CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

On the daily, we’re yet to see a bearish MA crossover (3-EMA vs 8-EMA) and the 5-day ROC is still positive, which keeps me holding a modest bullish bias, but we’re back testing the former breakout at 3912.

US500 Daily chart

(Source: Tradingview - Past performance is not indicative of future performance.

It’s make-or-break time and while the current price on our charts represents the strong after-hours performance from Microsoft and Alphabet, the bulls need the index to push through 4000 – where potentially we can see a trend develop. Options market makers are short gamma, and while the S&P 500 futures bid-offer spread has improved, the same can’t be said for depth at touch price and the propensity to move the market causing exacerbated moves on any size orders is there.

US earnings are coming in rapidly and with 30% of the S&P500 having now reported Q2 earnings, we’ve seen 70% beating on EPS and 60% on sales. Sounds impressive, but this is modestly below the long-term trend in beats – analysts are always low-ball in their calls. We haven’t yet seen sizeable consensus downgrades to FY EPS assumptions and maybe that comes, but its hard to have a fundamental conviction that we’ve seen a definitive low in the equity market until consensus earnings have been cut – we know it’s coming, it’s a matter of when and how severe.

In the session ahead we get numbers from Meta platforms in the post-market trade, where the implied move on the day (priced from options) is 12.6%, as well as QUALCOMM (implied move of 8%). Apple (5.1%) and Amazon will potentially move the dial tomorrow – so if trading the index or individual equity, make sure you’re in front of the screens between 6:00 am and 06:30 am AEST. It could get lively.

The other big factor is the FOMC meeting (Thursday 4 am) and Chair Powell’s presser. Last month the US500 fell 2.8% in the following 6 hours from the FOMC statement, although this statement should be about nuance, than sweeping changes. See our preview.

(Source: Bloomberg - Past performance is not indicative of future performance.

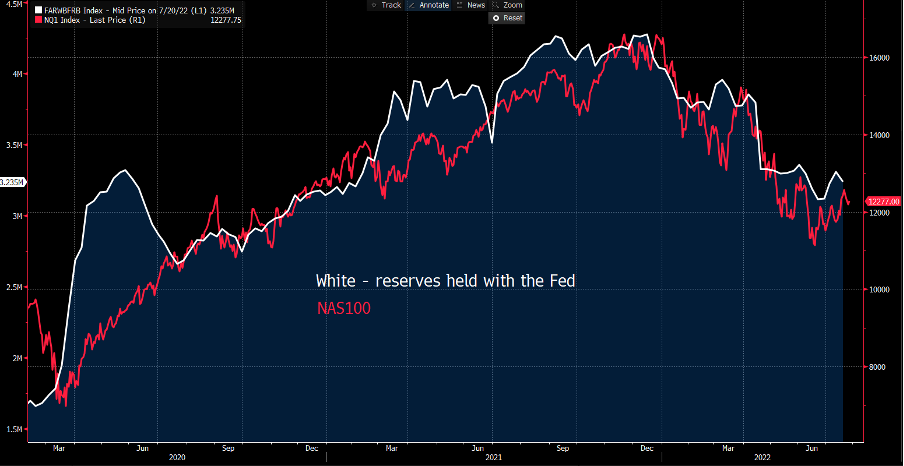

From a central bank system liquidity perspective we know the Fed’s QT program ramps up to full capacity in September and this means excess reverses will likely fall – this has typically resulted in a headwind to equity markets, and if the liabilities on the Fed’s balance sheet turn lower again then I suspect the NAS100 and US500 will follow.

So, there's many reasons to think we’ve not hit a low and that we turn back through 3800 supports, but price is true and if the buyers can build then we could see trending conditions. As always, be open to whatever will be and trade the possibilities with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.