- English

- Italiano

- Español

- Français

I suspect Citi’s call on Friday for four consecutive 50bp hikes to see the fed funds at 2.75% to 3% by year-end tops the lot – this would almost certainly take US real rates towards being positive, which would be a far larger headwind to equity returns. I also think the market will pay far more attention to consumer and business surveys in the near term, as they haven’t really correlated with returns in risk assets for a while.

As it is, we’ve seen the market price around 200bp of further hikes (from the Fed) for the year, which has seen US 2yr Treasuries rise a sizeable 33bp last week, in turn supporting the USD, yet equities indices have rallied, with the US500 gaining 1.8% and NAS100 +2% on the week. Gold even managed a 2% rally closing at $1958.

The EUR remains the ugly child of G10 FX, and while the JPY is also in clear disdain as its role as a funder in the central bank divergence trade (as well as being a commodity importer), if we look at the Eurozone the word ‘recession’ is being used ever more liberally and few want capital working in an area where growth will underperform – The recent ZEW and IFO ‘expectations’ survey offers increasing belief this will be the case – EUR shorts vs CAD and other commodity play still seem compelling.

Sentiment has certainly improved, but how much of this is down to month- and quarter-end? We shall see how funds react once we get the turn. A VIX below 20% could see new capital into the market, but I’m not so sure we get that and feel what we’re seeing is more a bear market rally. Anyhow, markets are far from sanguine, and opportunity is abundant.

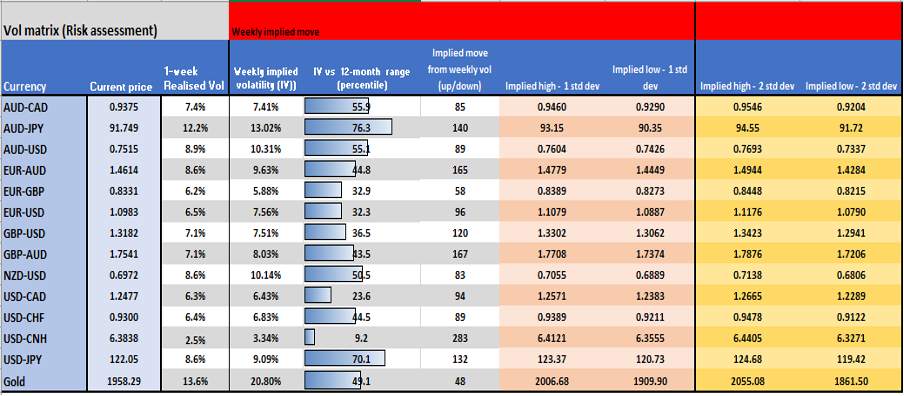

Using options pricing to see the weekly implied volatility and to adjust the spot price to see the expected range with 1- and 2-standard deviations – with so much event risk on the calendar it's good to know how the market feels about future movement.

Implied volatility matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

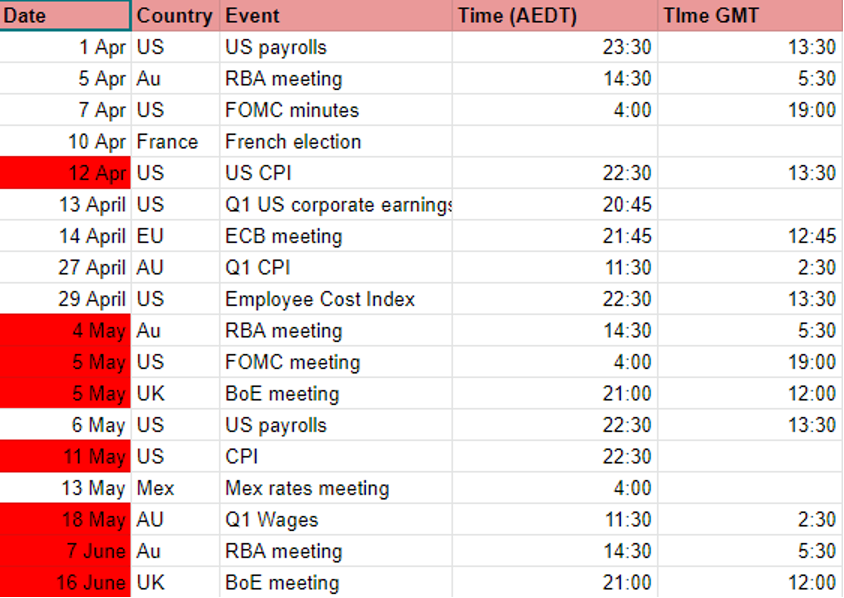

- OPEC+ meet in Vienna (Thursday) – the last OPEC meeting was a non-event and we shouldn’t see the group deviate away from its agreed 400k barrel output hike this time around – I’m biased for higher SpotCrude in the short-term but will reassess below 113.41

- We see options expiry in Brent, heating oil, RBOB gasoline and natural gas (Monday) and same instrument futures expiry (Thursday) – these factors should see position squaring and elevated volatility in energy products.

- Month- and quarter-end flows – most of the rebalancing should have already played out, but ahead of quarter-end we could see big and questionable moves.

- US non-farm payrolls (Friday 23:30 AEDT) – The consensus is calling for 490k jobs (range 700k to 70k), 3.7% unemployment rate (from 3.9%), 5.5% average hourly earnings – A big week for the USD as US bond yields push higher and the market pricing of the fed fund terminal rate pushes closer to 3% (and further above neutral).

- US ISM manufacturing (Sat 2 am AEDT) – The market expects this to tick up to 59.0 (from 58.6) – ISM manufacturing hasn’t been a massive vol event for markets for a while, but PMIs should have a higher correlation with equity returns – if the market is correct, a 59 print is good news, but we will watch the sub-components for new understanding on supply-side constraints.

- US consumer confidence (Wed 1 am AEDT) – consensus is calling for this to drop from 110.5 to 107 – One must question when consumer and business confidence become a bigger concern for markets, as it really hasn’t correlated with equity returns since April 2020.

- US PCE inflation (Thursday 23:30 AEDT) – consensus sits at 5.5% (from 5.2%) – unless it’s a big miss the market shouldn’t react as CPI is where we focus.

- Fed speakers this week – Harker, Bostic, Barkin, George, Williams x2, Evans

- Japan – BoJ Summary of Opinions (Tues 10:50 AEDT) – Eyes on JGBs this week as we approach the 25bp cap, but will the JPY strength we saw on Friday follow-through, and is the week the JPY fights back? Comments on JPY weakness in this report could see the JPY move around.

- Japan – Japan’s capital spending plans for the new fiscal year

- China – manufacturing and services PMI (Thurs 12:30 AEDT) – the market expects these data points to come in at 50.0 and 50.6 respectively (from 50.2 and 51.6) – With China’s COVID zero policy it wouldn’t surprise to see these weaker, but will the market worry? I suspect the markets see’s weak numbers increasing the prospect of more easing from the PBoC.

- Australia (Tuesday) – Aussie Govt FY2023 Budget – Hard to see this being a vol event for the AUD, but with cash balances running ahead of MYEFO projections there is scope to push for measures to address the cost of living – many of which have been speculated on in the news. AUDUSD needs a break of 0.7555 to continue to bull trend and short-term I wouldn’t bet against it.

- UK – BoE Gov Andrew Bailey to speak on the economy (Monday 22:00 AEDT), BoE member Broadbent speaks (Wed 19:10 AEDT) – like many I am sceptical of 5 hikes from the BoE this year.

- Europe – April consumer confidence (Wed 20:00 AEDT) – there’s no survey but it would not shock to see this drop from the prior read of -18.7. We see German GfK consumer confidence on Tuesday (17:00 AEDT) and the market expects this to drop to -14.5 (from -8.1)

- 14 ECB speakers – including Christine Lagarde (Wed 19:00 AEDT), and Chief Economist Lane (Thurs 19:00 AEDT) – I like EUR lower vs CAD, AUD, and NZD

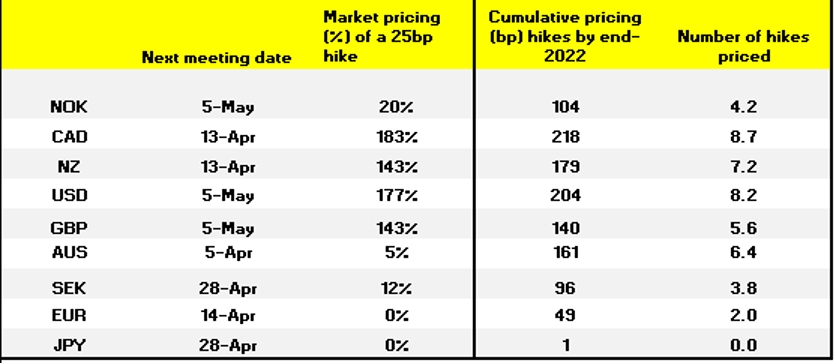

Looking at swaps pricing for the prospect of a 25 or 50bp hike in the upcoming meeting and what’s priced out the curve for the full-year.

Rate hike matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

Looking ahead – the marquee events traders should have on their radar.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.