- English

- Italiano

- Español

- Français

That said, we still have the small issue of this Saturday’s Brexit vote and whether it can pass through the Commons. One suspects it won’t, but it could be close, and the pollsters have support for the deal at between 310 to 315 votes, just shy of the 320 required to pass. Obviously, if this does pass then, we will see a decent gap higher on the Monday open and is a risk for those short GBP into the weekend.

With the risks skewed to the vote failing, we are looking at the prospect of a small move lower on the open in GBP – but that feels too obvious. Johnson is mandated to request an extension to the 31 October Brexit deadline, although even this is not straight-forward. But we’d be surprised if the deadline wasn’t extended, where the focus then turns to a twist in political developments and the idea of trading around an impending election.

We also have the affair of Fed vice chair Richard Clarida speaking tonight (02:30 AEDT) and recall he is the last Fed member to speak before the blackout period and the Fed meeting on 30 October. USDJPY is worth watching here because if he doesn’t like the market pricing an 82% chance for a cut, then he’ll let us know and we could see a move higher in USDJPY. One suspects he’ll toe the line and the rates market will be happy with its pricing.

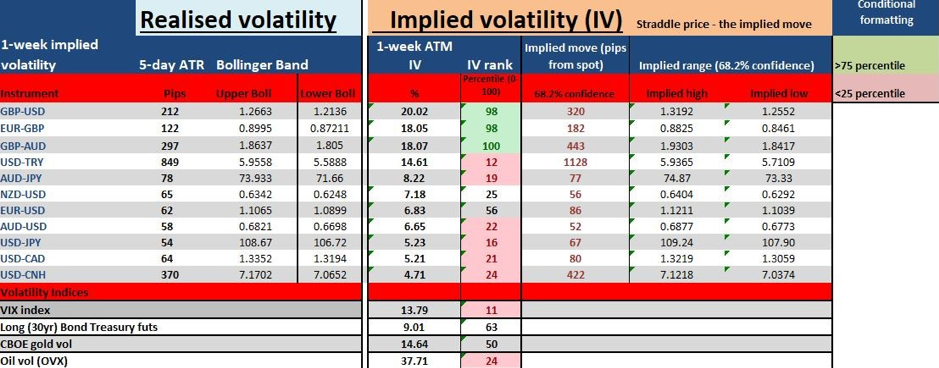

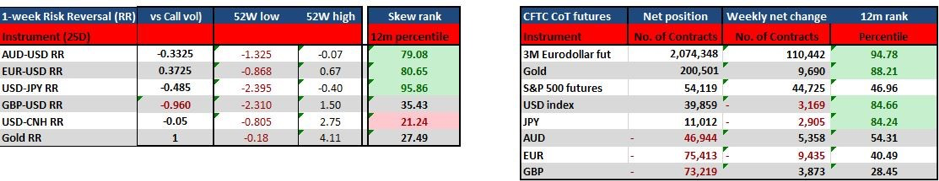

See the implied moves for next week in the weekly vol report. One thing is clear: there is massive divergence is the vol structures between GBP crosses and all other developed FX pairs. Look at the implied vol rank, which looks at the current IV level relative to its 12-month range. Big moves are expected, and that is key for your position sizing.

One-week risk reversals are also interesting, notably again in GBPUSD. Here, despite spot trading at 1.2849, we see traders paying up for put vol over call vol, and consider that last Thursday this stood at +1.8, with traders paying up for call volatility. This is an interesting shift in sentiment, even if spot hasn’t followed lower.

The other talking point today was the China data dump, although take a listen to RBA gov Lowe's speech and it is clear we are getting to the lower bounds. The China GDP print will get the headlines though, as it is the lowest annual read since 1992, but the IP print was a big beat, and that is important. Comments today from the Stats Bureau are a big a worry detailing the domestic economy faces complex and 'serious situation', rise in external uncertainties. There hasn’t been too great a reaction in markets though.

Good luck to all involved in the GBP and the headlines will likely be breaking just before the biggest rugby game for years. The English get up on paper and are rightful favourites, but just like the UK parliamentary vote we never know.

I am off next week on annual leave, so no daily commentary.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.