CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

US equity playbook – new all-time highs or will falling liquidity impact?

That is certainly a possibility, especially if the market strongly believes the Fed pause again in the July FOMC meeting. Subsequently, if the S&P500 breaks 4450/4500, it will be call options buyers and momentum (some FOMO) players that lead us further higher, as funds aggressively chase the market higher.

We can scratch around for positive catalysts, and there are many we can point to; volatility remaining low, a mountain of cash still on the sidelines, the Fed potentially at peak rates, and China ramping up stimulus. However, the list of upside catalysts seems scarce relative to the list of tier 1 triggers that could feasibly lead to a 10% move lower.

As we’ve learnt throughout 2022, an open mind will always serve you well, and a momentum-driven market is one not worth fighting, and positioning and flow mean everything.

A checklist to assess the risk-to-reward trade-off

When assessing the risk-to-reward trade-off, we can go into huge depth drawing up a varied checklist that can often lead to significant complications. These will include any or all, of the following:

Liquidity, positioning, valuation, sentiment, technical indicators, options hedging activity, gamma exposure and breadth.

They can all have a place in our understanding of where the skew of risk sits – price is, however, always the arbiter of truth.

We can be early to a trade, but we must be able to handle drawdown, and in all cases, just knowing when to take a loss is key. Timing the market is key when trading with leverage, but so is knowing how to take a loss.

At this juncture, positioning in US equity futures is rich, especially when we see the net long position of the highly influential CTAs (trend-following funds) and volatility-dynamic funds.

We can see the market has cut portfolio hedges dramatically, with S&P 1-month ‘skew’ at the lowest levels since 2018 and the CBoE equity put/call ratio at 0.46x – the lowest since April 2022. Hedges cost money in a bull market. But when volatility ramps up, aggressive re-hedging can send risk lower.

Valuation is rich, with the S&P500 trading on 20.2x forward earnings, and the Equity Risk Premium (ERP) at the lowest since 2002. This shows how little compensation investors get for taking on equity risk, so again this reduces the attractiveness of equity.

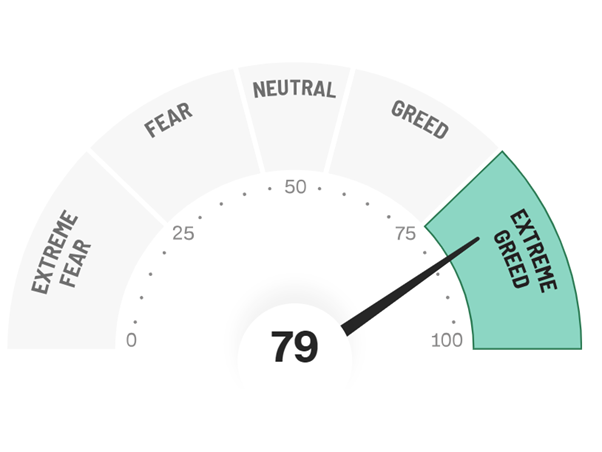

Sentiment is near extremes – one can look at the CNN Fear and Greed index and see this moving to 79 – extreme levels, but again, one wouldn’t take a short position in the US500 or NAS100 on extreme sentiment in isolation, but it is a big consideration.

Central bank balance sheets about to turn sharply lower

Perhaps the biggest factor the bears have at the centre of their thesis is the expected turn lower in liquidity, and specifically an impending decline in the major central bank's balance sheets.

Balance sheets of Fed, ECB, BoJ and PBoC

The US is at the heart of this concern, where we know the Fed’s $95b per month QT (Quantitative Tightening) is coming in late June. At the same time, the US Treasury’s massive net T-bill issuance to rebuild its depleted cash levels is about to ramp up. So far, the USTs bill issuance has been funded by capital from the Fed’s RRP facility, which is seen as a positive for US equity markets. However, the risk is now skewed that the TGA rebuild is to be funded by bank reserves - where falling reserves would be seen as a liquidity drain.

EU banks are due to repay E470B in TLTRO loans at the end of June, and with QT playing out in Europe and the UK, the prospect of the aggregated global central bank balance sheets about to turn lower is a major risk - with well over $1t of liquidity due to come out of the market in the coming weeks.

China is also a growing consideration, and we watch the price action in the HK50, CHINAH and USDCNH. China has started to ramp up its policy easing and support and has been increasing liquidity - but it has been underwhelming. Recall, Shanghai came out of lockdown in June, so the Chinese reopening data impulse is about to face serious headwinds – will the PBoC and govt be able to put the right mix in place to counter this weakness?

Core inflation is an ongoing concern

Another key risk markets are focused on is inflation. Central banks have made it clear their concern lies in targeting core (sticky) inflation and they are incredibly worried that inflation has become entrenched. We can look at the UK, NZ and Australia and see rising risks that the central banks may have to keep lifting rates and actually cause a recession to bring core inflation down to target. If we see core inflation readings stay firm, then this will be a big headwind for equity markets.

An inflexion point

The bottom line is we may be at a clear inflexion point for equity markets – either the central bank balance sheet rolls off and heads sharply lower in the coming weeks, and equity reacts with the US500 falling 5-10%, as per the bear's thesis. Or, prices remain firm despite the central bank balance sheet contraction. In which case, rising prices may see a capitulation from the bears, resulting in new highs playing out as momentum kicks in once more and funds chase into Q3.

Which way do you see it playing out?

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.