CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

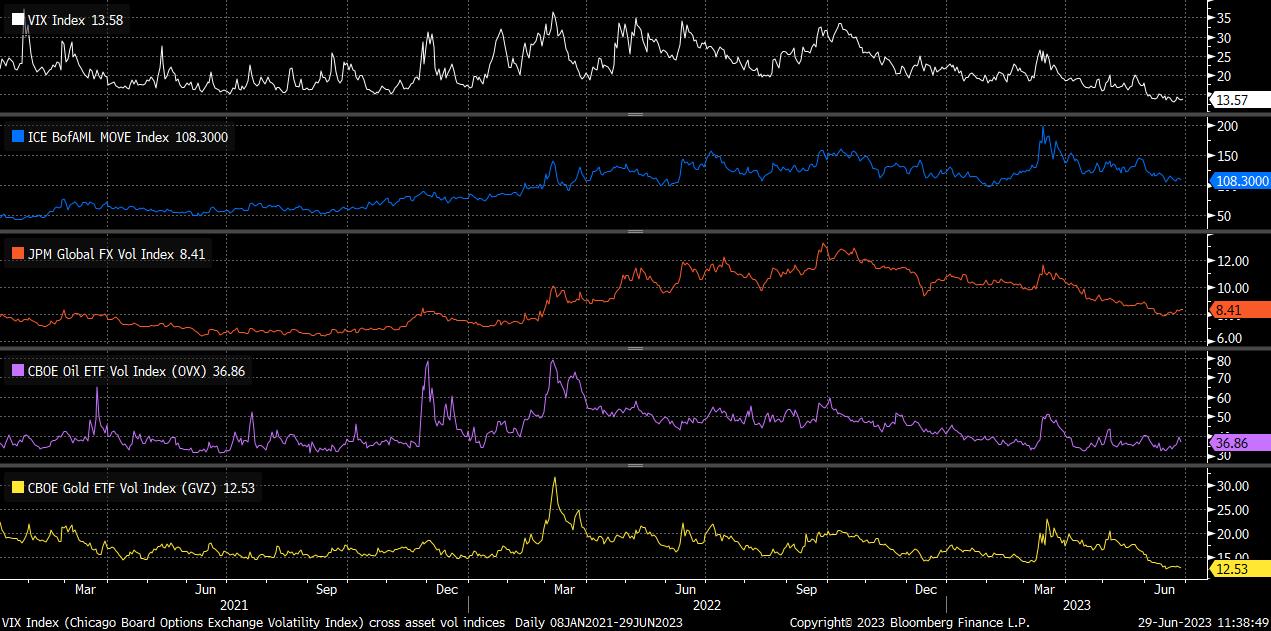

Nevertheless, we are already seeing signs that summer market themes are starting to develop. Implied volatility has continued to decline of late, with the VIX briefly dipping below the 13 handle for the first time since before the pandemic, while implieds have also fallen significantly across a range of other asset classes, as the below shows.

It is not only implied vol, but also realised volatility that has been declining. This is true not just of the equity space, where CBOE’s realised vol index is whiskers away from its lowest level since December 2021, but also in the FX market.

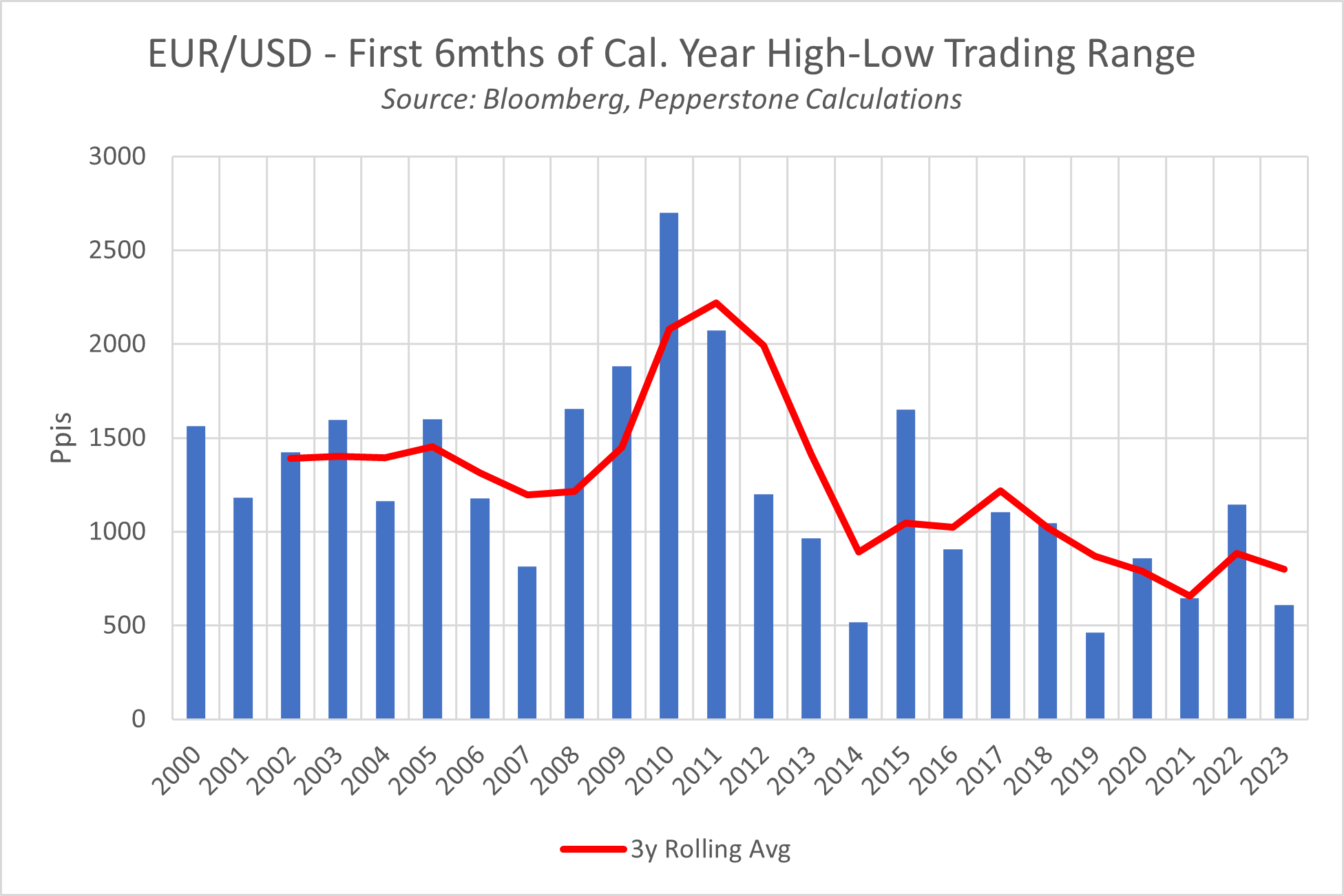

EUR/USD, for instance, has traded in a roughly 600 pip high-low range this year, the third tightest H1 range that the pair has been trapped within since the inception of the common currency.

It is, however, a little unusual to see said subdued conditions grip markets so soon. Typically, we associate summer market conditions with the period between Independence Day and Labor Day, though it seems market participants are looking to kick-off their summer breaks a little earlier this year.

As noted above, this time of year is typically associated with falling volumes, thin liquidity, and relatively low volatility. It is also a time where institutional desks tend to be more lightly staffed than usual, potentially with those employees on desk being more junior in nature as well. This does, however, mean that additional caution can be required, especially in the event that unexpected news breaks, or another ‘black swan’ event occurs.

Barring such a surprise, however, this time of year tends to lead to markets taking a ‘path of least resistance’, unless and until a catalyst were to emerge to derail such a trend.

As things currently stand, for equities at least, that path of least resistance continues to lead us higher, with the tech sector leading the way as it has done for much of the year so far. Although the S&P 500 has pulled back a little of late, the medium-run momentum clearly remains to the upside, with the index trading considerably above all of the upward-trending moving averages. 4,500 stands out as the next technical milestone were the gains to continue.

Elsewhere, markets are struggling for direction a little more. Treasuries, for instance, have traded in an incredibly tight range for the last couple of months, with the 10-year yield having been trapped within a 20bps range (3.6% to 3.8%) over this period.

Fixed income traders have, thus far at least, largely shrugged off the FOMC’s continued hawkish overtures, with incoming, and softening, economic data continuing to cast doubt on the Fed’s ability to raise rates twice more this year, in line with the latest dot plot projections.

Range trading has also been the ‘order of the day’ in the G10 FX space of late, by and large. Perhaps the most obvious exception to this trend, though, has been the JPY, which has softened significantly across the board.

The primary driver of the JPY’s weakness has been an increased favour for carry trades, itself a derivative of the low vol environment that we currently see. While the move lower in the JPY is justified by economic fundamentals – given the BoJ’s continued reluctance to adjust the present ultra-loose policy stance, with most traders now not seeing any shifts until the turn of the year – one must be cognisant of the potential for intervention to prop up the JPY. Such intervention would derail, and could entirely turn, the current trend, as was seen during the prior bout of JPY buying during Q4 22.

_2023-06-29_11-34-58.jpg)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)