- English

- Italiano

- Español

- Français

We watch to see how it trades through EU/US and the open of the NYSE to see how the SLV ETF trades.

The Reddit community have an influence on markets and there's a respect for the impact this critical mass of traders working together can achieve. Given the level of attention, not just on Reddit, but on Twitter and other forums, where typically more sophisticated participants share and debate intel, it was clear XAGUSD was going to get some sizeable focus from traders.

Under the new model adopted by the WallStreetBets crowd, there are four variables they want to achieve to create incredible moves.

- The hedge funds running news recognising algo’s sense an impending wave of retail buying and take long positions

- Price moves higher compelling FOMO buying from retail traders and subsequently forcing elevated shorts to close, which just exasperates the move

- The short-covering rally results in market markers hedging their options short gamma exposure – this means buying the underlying stock

- As the stock rallies further passive funds have to buy more of the stock as the move means it has greater representation in a set benchmark.

Running the traders playbook over this scenario and we see the backdrop is very different for silver. Hedge funds and other speculative players are net-long 54,460 futures contracts, so it’s a different angle than just generic positioning. This is a play on what's considered by many to be manipulation from bullion banks to keep the price of silver (and gold) artificially low. By the collective pitting their capital together to buy the SLV ETF the bullion banks would have to purchase increased quantities of physical silver for delivery. In turn, this would force the silver price up significantly.

By way of flow, on Friday the SLV ETF saw incredible inflows as traders got set for a big move in silver. Silver stocks are flying and volumes in silver futures at the time of writing are already half a normal day’s trade. Talk from physical silver dealers on Sunday was that they couldn’t keep up with demand and the lack of physical silver to sell seems to just re-enforce the FOMO effect.

Traders expect movement in silver

It's clear traders expect movement. In the options markets, 1-week XAGUSD implied volatility has pushed to 81%, which implies a 5.1% daily move. It’s all call buyers and the premium for 1-week call volatility over puts has blown out to record levels. It's pricey to trade upside in silver now, but it tells of a story where traders believe that if we’re going to see a move then it will be far more pronounced to the upside.

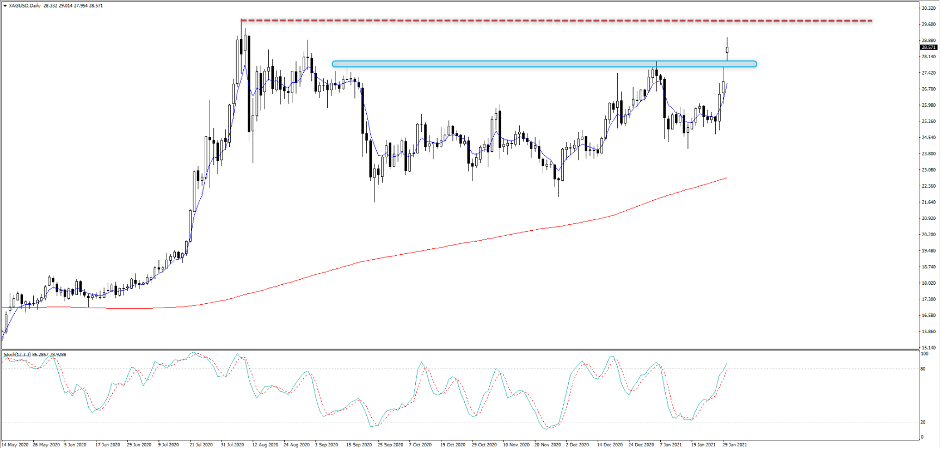

(Daily chart of silver)

We look for the open of the NYSE to see the moves in the SLV ETF, as this is the instrument the masses are talking of buying to cause the short squeeze. So, consider that the ETF tracks our XAGUSD price 100%, so traders will see any moves in SLV ETF play out in XAGUSD.

We’ve already seen XAGUSD trade into $29.01, although the price has pulled back a touch and currently sits up 5.9% at $28. 56 (at the time of writing) and in line with the daily implied moves priced by the options volatility. The focus falls on whether we now see silver make an assault on the 7 August highs of $29.85 and possibly establish a new trading range above $30. Or for those who feel this ‘squeeze’ has legs and wants a relative performance trade, looking at the gold and silver ratio, which has really broken down today and sits at the lowest levels since 2016. Then long XAUUSD and short XAUUSD as a relative pair’s idea may work.

(Source: Bloomberg)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.