- English

- Italiano

- Español

- Français

The Fed remain hell-bent on seeing price pressures as transitory and the way equity traded Friday suggests the market knows this is a major risk in the making, but one that will cause pockets of volatility and not a sustained drawdown. At this stage the 50-day MA in the S&P 500 could again the level to buy the dip.

The snapback in risk helping small caps to outperform, with the Russell 2k +2.5%, with the NAS100 not too far off. The S&P 500 gained 1.5% and breadth was solid, with 86% of stocks higher. Volumes were on the lighter side and some 11% below the 30-day average in the S&P 500 cash market, with 1.5m S&P 500 futures traded. Volume aside, I see upside this week to equity markets, although this is a market to take the timeframe down and one’s time in the market and duration of exposures for traders will be lower – a higher vol regime is coming there's little doubt in my mind.

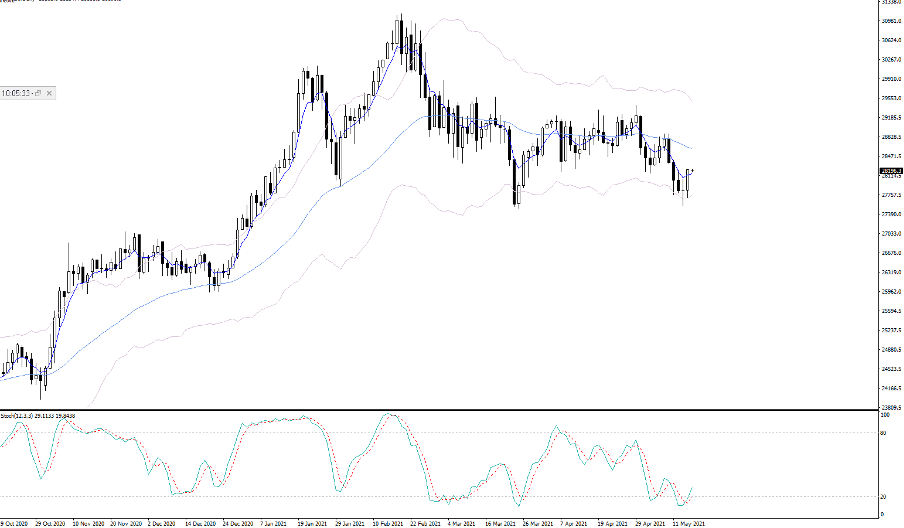

On the stock side, Tesla found some buyers in line with other high beta plays but holds below the 5-day EMA. This week I would be expecting greater interest in some of the Asian plays, with Baidu (tomorrow) and Tencent (20 May) reporting – Tencent holds a near 10% weight on the Hang Seng. For index traders this could pose a risk and a catalyst in a stock so many hold and are keen for a positive catalyst to arrest the downtrend in place since mid-February. The HK50 has a pronounced double bottom into 27500 and looks to be skewed for some mean reversion into 28,600 this week.

(Daily HK50 with Keltner band)

Gold looking constructive

A 3bp decline on Friday in US real 10yr rates to -91bp putting a bid in tech and also in Gold, which on the weekly is starting to really shape up quite nicely. A bit of work still needed before we see better trending conditions, but after reaching the double bottom target, price has held in well and looks like consolidation in an uptrend. If this kicks up I would be expecting 1880 and maybe 1900, and it will be fascinating to see if this move lower in Crypto has any positive implications for Gold at all, given the relative store of value proposition.

Elon Musk, it seems, has been taking on all comers on Twitter over the weekend and caused some chunky gyrations across the coins – our weekend trading has kicked up and we’re looking at some serious liquidations through the exchanges, where the last 24 hours we’ve seen over to $1.5b liquidated. Buyers are coming in as we roll into the new week and vol is rising. I'm closing the short Bitcoin and long Ethereum trade and moving to the sidelines, as I feel the dust really needs to settle here.

(Daily of DXY)

(Source: Tradingview)

In the land of fiat the USD is looking pretty ugly and that seems to help risk too. A break of 90 in the USDX will no doubt provide greater tailwinds to the commodity trade, which has fed full circle into higher inflation expectations. 90 has been the line in the sand in the USD and there's been solid defence here through 2021, but I suspect we’ll need to see 10yr real rates break -100bp and US equities into new highs for the level to breaking. One to watch this week.

The Fed can change this dynamic, but they'll not want to do anything until the next payrolls report on 4 June – but even then, we just shouldn’t underestimate the resolve of the Fed and they will let this cook for as long as it takes until the labour market shows a move towards full employment. When they do dial up the taper language, the USD could rally hard.

EURUSD the obvious driver of the USDX and one questions if we can re-test the mid 1.21’s, where a close above 1.2170 would be bullish. Although, I’d be surprised if the pair can squeeze past 1.2220 this week and I’d be looking for higher conviction mean reversion moves should we see 1.2240/50 come into play.

Eyes on the AUD this week

The AUD needs close inspection this week with the event risk stacked up. Positioning is constructive, but at 16k contracts, leveraged funds (as per weekly CFTC data) have been steadily reducing long exposures. Options pricing modestly favours puts (over calls), with 1-week AUDUSD put vol at a slight premium to calls, and we also see future interest rate pricing offering little – with 33bp of hikes priced in Aus vs 32 in the US over the coming two years. It goes some way to explain the choppy nature of the AUDUSD daily chart, with the AUD likely facing the additional headwind of a solid move lower in iron ore futures on Friday.

Weekly implied volatility in AUDUSD sits at 8.46%, which is pushing towards the 12-month low range. Will this Thursday’s April job number move the dial? Vols suggest no and if we look at the pedigree of FX moves in past jobs reports – and here I’ve looked at the reaction in the AUDUSD in the following 5 minutes – we can see even big beats and misses have had limited effects.

In this meeting, 20k jobs are expected to have been created and the unemployment rate expected to remain at 5.6%. but perhaps this gets more credence as we try to understand what the RBA will do at its 6 July meeting. Will they roll its 3yr QE target to the November 2024 maturity and increase the envelope of QE by a further A$100b?

Looking at GBPJPY and NZDJPY longs

(Source: Tradingview)

The market is looking more at the JPY than the USD as the funding currency here, with real money players reducing JPY longs. GBPJPY looks good for upside here and I’d be long with a stop on a close below the 5-Day EMA. NZDJPY also looks set to run hot and again this looks good for a short-term move higher.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.