CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

The potential for a re-run of the 2020 US Election, where just 43k votes in Georgia, Arizona and Wisconsin determined the election outcome, is fast becoming a real possibility.

With the live debates now behind us, if voters haven’t already made up their minds, then the influence of relative ad spend, notably in the six key swing states, and any live events from Trump or Harris on the campaign trail may still resonate with any still ‘undecided’ voters. And, we may still get an ‘October Surprise’, where a controversial revelation involving one of the presidential candidates (or another member of the senior cabinet) could still make headline news.

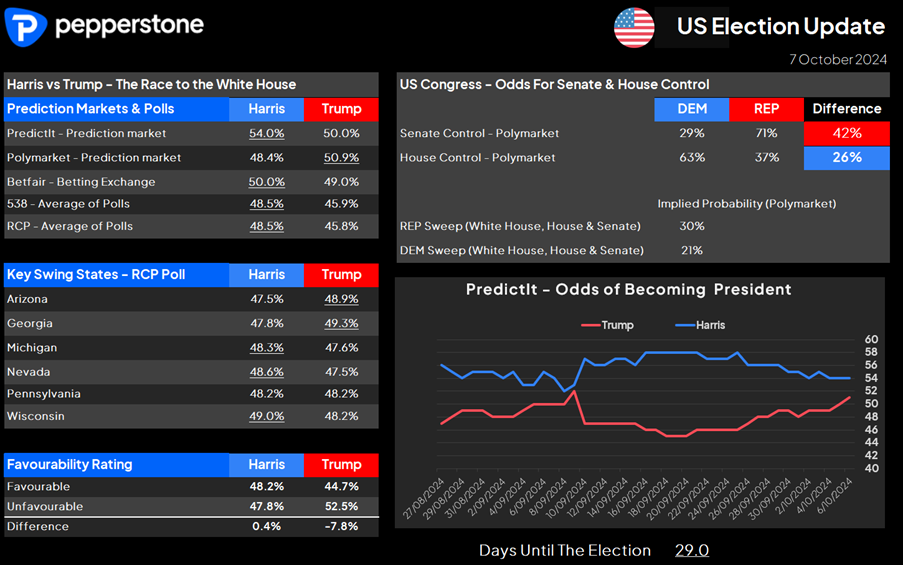

The US Election Dashboard – current expectations and polling

As we see from our US Election Dashboard, the RealClear average of the polls in the six key battleground states shows Trump ahead in Arizona, and Georgia, and tied in Pennsylvania. Kamala Harris is ahead in Michigan, Nevada and Wisconsin – considering that these are the states that will likely decide the election outcome, it’s no surprise that the betting markets price a roughly even probability in the race to the White House.

Who becomes the president is obviously key, but Congressional control could also have a significant impact on the extent of any moves in financial markets. The makeup of the Senate and the House should be considered when expressing US Election trades, as the power dynamic in Congress could limit the smooth passing of many of the major policy initiatives (for both candidates).

Again, the US Election Dashboard highlights that the Republicans (REP) are currently given a 71% chance of claiming the Senate (source; Polymarket), while the Democratic Party (DEM) are offered a 63% probability of taking the House. A split congress is therefore considered the current base case.

A ‘Red Wave’ (I.e. the REPs claim the White House, Senate and House) is currently given a 30% chance of playing out. The odds of the REPs claiming the House (and therefore both chambers of Congress) would increase should Trump become president, and should it materialise would facilitate a heightened ability to pass Trump’s proposed policies and likely promote increased volatility across broad markets.

A ‘Blue Wave’ or sweep (the DEMs claim the White House, Senate and House) is seen as less likely, where we currently see the betting markets giving this a 21% implied probability. With Harris’s agenda-pushing higher corporate tax rates, and capital gains (for those earning over $1m) with increased regulation on business, it’s fair to assume that in the lower probability of a ‘Blue Wave’ playing out that US equity markets and the USD would be negatively impacted.

When will the US election become the dominant market theme?

With rising geopolitical concerns, the Fed (and many other central banks) starting its easing cycle and China going hard on stimulus, it makes placing outright US election trades more challenging. Many of the tactical trades include markets affected by these macro dynamics, so expressing a view on how the election outcome and policy implementation could affect the corporate landscape, or macro markets is not a clear-cut exercise.

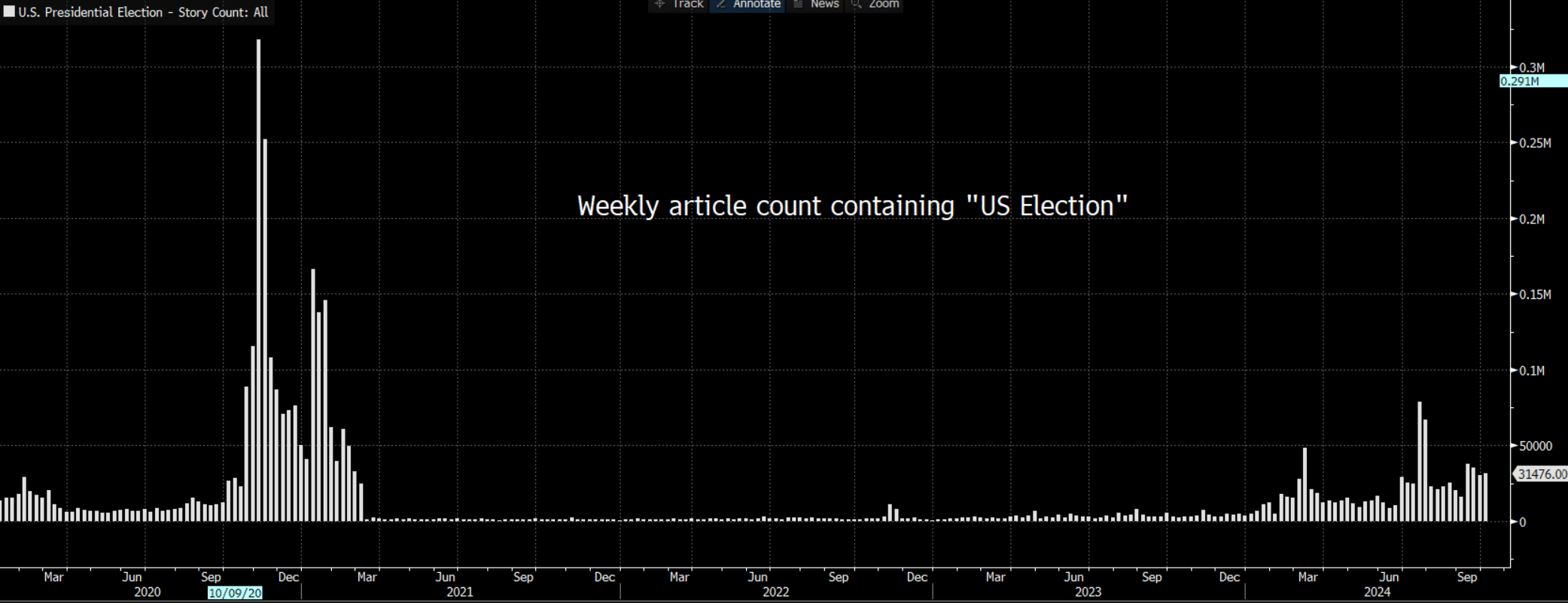

We can also see that media mentions and articles on the US Election have risen, as one would expect, but they are still well below the levels we saw in the lead-up to the 2020 election. When the US and global media focus myopically on the election, then I would assume traders will have far more confidence to trade tactical election trades.

The key policies traders consider to be the most influential on markets

Arguably the two policies which receive the greatest level of focus from market players are the respective polices on trade (tariffs) and tax. Fiscal stimulus and the deficit, immigration and regulation also get strong consideration from market players, but the debate on how tariffs and taxes could impact markets is front and centre.

If we drill down into these two key policies, the proposed tax policy changes from both Trump and Harris seem conditional on the makeup of Congress. Assuming the DEMs claim the House, Kamala Harris will also need the Senate to pass her proposed 7pp hike to the corporate tax rate, and that seems highly unlikely.

Assuming the REPs control the Senate, Trump will need the House to pass his proposed tax cuts. Given the current odds of the DEMs controlling the Senate, and REPs the House passing tax policy may be problematic.

Trade tariffs are the key focal point for traders

Trade tariffs are a very real proposition though, and while VP Harris has described tariffs as a “sales tax” and is keen to keep tariff rates unchanged, Trump has put tariffs at the heart of his campaign.

Unlike the proposed tax changes, changes to trade policy and tariffs can be implemented far more easily.

The key questions asked by market participants surrounding Trump’s proposed 60 percentage point (pp) additional tariffs on Chinese imports and 10pp additional blanket tariffs on all imports are:

• Are the proposed tariff levels that Trump has campaigned on realistic?

• If so, how quickly can they be implemented?

• What sort of counter-response would we see from countries targeted by US tariffs? • What will be the potential impact on US inflation, as well as the impact on real consumption and corporate margins?

• Could higher tariffs even lead to the Fed holding off from potential rate cuts given the expected lift in the price level?

These are questions that can all lead to increased volatility in USDCNH, USDMXN, and EURUSD and potentially compel tactical traders into long/short (pairs) trades in the HK50/US2000, US500/US2000 and US importers vs domestic producers.

Clearly, Trump’s tariffs policies are a net negative for market sentiment, but this should be offset by his proposed plans on tax cuts and deregulation and let’s not forget Trump views the US equity market as a referendum on his leadership and will champion equity markets higher.

So, it's all to play for and we watch to see if polling shifts to offer one party a greater edge – should that happen, then we could see increased trends and volatility develop in markets, with traders holding increased confidence to express election trade.

We update the US Election Dashboard daily, so stay updated with changes in polling averages and the betting market probabilities on our US election page.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.