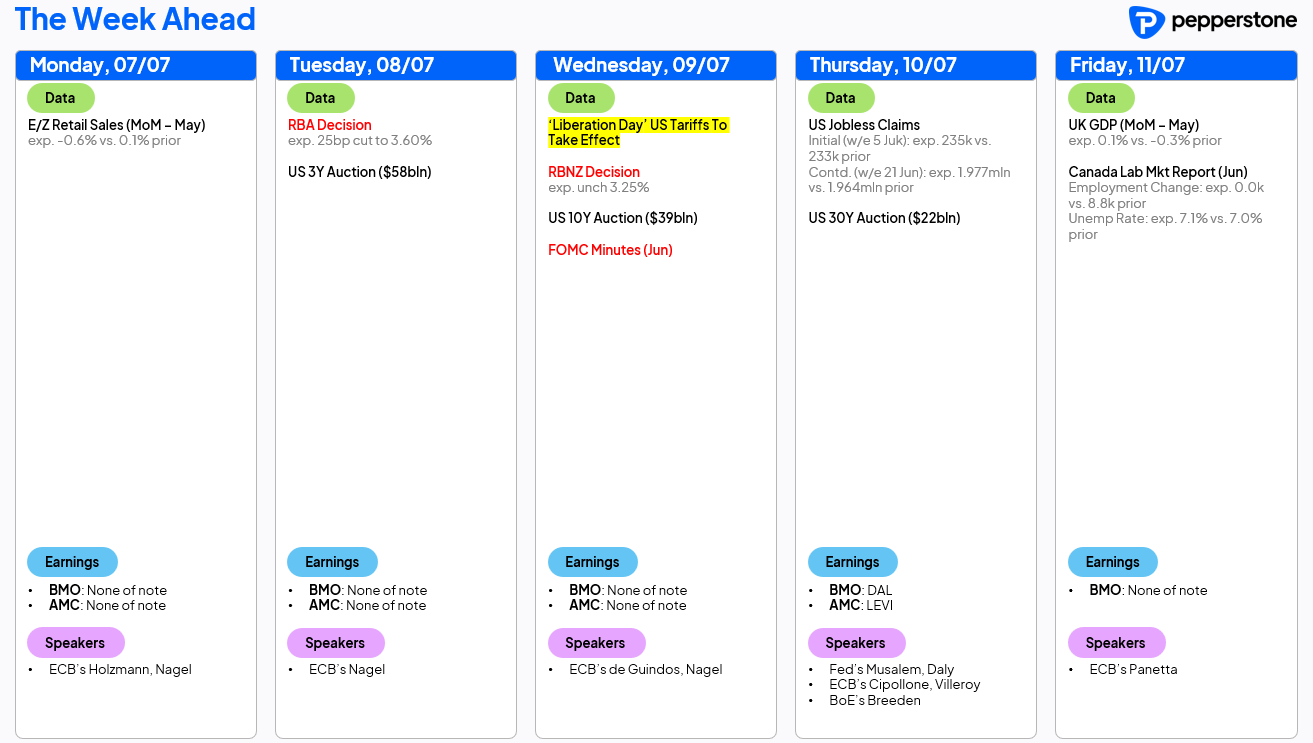

A quick glance at this week’s economic docket, below, leads one to conclude that there isn’t really much for participants to get their teeth into.

That conclusion would, bluntly, be correct, amid a dearth of top-tier data releases, and with relatively little else in terms of scheduled event risk.

Naturally, most attention will hence fall on the issue of trade, ahead of the ‘Liberation Day’ tariffs being due to take effect on Wednesday, although of course the situation remains incredibly fluid. My working assumption remains that we will not see a return to the punitive tariff levels announced in early-April or, if we do, that this will be very short-lived indeed, used only as a negotiating gambit. The Trump Administration have proved, with the China trade truce, that they have no desire, nor ability, to stomach tariffs at a level akin to a trade embargo, and that stance is unlikely to have changed in such a short space of time.

Elsewhere, the RBA will deliver a 25bp cut on Tuesday, while the RBNZ will stand pat the following day. The former remain considerably behind the curve when it comes to the global easing cycle, with further such cuts set to be delivered this year, in September and December based on current market pricing.

Besides that, as noted earlier, a sizeable week of Treasury supply awaits, with most interest likely falling on the 30-year sale on Thursday, where any weakness will naturally reignite fiscal fears, especially after the ‘OBBBA’ was passed last week.

On the data front, there’s little to write home about. UK GDP highlights things, though I use that term very loosely indeed, with monthly GDP data being about as noisy as a heavy metal concert, and the ONS being about as useful as a chocolate teapot. Other than that, Canadian jobs figures, and the weekly US jobless claims report, are about all there is of note.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.