- English

- Italiano

- Español

- Français

Volatility has pushed a touch higher with the VIX at 17.9%. The US Breakeven rates – or the market's perception of inflation (averaged) over the coming 5 years fell 3bp, so cyclical areas of the market have responded negatively to this. As mentioned yesterday, there's a certain unease that has descended on markets – growth has been called into question.

Crypto is kicked lower with good offers in Link, Dash and Ethereum – it seems the momentum is coming out these plays – however, generally this is where an influential talisman hits the Twittersphere. Our clients remain steadfastly long of the various coins.

Anyhow, here are a few charts on the radar

AUDJPY – eyeing limit shorts into 78.87

I talked this up in yesterday’s note as a proxy of global risk, but the cross has broken the range lows. The JPY found buyers quite readily, and while the RSI has made a higher low (divergence?), is the currency cross about to start trending? I would want to be set in case it does. A retest of the breakout area around 78.87 would represent about 75% of the days range, and an area that I would look to fade a short covering rally – as always, offering and eyeing levels is one thing, but then we take the timeframe right down to see the price reaction. Should the pair trade to the desired fill level, as part of the risk approach I’d be happy to close the trade on a daily close above the 5-day MA.

(Source: Tradingview)

NZDUSD – levels for the brave

My colleague Luke did a more thorough piece on the RBNZ meeting yesterday, just as the news of lockdowns was breaking. Well we’ve heard of four new cases and a number of economists altering calls from a 25bp hike to holding the cash rate. The market was toying with the idea of a 25bp to 50bp hike, but now the argument has obviously shifted to one of waiting to see how this plays out knowing the trend in lockdowns is typically longer than initially thought – I guess this is the new line of least regret.

The swaps market places a 76% chance of a hike, which has come down from a small chance of a 50bp hike and NZ 2yr govt bond fell 9bp on the day to 1.11%. NZDUSD Overnight implied volatility sits above 20%, so the market is primed for another 1%+ move on the day.

While hedge funds have reduced NZD longs ahead of the meeting, if the RBNZ held rates at 25bp, which now feels fair, we could see a spike down through the July low of 0.6880 to perhaps to 0.6850 – but the market distribution (of outcomes) places a 20% chance it falls past here. A move to 0.6810 would be extreme and I’d be leaving limit buyers here for a rapid snapback - so 0.6850 may be more realistic downside caps. If the RBNZ hike 25bp and look past the lockdowns the pair should rally fairly hard, but a lot depends on the outlook and whether they meet the three hikes priced over the next year. The upside on the day should be capped into 0.6870/80.

(Source: Tradingview)

XAUAUD

I will be doing a live piece on YouTube at 3:00pm AEST on Gold and XAUAUD will get a good run in the presentation. The bulk of our flow has been in XAUUSD, which has moved sideways of the day, hitting $1795 before finding sellers present with the USD finding good safe-haven flows. After a poor US retail sales data (-1.1% vs -0.3% eyed) it feels like we’re going to need to see a blockbuster NFP print (say above 900k jobs) on 3 September for the Fed to be comfortable in announcing a tapering of QE in September. Regardless of the data, which in theory was USD negative, the USD has been bid against all G10 currencies.

US real Treasury yields are 4bp higher on the day, which seems to have weighed on XAUUSD, with inflation expectations falling faster than nominal bond yields. The preference, as always, is to be long gold in the weakest currency (or short in the strongest), so for gold traders the currency effect is a major consideration at these levels. The AUD has been the weakest currency we offer gold in, and we’re seeing a re-test in XAUAUD of the range highs of 2480. The rally from 2340 has been swift and aggressive – for further upside naturally a weaker AUD is key, but the question now becomes will XAUAUD break to new highs?

(Source: Tradingview)

For the precious metal’s heads, Palladium fell 4.5% and is eyeing a big test of the June lows of 2459 – another for the radar.

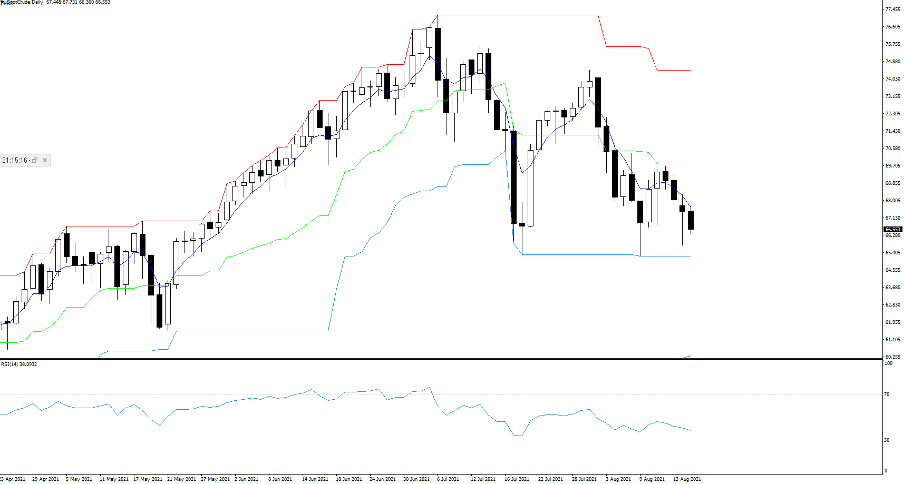

SpotCrude – not looking that slick

Crude is just so key for broad markets and having fallen for a fourth day – its longest run of losses since March - price is now eyeing a test of the July and August double bottom at $65.30. A break here would be meaningful and increase the prospect of a move into $61.50. Clearly, the move has been driven on the perception of weakening demand, with Delta concerns and an economic slowdown, notably in China, impacting the crude tape. One suspects the Delta concerns are in the price, but much now depends on further data trends and USD strength – my trading bias is for the range low to be tested, but the market may put up a good defensive. A downside break could also really impact XAUUSD, as it would push US real yields higher and put a safe haven bid in the USD.

Clients are generally feeling the range low holds, with 70% of open positions held long. Let's see, but a long position in crude is a play that the global data flow turns more positive.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.